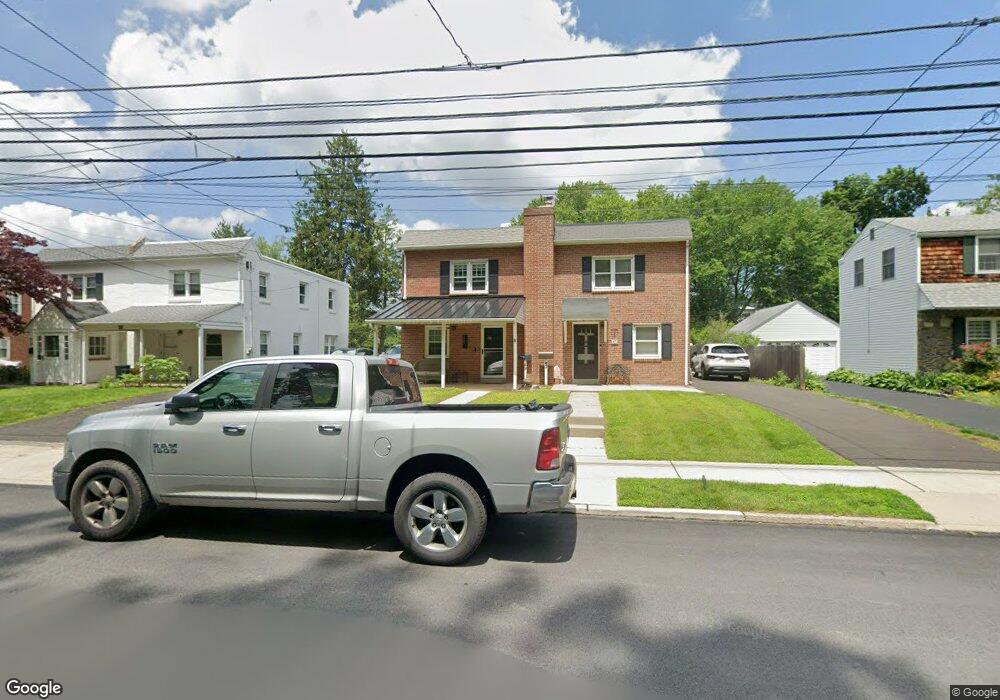

49 Gordon Rd Glenside, PA 19038

Estimated Value: $359,000 - $437,325

3

Beds

1

Bath

1,116

Sq Ft

$348/Sq Ft

Est. Value

About This Home

This home is located at 49 Gordon Rd, Glenside, PA 19038 and is currently estimated at $388,081, approximately $347 per square foot. 49 Gordon Rd is a home located in Montgomery County with nearby schools including Erdenheim Elementary School, Enfield Elementary School, and Springfield Township Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2016

Sold by

Sweeney Shawn P and Sweeney Paula M

Bought by

Collins Michale A and Sweeney Angela Rose

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,000

Outstanding Balance

$147,720

Interest Rate

3.42%

Mortgage Type

New Conventional

Estimated Equity

$240,361

Purchase Details

Closed on

Apr 13, 2009

Sold by

Sweeney Shawn P and Sweeney Paula M C

Bought by

Sweeney Paula M and Sweeney Shawn P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,700

Interest Rate

4.93%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Collins Michale A | $230,000 | First American Abstract | |

| Sweeney Paula M | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Collins Michale A | $184,000 | |

| Previous Owner | Sweeney Paula M | $168,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,252 | $111,500 | $37,200 | $74,300 |

| 2024 | $5,252 | $111,500 | $37,200 | $74,300 |

| 2023 | $5,069 | $111,500 | $37,200 | $74,300 |

| 2022 | $4,924 | $111,500 | $37,200 | $74,300 |

| 2021 | $4,795 | $111,500 | $37,200 | $74,300 |

| 2020 | $4,683 | $111,500 | $37,200 | $74,300 |

| 2019 | $4,611 | $111,500 | $37,200 | $74,300 |

Source: Public Records

Map

Nearby Homes

- 106 Montgomery Ave

- 9402 Meadowbrook Ave

- 118 E Hillcrest Ave

- 180 Hillcrest Ave

- 1009 Cromwell Rd

- 28 Grove Ave

- 116 E Chestnut Hill Ave

- 124 E Chestnut Hill Ave

- 8720 Stenton Ave

- 8408 Prospect Ave

- 9 Comly Ct

- 4 Comly Ct

- 310 E Evergreen Ave

- 8610 Evergreen Place Unit 100

- 8610 Evergreen Place Unit 201

- 300 Preston Rd

- 4134 Jackson Dr

- 8810 Tyson Rd

- 418 Glenway Rd

- 8550 Trumbauer Dr Unit L35