4912 SW 141st Ave Unit 5 Miramar, FL 33027

Miramar Patio Homes NeighborhoodEstimated Value: $309,000 - $382,000

3

Beds

3

Baths

1,067

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 4912 SW 141st Ave Unit 5, Miramar, FL 33027 and is currently estimated at $343,008, approximately $321 per square foot. 4912 SW 141st Ave Unit 5 is a home located in Broward County with nearby schools including Coral Cove Elementary School, New Renaissance Middle School, and Everglades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2023

Sold by

Ibanez Jesus and Ibanez Giovanna Palacios

Bought by

Ibanez Jesus and Glorioso Giovanna Palacios

Current Estimated Value

Purchase Details

Closed on

Mar 12, 2021

Sold by

Tavarez Edgardo

Bought by

Ibanez Jesus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,800

Interest Rate

2.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 2009

Sold by

Edgardo Tavarez

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Aug 26, 2006

Sold by

Mendez Josue and Mendez Ana E

Bought by

Tavarez Edgardo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,500

Interest Rate

8.05%

Mortgage Type

Balloon

Purchase Details

Closed on

May 19, 2006

Sold by

Southern Homes Of Broward X Llc

Bought by

Mendez Josue and Mendez Ana E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$221,500

Interest Rate

6.44%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ibanez Jesus | -- | C & C Title Agency | |

| Ibanez Jesus | $240,000 | C & C Title Agency | |

| Deutsche Bank National Trust Company | -- | Attorney | |

| Tavarez Edgardo | $285,000 | Floridian Home Title Corp | |

| Mendez Josue | $246,200 | Four Points Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ibanez Jesus | $232,800 | |

| Previous Owner | Tavarez Edgardo | $256,500 | |

| Previous Owner | Mendez Josue | $221,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,365 | $304,600 | -- | -- |

| 2024 | $5,846 | $304,600 | $27,230 | $245,110 |

| 2023 | $5,846 | $251,740 | $0 | $0 |

| 2022 | $5,060 | $228,860 | $22,890 | $205,970 |

| 2021 | $4,442 | $194,340 | $0 | $0 |

| 2020 | $4,160 | $186,980 | $18,700 | $168,280 |

| 2019 | $3,811 | $160,910 | $16,090 | $144,820 |

| 2018 | $3,576 | $165,940 | $16,590 | $149,350 |

| 2017 | $3,272 | $132,750 | $0 | $0 |

| 2016 | $3,081 | $120,690 | $0 | $0 |

| 2015 | $2,918 | $109,720 | $0 | $0 |

| 2014 | $2,535 | $99,750 | $0 | $0 |

| 2013 | -- | $90,690 | $9,070 | $81,620 |

Source: Public Records

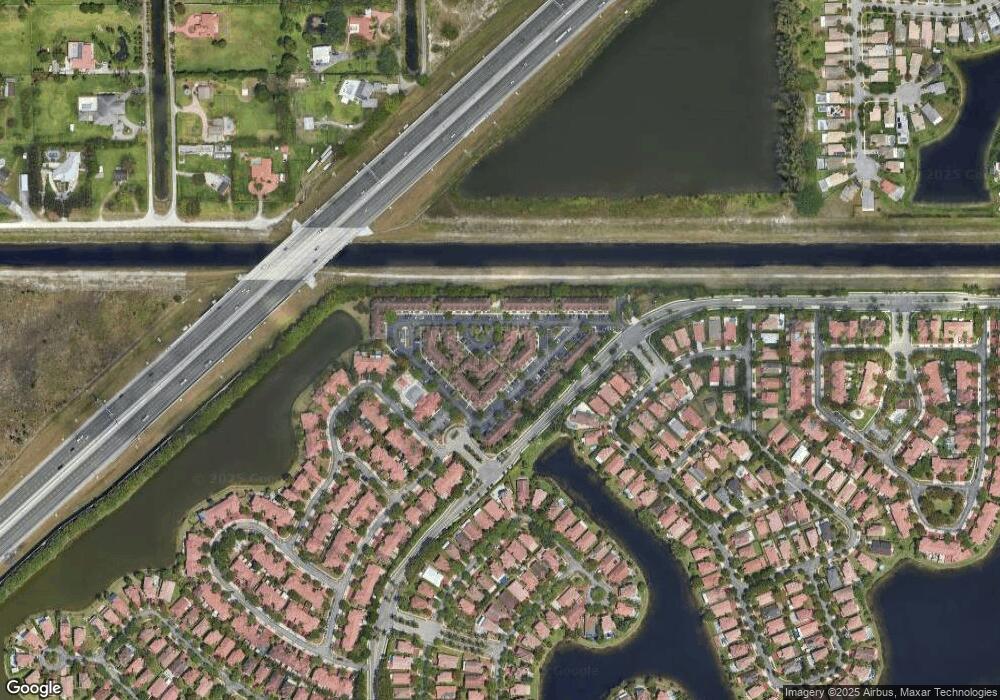

Map

Nearby Homes

- 4964 SW 140th Terrace Unit 8

- 14053 SW 49th St Unit 7

- 14111 SW 49th St Unit 8

- 4913 SW 141st Ave Unit 2

- 4921 SW 140th Terrace Unit 1

- 4917 SW 141st Ave Unit 4

- 14078 SW 50th Ct

- 14082 SW 50th Ct

- 14075 SW 50th Ln

- 5074 SW 140th Terrace

- 5046 SW 137th Terrace

- 14098 SW 51st Ct

- 13680 SW 50th Ct

- 5000 SW 136th Ave

- 5048 SW 136th Ave

- 4800 SW 141st Ave

- 13519 SW 50th Ct

- 13357 SW 46th Ct

- 14201 SW 48th Ct

- 4980 SW 134th Ave

- 4921 SW 140th Terrace

- 14109 SW 49th St

- 4961 SW 140th Terrace Unit 9

- 4917 SW 140th Terrace Unit 9

- 4907 SW 140th Terrace Unit 4

- 4903 SW 141st Ave Unit 1

- 14005 SW 49th St Unit 9

- 14043 SW 49th St Unit 1

- 14073 SW 49th St Unit 14

- 14065 SW 49th St Unit 1

- 14107 SW 49th St Unit 10

- 4928 SW 140th Terrace Unit 2

- 4912 SW 141st Ave Unit 1

- 14109 SW 49th St Unit 9

- 14087 SW 49th Ct Unit 8

- 4906 SW 141st Ave Unit 4

- 14015 SW 49th St Unit 4

- 4925 SW 140th Terrace Unit 11

- 4911 SW 140th Terrace