4910 SW 173rd Way Southwest Ranches, FL 33331

Estimated Value: $1,431,767 - $1,802,000

--

Bed

--

Bath

2,348

Sq Ft

$706/Sq Ft

Est. Value

About This Home

This home is located at 4910 SW 173rd Way, Southwest Ranches, FL 33331 and is currently estimated at $1,657,692, approximately $706 per square foot. 4910 SW 173rd Way is a home located in Broward County with nearby schools including Hawkes Bluff Elementary School, Silver Trail Middle School, and West Broward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2006

Sold by

Marr Robert and Marr Colleen

Bought by

Romero Iris L and Lindo Ramon A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$690,000

Outstanding Balance

$397,519

Interest Rate

6.5%

Mortgage Type

Unknown

Estimated Equity

$1,260,173

Purchase Details

Closed on

Aug 14, 2003

Sold by

Hernandez Maria Isabel and Cestino Luis

Bought by

Marr Robert and Marr Colleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$471,750

Interest Rate

5.52%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 21, 1997

Sold by

Humberto and Debien Connie Debien

Bought by

Hernandez Maria I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,600

Interest Rate

7.27%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 1, 1987

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romero Iris L | $920,000 | None Available | |

| Marr Robert | $555,000 | Premier Guaranty Title & Tru | |

| Hernandez Maria I | $272,000 | -- | |

| Available Not | $50,679 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Romero Iris L | $690,000 | |

| Previous Owner | Marr Robert | $471,750 | |

| Previous Owner | Hernandez Maria I | $217,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,436 | $749,620 | -- | -- |

| 2024 | $15,642 | $749,620 | -- | -- |

| 2023 | $15,642 | $619,530 | $0 | $0 |

| 2022 | $12,848 | $563,210 | $0 | $0 |

| 2021 | $8,487 | $393,050 | $0 | $0 |

| 2020 | $7,623 | $357,320 | $115,550 | $241,770 |

| 2019 | $7,873 | $363,980 | $115,550 | $248,430 |

| 2018 | $7,601 | $347,970 | $115,550 | $232,420 |

| 2017 | $7,135 | $338,890 | $0 | $0 |

| 2016 | $6,925 | $325,570 | $0 | $0 |

| 2015 | $6,387 | $295,980 | $0 | $0 |

| 2014 | $6,207 | $282,170 | $0 | $0 |

| 2013 | -- | $0 | $0 | $0 |

Source: Public Records

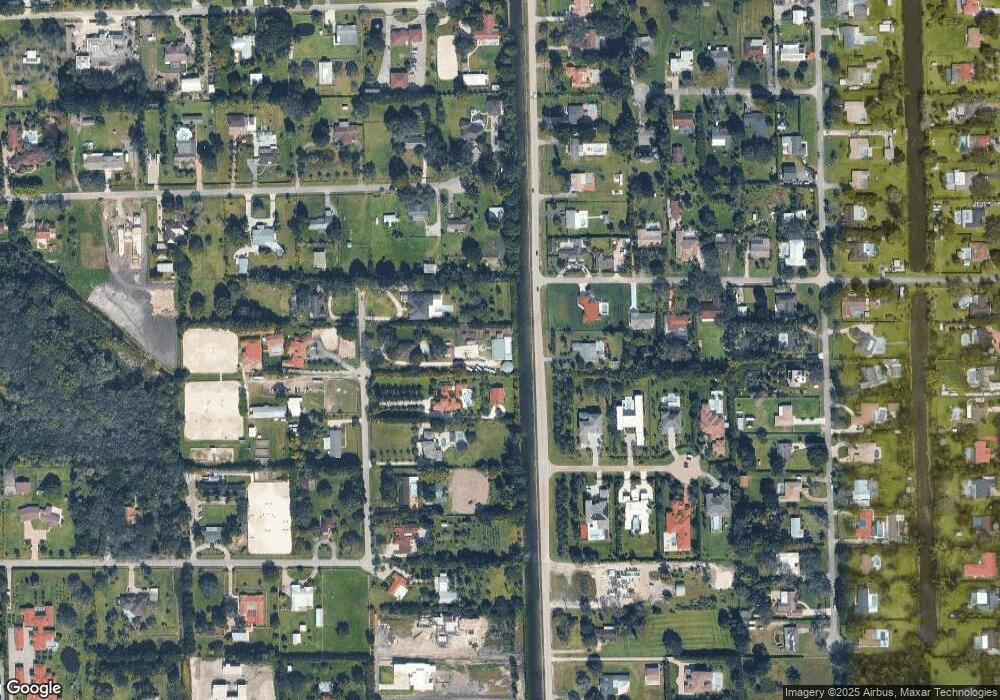

Map

Nearby Homes

- 17510 SW 48 St

- 17510 SW 48th St

- 17311 SW 52nd Ct

- 17301 SW 52nd Ct

- 17349 SW 46th St

- 17101 SW 48th St

- 17041 SW 48th St

- 70 Sw Place

- 5310 SW 172nd Ave

- 17100 SW 54th St

- 4361 Dogwood Cir

- 17801 SW 50th St

- 5101 SW 178th Ave

- 17500 SW 54th St

- 16701 SW 49th St

- 4304 Beechwood Cir

- 4466 Blossom Ln

- 4920 SW 167th Ave

- 4357 Magnolia Ridge Dr

- 17025 Stratford Ct

- 4900 SW 173rd Way

- 5001 SW 173rd Way

- 4901 SW 173rd Way

- 5005 SW 173rd Way

- 17320 SW 48th St

- 4911 SW 173rd Way

- 17200 SW 48th St

- 5030 SW 173rd Way

- 17300 SW 48th St Unit n/a

- 17300 SW 48th St

- 5011 SW 173rd Way

- 48 SW 48th St

- 17401 SW 51st St

- 4910 SW 172nd Ave

- 4900 SW 172nd Ave

- 17135 Reserve Ct

- 5110 SW 173rd Way

- 4840 SW 172nd Ave

- 4830 SW 172nd Ave