4933 Vireo Dr Unit 98 Flowery Branch, GA 30542

Estimated Value: $285,000 - $301,000

3

Beds

3

Baths

1,674

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 4933 Vireo Dr Unit 98, Flowery Branch, GA 30542 and is currently estimated at $292,225, approximately $174 per square foot. 4933 Vireo Dr Unit 98 is a home located in Hall County with nearby schools including Flowery Branch Elementary School, West Hall Middle School, and West Hall High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2023

Sold by

Montoya Edwin

Bought by

Laub Monica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,250

Outstanding Balance

$202,323

Interest Rate

7.29%

Mortgage Type

New Conventional

Estimated Equity

$89,902

Purchase Details

Closed on

Aug 20, 2020

Sold by

Davis Marilyn L

Bought by

Montoya Edwin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,667

Interest Rate

3%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 30, 2005

Sold by

Garen Homes Inc

Bought by

Davis Marilyn L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,224

Interest Rate

5.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 23, 2002

Sold by

Landstar Corp

Bought by

Garen Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laub Monica | $275,000 | -- | |

| Montoya Edwin | $184,000 | -- | |

| Davis Marilyn L | $133,300 | -- | |

| Garen Homes Inc | $426,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Laub Monica | $206,250 | |

| Previous Owner | Montoya Edwin | $180,667 | |

| Previous Owner | Davis Marilyn L | $131,224 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,312 | $121,000 | $20,560 | $100,440 |

| 2024 | $3,119 | $116,120 | $21,000 | $95,120 |

| 2023 | $2,732 | $108,880 | $20,000 | $88,880 |

| 2022 | $2,272 | $86,880 | $13,320 | $73,560 |

| 2021 | $1,861 | $69,880 | $7,000 | $62,880 |

| 2020 | $1,770 | $64,560 | $4,800 | $59,760 |

| 2019 | $1,763 | $63,720 | $4,800 | $58,920 |

| 2018 | $1,647 | $57,640 | $4,800 | $52,840 |

| 2017 | $1,564 | $53,400 | $4,000 | $49,400 |

| 2016 | $1,414 | $49,440 | $2,000 | $47,440 |

| 2015 | $842 | $45,520 | $6,000 | $39,520 |

| 2014 | $842 | $29,230 | $3,000 | $26,230 |

Source: Public Records

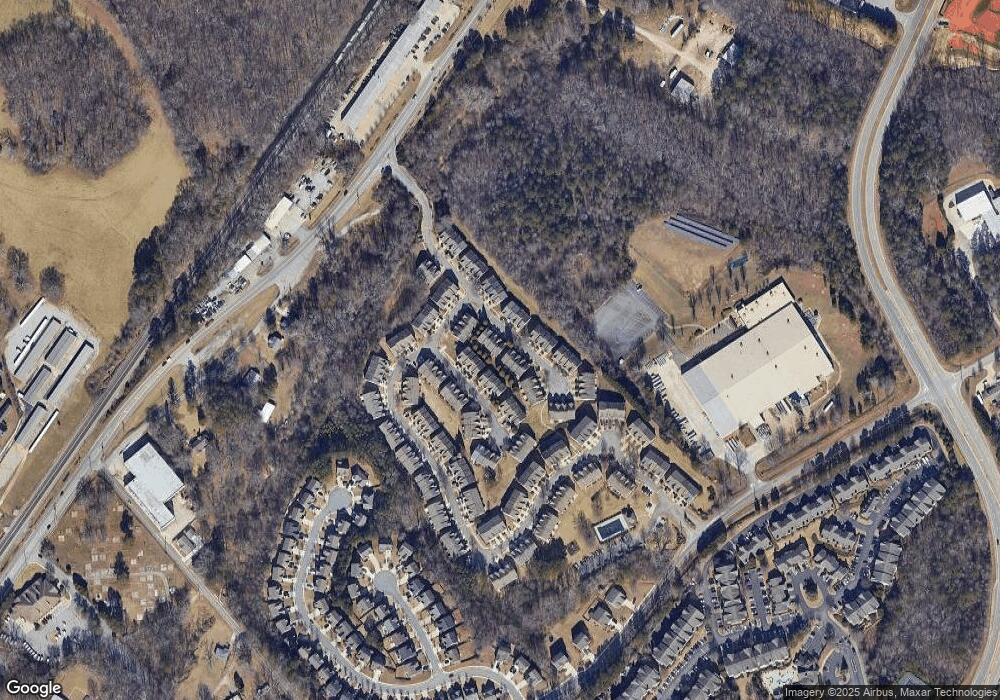

Map

Nearby Homes

- 4905 Vireo Dr

- 4836 Clarkstone Cir

- 5465 Hargrove Way

- 5357 Frontier Ct

- 5556 Coalie Trace

- 5529 Coalie Trace

- 4611 Thurmon Tanner Pkwy

- 5525 Coalie Trace

- Marigold Plan at Eastlyn Crossing - Townhomes

- Foxglove Plan at Eastlyn Crossing - Townhomes

- 5404 Falling Branch Ct

- Lancaster Plan at Eastlyn Crossing - Single Family

- Pearson Plan at Eastlyn Crossing - Single Family

- Savoy Plan at Eastlyn Crossing - Single Family

- Hampstead Plan at Eastlyn Crossing - Single Family

- Buckley Plan at Eastlyn Crossing - Single Family

- 5343 Hargrove Way

- 5333 Frontier Ct

- 5967 Screech Owl Dr

- 5325 Frontier Ct

- 4933 Vireo Dr

- 4929 Vireo Dr

- 4935 Vireo Dr

- 4927 Vireo Dr Unit 25C

- 4927 Vireo Dr

- 4937 Vireo Dr

- 4939 Vireo Dr Unit 24-D

- 4939 Vireo Dr

- 4939 Vireo Dr Unit D

- 4925 Vireo Dr

- 4925 Vireo Dr Unit B

- 4923 Vireo Dr

- 4811 Zephyr Cove Place Unit 4811

- 4811 Zephyr Cove Place

- 4815 Zephyr Cove Place Unit 4818

- 4815 Zephyr Cove Place Unit .

- 4815 Zephyr Cove Place

- 4815 Zephyr Cove Place

- 4809 Zephyr Cove Place

- 4817 Zephyr Cove Place Unit 4817