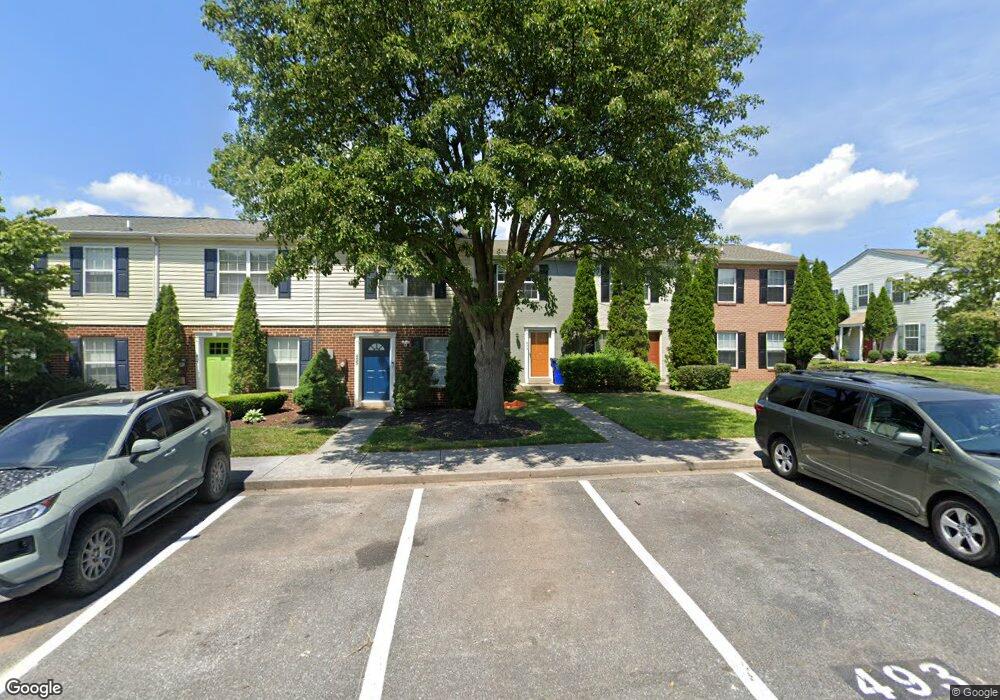

493 Arwell Ct Frederick, MD 21703

Frederick Heights/Overlook NeighborhoodEstimated Value: $296,000 - $309,620

Studio

2

Baths

1,088

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 493 Arwell Ct, Frederick, MD 21703 and is currently estimated at $302,405, approximately $277 per square foot. 493 Arwell Ct is a home located in Frederick County with nearby schools including Hillcrest Elementary School, West Frederick Middle School, and Frederick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2025

Sold by

Jensen Michael Gerald and Jensen Susan Margaret

Bought by

Jensen Michael Gerald

Current Estimated Value

Purchase Details

Closed on

May 1, 2006

Sold by

Part. Alban Place Ltd

Bought by

Jensen Michael Gerald and Jensen Susan Margaret

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,950

Interest Rate

6.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 25, 2006

Sold by

Part. Alban Place Ltd

Bought by

Jensen Michael Gerald and Jensen Susan Margaret

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,950

Interest Rate

6.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jensen Michael Gerald | -- | None Listed On Document | |

| Jensen Michael Gerald | -- | None Listed On Document | |

| Jensen Michael Gerald | $243,740 | -- | |

| Jensen Michael Gerald | $243,740 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jensen Michael Gerald | $194,950 | |

| Previous Owner | Jensen Michael Gerald | $194,950 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,095 | $235,200 | $85,000 | $150,200 |

| 2024 | $4,095 | $218,600 | -- | -- |

| 2023 | $3,685 | $202,000 | $0 | $0 |

| 2022 | $3,378 | $185,400 | $75,000 | $110,400 |

| 2021 | $3,145 | $172,100 | $0 | $0 |

| 2020 | $2,897 | $158,800 | $0 | $0 |

| 2019 | $2,661 | $145,500 | $42,000 | $103,500 |

| 2018 | $2,467 | $133,367 | $0 | $0 |

| 2017 | $2,229 | $145,500 | $0 | $0 |

| 2016 | $2,071 | $109,100 | $0 | $0 |

| 2015 | $2,071 | $109,100 | $0 | $0 |

| 2014 | $2,071 | $109,100 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 534 Lancaster Place

- 545 Beebe Ct

- 525 Beebe Ct

- 615 Himes Ave Unit 108

- 615 Himes Ave Unit 106

- 1217 Dahlia Ln

- 607 Himes Ave Unit 102

- 18 S Pendleton Ct Unit 10C

- 578 Boysenberry Ln

- 591 Winterspice Dr

- 13 Consett Place

- 111 Lauren Ct

- 1008 Inkberry Way

- 1228 Danielle Dr

- 1236C Danielle Dr

- 1249 A Danielle Dr Unit 1249A

- 401 Linden Ave

- 554 Eisenhower Dr

- 590 Over Ridge Dr

- 1339 Orchard Way

Your Personal Tour Guide

Ask me questions while you tour the home.