491 Mapleport Way Unit 10D Cincinnati, OH 45255

Estimated Value: $196,000 - $204,000

2

Beds

2

Baths

1,113

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 491 Mapleport Way Unit 10D, Cincinnati, OH 45255 and is currently estimated at $199,692, approximately $179 per square foot. 491 Mapleport Way Unit 10D is a home located in Clermont County with nearby schools including Withamsville-Tobasco Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2025

Sold by

Reynolds Jeffrey

Bought by

Reynolds Jeffrey and Halcomb Ronald J

Current Estimated Value

Purchase Details

Closed on

Mar 6, 2003

Sold by

Hensley David

Bought by

Reynolds Jeffrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,100

Interest Rate

6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 28, 2003

Sold by

Hensley David and Hensley Michelle

Bought by

Reynolds Jeffrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,100

Interest Rate

6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 7, 2000

Sold by

Dipuccio Barbara J

Bought by

Hensley David

Purchase Details

Closed on

Oct 20, 1994

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reynolds Jeffrey | -- | None Listed On Document | |

| Reynolds Jeffrey | -- | None Listed On Document | |

| Reynolds Jeffrey | $96,100 | -- | |

| Reynolds Jeffrey | $96,100 | First Title Agency Inc | |

| Hensley David | $95,500 | -- | |

| -- | $86,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Reynolds Jeffrey | $56,100 | |

| Previous Owner | Reynolds Jeffrey | $56,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,655 | $52,650 | $9,210 | $43,440 |

| 2023 | $2,659 | $52,650 | $9,210 | $43,440 |

| 2022 | $1,864 | $31,990 | $5,600 | $26,390 |

| 2021 | $1,872 | $31,990 | $5,600 | $26,390 |

| 2020 | $1,874 | $31,990 | $5,600 | $26,390 |

| 2019 | $1,205 | $24,050 | $5,320 | $18,730 |

| 2018 | $1,217 | $24,050 | $5,320 | $18,730 |

| 2017 | $1,370 | $24,050 | $5,320 | $18,730 |

| 2016 | $1,552 | $27,760 | $5,250 | $22,510 |

| 2015 | $1,507 | $27,760 | $5,250 | $22,510 |

| 2014 | $1,506 | $27,760 | $5,250 | $22,510 |

| 2013 | $1,536 | $28,010 | $5,500 | $22,510 |

Source: Public Records

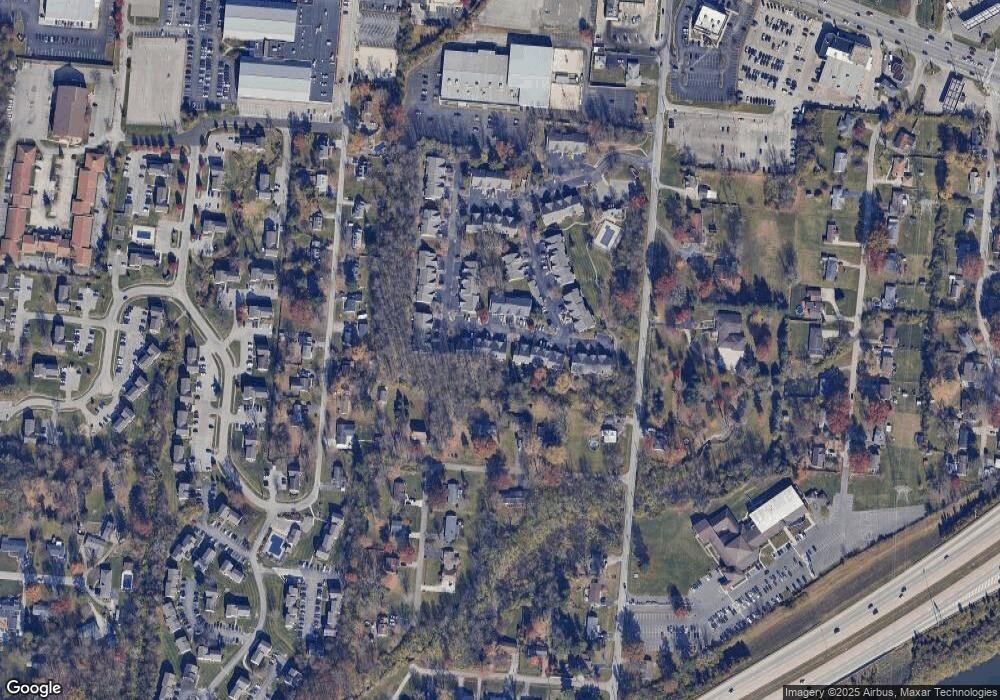

Map

Nearby Homes

- 495 Shannon Ln

- 1081 White Pine Ct

- 4070 Independence Dr

- 4077 Mclean Dr

- 499 Vinegarten Dr

- 3904 Columbard Ln

- 8538 Sunmont Dr

- 8512 Prilla Ln

- 3910 Vineyard Green Dr

- 3904 Michael Dr

- 1094 Pamela Rd

- 3892 Michael Dr

- 488 Madeira Ct

- 983 Pamela Rd

- 854 Nordyke Rd

- 604 Legend Hills

- 1082 Eight Mile Rd

- 3875 Michael Dr

- 8557 Linderwood Ln

- 457 Courtland Place Unit 28D

- 491 Mapleport Way Unit A

- 491 Mapleport Way Unit 10C

- 491 Mapleport Way Unit 10B

- 491 Mapleport Way Unit 10A

- 491 Mapleport Way

- 491 Mapleport Way Unit C

- 491 Mapleport Way Unit D

- 495 Mapleport Way

- 495 Mapleport Way Unit 12F

- 495 Mapleport Way

- 495 Mapleport Way

- 495 Mapleport Way Unit H

- 495 Mapleport Way Unit F

- 489 Mapleport Way Unit 10G

- 489 Mapleport Way Unit 10F

- 489 Mapleport Way Unit 10E

- 489 Mapleport Way Unit 10H

- 489 Mapleport Way

- 489 Mapleport Way Unit E

- 489 Mapleport Way Unit F