4941 Autumn Oaks Dr Maryville, IL 62062

Estimated Value: $466,056 - $523,000

5

Beds

3

Baths

2,226

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 4941 Autumn Oaks Dr, Maryville, IL 62062 and is currently estimated at $494,264, approximately $222 per square foot. 4941 Autumn Oaks Dr is a home located in Madison County with nearby schools including Maryville Elementary School, Dorris Intermediate School, and Collinsville Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 8, 2005

Sold by

Loyet Wesley D and Loyet Jamie M

Bought by

Mckinney Belinda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$159,986

Interest Rate

6.95%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$334,278

Purchase Details

Closed on

Apr 11, 2003

Sold by

Foreman Development Inc

Bought by

Loyet Wesley D and Loyet Jaimie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,950

Interest Rate

5.76%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mckinney Belinda | $350,000 | Mctc | |

| Loyet Wesley D | $266,000 | -- | |

| Foreman Development Inc | $47,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mckinney Belinda | $280,000 | |

| Previous Owner | Loyet Wesley D | $220,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,414 | $146,470 | $25,430 | $121,040 |

| 2023 | $9,414 | $135,570 | $23,540 | $112,030 |

| 2022 | $8,903 | $125,370 | $21,770 | $103,600 |

| 2021 | $8,436 | $123,180 | $21,430 | $101,750 |

| 2020 | $8,131 | $117,530 | $20,450 | $97,080 |

| 2019 | $7,900 | $113,510 | $19,750 | $93,760 |

| 2018 | $7,705 | $107,520 | $18,710 | $88,810 |

| 2017 | $7,676 | $105,380 | $18,340 | $87,040 |

| 2016 | $7,991 | $104,660 | $18,340 | $86,320 |

| 2015 | $7,441 | $101,940 | $17,860 | $84,080 |

| 2014 | $7,441 | $101,940 | $17,860 | $84,080 |

| 2013 | $7,441 | $101,940 | $17,860 | $84,080 |

Source: Public Records

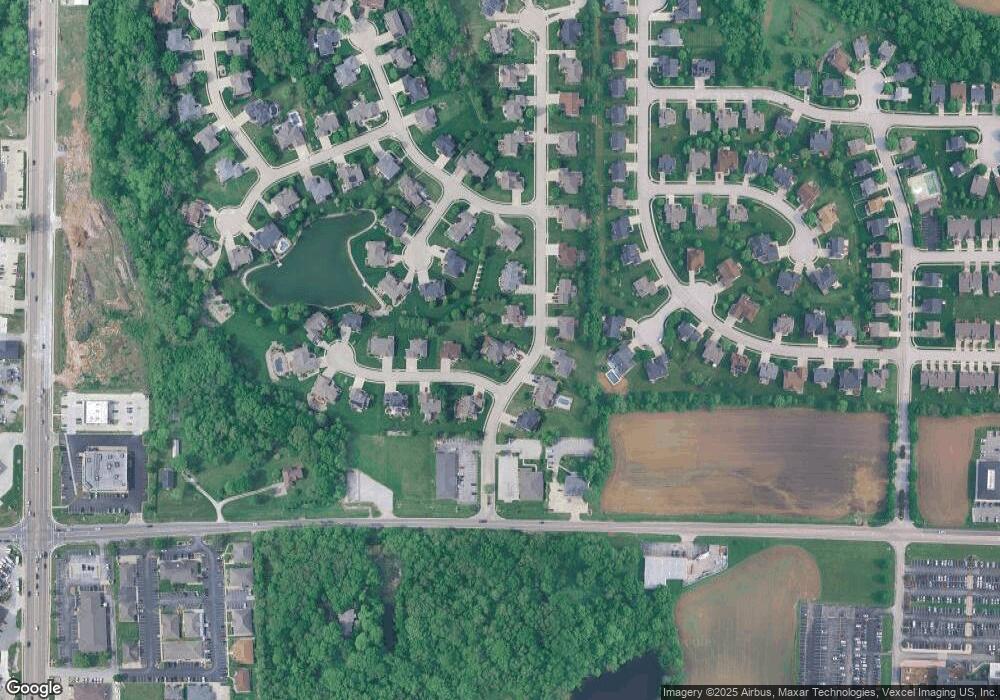

Map

Nearby Homes

- 2301 Preswyck Ct

- 10 Dunbridge Ct

- 77 Kingsley Way

- 24 Alta St

- 1 Heather Green

- 6817 Bouse Rd

- 14 Lou Juan Dr

- 0 Route 159

- 17 Waterford Ln

- 4519 Bruin Ln

- 1 Pioneer Trail

- 126 Kingsbrooke Blvd

- 1313 Jacquelyn Ct

- 53 Cheshire Dr

- 5 Chariot Ct

- 419 N Donk Ave

- 109 Kingsbrooke Blvd

- 671 Glen Crossing Rd

- 501 Drost St

- 204 Aspen Point

- 4937 Autumn Oaks Dr

- 5 Ashford Oaks Dr

- 4944 Autumn Oaks Dr

- 4948 Autumn Oaks Dr

- 4940 Autumn Oaks Dr

- 4945 Autumn Oaks Dr

- 4933 Autumn Oaks Dr

- 10 Arbor Crest Ct

- 4952 Autumn Oaks Dr

- 4936 Autumn Oaks Dr

- 9 Ashford Oaks Dr

- 6 Ashford Oaks Dr

- 5 Ashford Oaks Ct

- 6 Ashford Oaks Ct

- 6 Arbor Crest Ct

- 4932 Autumn Oaks Dr

- 10 Ashford Oaks Dr

- 15 Ashford Oaks Dr

- 2246 Chatham Ct

- 14 Arbor Crest Ct