4926 Walden Lake Square Unit 34 Decatur, GA 30035

Southwest DeKalb NeighborhoodEstimated Value: $175,838 - $199,000

3

Beds

3

Baths

1,456

Sq Ft

$130/Sq Ft

Est. Value

About This Home

This home is located at 4926 Walden Lake Square Unit 34, Decatur, GA 30035 and is currently estimated at $189,460, approximately $130 per square foot. 4926 Walden Lake Square Unit 34 is a home located in DeKalb County with nearby schools including Fairington Elementary School, Miller Grove Middle School, and Miller Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 13, 2024

Sold by

Ezepue Geoffrey U

Bought by

Quarles Justin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,300

Outstanding Balance

$166,253

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$23,207

Purchase Details

Closed on

Aug 23, 2011

Sold by

Secretary Of Housing And U

Bought by

Ezepue Geoffrey U

Purchase Details

Closed on

Nov 2, 2010

Sold by

Wells Fargo Bk Na

Bought by

Hud-Housing Of Urban Dev

Purchase Details

Closed on

Dec 29, 2003

Sold by

S-Walden Constuction Co Llc

Bought by

Perkins Consuela L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,770

Interest Rate

5.85%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Quarles Justin | $187,000 | -- | |

| Ezepue Geoffrey U | $31,000 | -- | |

| Hud-Housing Of Urban Dev | -- | -- | |

| Wells Fargo Bk Na | $128,860 | -- | |

| Perkins Consuela L | $117,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Quarles Justin | $168,300 | |

| Previous Owner | Perkins Consuela L | $113,770 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,199 | $78,640 | $20,000 | $58,640 |

| 2024 | $3,532 | $79,600 | $20,000 | $59,600 |

| 2023 | $3,532 | $83,040 | $20,000 | $63,040 |

| 2022 | $2,654 | $59,920 | $4,800 | $55,120 |

| 2021 | $1,834 | $41,240 | $4,800 | $36,440 |

| 2020 | $1,571 | $35,240 | $4,800 | $30,440 |

| 2019 | $1,486 | $33,320 | $4,800 | $28,520 |

| 2018 | $1,029 | $24,360 | $4,800 | $19,560 |

| 2017 | $1,052 | $23,320 | $4,800 | $18,520 |

| 2016 | $1,007 | $22,240 | $3,400 | $18,840 |

| 2014 | $868 | $18,640 | $3,400 | $15,240 |

Source: Public Records

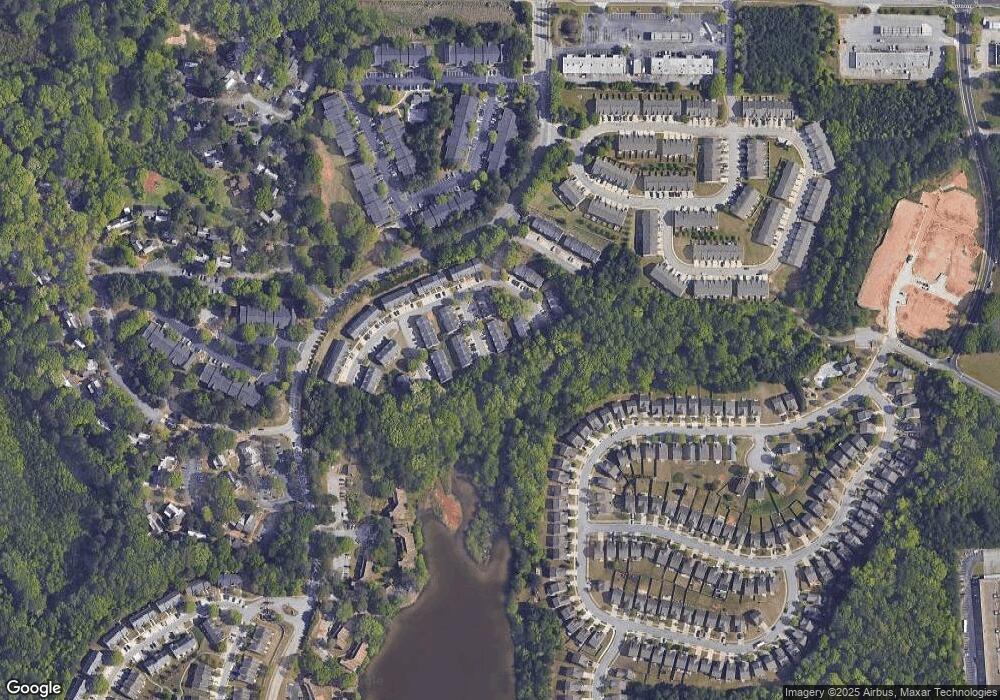

Map

Nearby Homes

- 2504 Walden Lake Dr

- 2502 Walden Lake Dr

- 4917 Walden Lake Square

- 2537 Walden Lake Dr

- 2566 Walden Lake Dr

- 5004 Jack Dr

- 2693 Avanti Way

- 2754 Shellbark Rd

- 2657 Avanti Way

- 5186 Longview Run

- 5154 Longview Run

- 5178 Longview Run

- 5142 Longview Run

- 5027 Jack Dr

- 2656 Avanti Way

- 29 Quail Run Unit B

- 4998 Longview Walk

- 9 Quail Run

- 4926 Walden Lake Square Unit 37

- 4926 Walden Lake Square

- 4924 Walden Lake Square

- 4924 Walden Lake Square Unit 33

- 4922 Walden Lake Square Unit DQ

- 4922 Walden Lake Square

- 4920 Walden Lake Square

- 4918 Walden Lake Square

- 2506 Walden Lake Dr

- 2508 Walden Lake Dr Unit 25

- 2508 Walden Lake Dr

- 4925 Walden Lake Square

- 4923 Walden Lake Square

- 4914 Walden Lake Square

- 4916 Walden Lake Square Unit 29

- 4919 Walden Lake Square Unit 38

- 4919 Walden Lake Square

- 4917 Walden Lake Square Unit 39

- 4912 Walden Lake Square Unit 27

- 4912 Walden Lake Square