4908 Lazy Oaks Way Saint Cloud, FL 34771

Estimated Value: $414,184 - $535,000

3

Beds

2

Baths

1,826

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 4908 Lazy Oaks Way, Saint Cloud, FL 34771 and is currently estimated at $470,296, approximately $257 per square foot. 4908 Lazy Oaks Way is a home located in Osceola County with nearby schools including Narcoossee Elementary School, Tohopekaliga High School, and Narcoossee Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2021

Sold by

Askew Ian and Askew Wendy

Bought by

Hasan Joanne E P and Askew Vanessa M

Current Estimated Value

Purchase Details

Closed on

Jan 14, 2005

Sold by

Coates Dave and Coates Patricia

Bought by

Askew Ian and Askew Wendy

Purchase Details

Closed on

Jan 16, 2004

Sold by

Tumas John H and Tumas Lucille

Bought by

Coates David and Coates Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,000

Interest Rate

6.03%

Mortgage Type

VA

Purchase Details

Closed on

May 22, 2003

Sold by

Lifestyle Bldr Orlando Inc

Bought by

Tumas John H and Tumas Lucille

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hasan Joanne E P | -- | Attorney | |

| Askew Ian | $228,000 | Orlando Title Group Inc | |

| Coates David | $163,000 | -- | |

| Tumas John H | $151,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Coates David | $163,000 | |

| Previous Owner | Tumas John H | $88,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,251 | $364,300 | $95,000 | $269,300 |

| 2023 | $5,029 | $287,254 | $0 | $0 |

| 2022 | $4,452 | $302,100 | $65,000 | $237,100 |

| 2021 | $3,979 | $237,400 | $55,000 | $182,400 |

| 2020 | $3,862 | $229,400 | $55,000 | $174,400 |

| 2019 | $3,734 | $218,300 | $55,000 | $163,300 |

| 2018 | $3,634 | $214,100 | $55,000 | $159,100 |

| 2017 | $3,488 | $199,700 | $45,000 | $154,700 |

| 2016 | $3,416 | $193,200 | $45,000 | $148,200 |

| 2015 | $3,322 | $186,100 | $40,000 | $146,100 |

| 2014 | $3,172 | $187,400 | $40,000 | $147,400 |

Source: Public Records

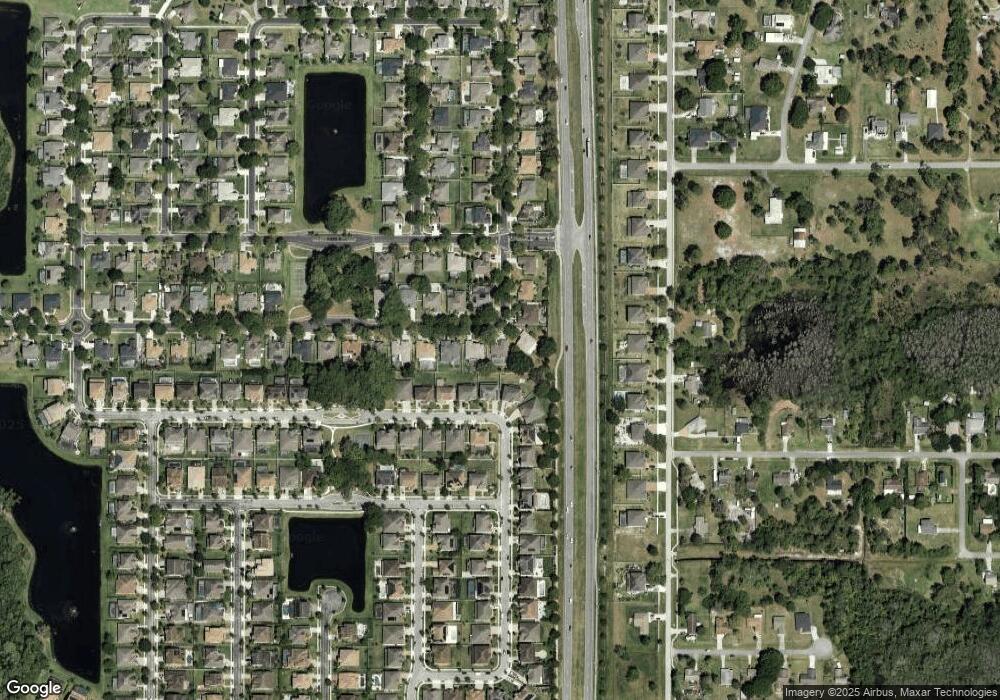

Map

Nearby Homes

- 4951 Cypress Hammock Dr

- 1620 Lake Parkway Dr

- 1700 Underwood Ave

- 1521 Lake Parkway Dr

- 4920 E Lake Cove Blvd

- 1481 Calm Waters Ct

- 1560 Canopy Pasture Dr

- 1501 Prairie Oaks Dr

- 0 N Main St Unit MFRS5111955

- 0 N Main St Unit MFRS5111206

- 1460 Prairie Oaks Dr

- Alexandria Plan at Brack Ranch

- Magnolia Plan at Brack Ranch

- Wellington Plan at Brack Ranch

- Miles Plan at Brack Ranch

- Meadowbrook Plan at Brack Ranch

- 2301 Avellino Ave

- 5133 Appenine Loop W

- 4962 Lazy Oaks Way

- 5107 Appenine Loop W

- 4910 Lazy Oaks Way

- 4906 Lazy Oaks Way

- 4943 Cypress Hammock Dr

- 4941 Cypress Hammock Dr

- 4904 Lazy Oaks Way

- 4912 Lazy Oaks Way

- 4939 Cypress Hammock Dr

- 4911 Lazy Oaks Way

- 4937 Cypress Hammock Dr

- 4913 Lazy Oaks Way

- 4945 Cypress Hammock Dr

- 4902 Lazy Oaks Way

- 4914 Lazy Oaks Way

- 4915 Lazy Oaks Way

- 4935 Cypress Hammock Dr

- 4902 E Lake Cove Blvd

- 4940 Cypress Hammock Dr

- 4947 Cypress Hammock Dr

- 4900 Lazy Oaks Way

- 4904 E Lake Cove Blvd