4944 S 1021 E Salt Lake City, UT 84117

Estimated Value: $489,000 - $517,261

3

Beds

3

Baths

1,328

Sq Ft

$379/Sq Ft

Est. Value

About This Home

This home is located at 4944 S 1021 E, Salt Lake City, UT 84117 and is currently estimated at $503,815, approximately $379 per square foot. 4944 S 1021 E is a home located in Salt Lake County with nearby schools including Twin Peaks Elementary School, Woodstock Elementary School, and Bonneville Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2007

Sold by

Hut John B and Hut Florina M

Bought by

Anderson V Karen

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2006

Sold by

Chilton Susan K

Bought by

Hut John B and Hut Florina M

Purchase Details

Closed on

Dec 22, 2003

Sold by

Chilton Susan Kay

Bought by

Chilton Susan K and Susan Chilton Living Trust

Purchase Details

Closed on

Dec 4, 2002

Sold by

Chilton Susan K

Bought by

Chilton Susan Kay

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

6.28%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson V Karen | -- | Equity Title | |

| Hut John B | -- | Landmark Title | |

| Chilton Susan K | -- | -- | |

| Chilton Susan Kay | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Chilton Susan Kay | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,452 | $452,700 | $135,800 | $316,900 |

| 2024 | $2,452 | $434,200 | $130,200 | $304,000 |

| 2023 | $2,460 | $418,600 | $125,600 | $293,000 |

| 2022 | $2,602 | $444,400 | $133,300 | $311,100 |

| 2021 | $2,322 | $350,600 | $105,200 | $245,400 |

| 2020 | $2,245 | $323,100 | $96,900 | $226,200 |

| 2019 | $2,205 | $308,400 | $92,500 | $215,900 |

| 2018 | $2,077 | $280,600 | $84,200 | $196,400 |

| 2017 | $1,667 | $251,800 | $75,500 | $176,300 |

| 2016 | $1,543 | $233,800 | $70,100 | $163,700 |

| 2015 | $1,577 | $222,500 | $66,800 | $155,700 |

| 2014 | $1,586 | $220,300 | $66,100 | $154,200 |

Source: Public Records

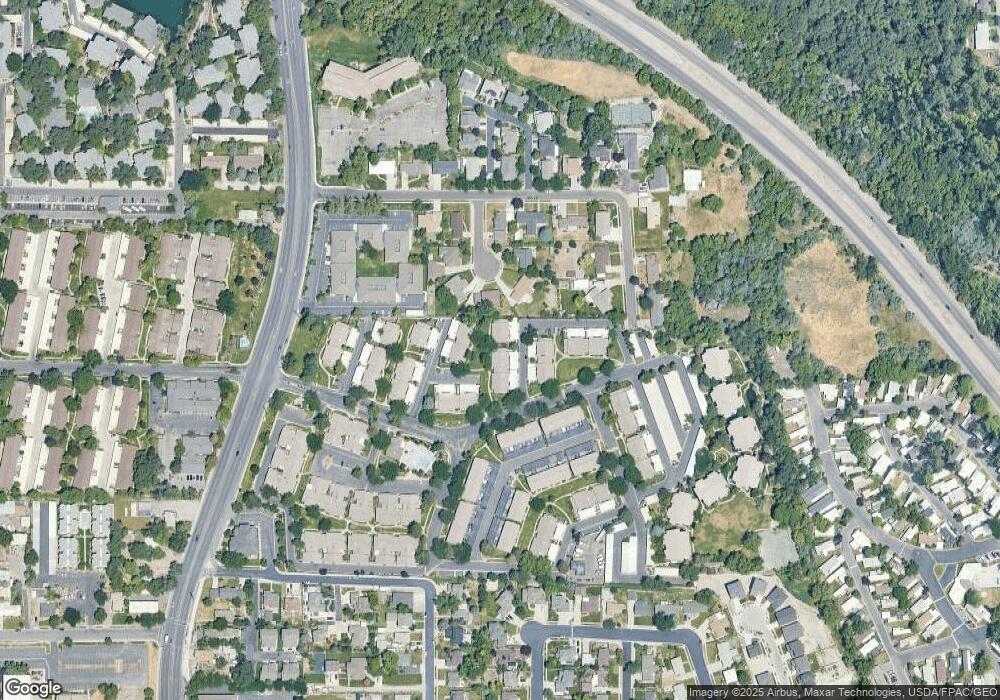

Map

Nearby Homes

- 4971 S 1065 E Unit 40

- 4956 S 975 E

- 4949 S Eastridge Ln Unit 137

- 4979 S Eastridge Ln Unit 190

- 877 E 4900 S

- 862 E Three Fountains Dr Unit 208

- 4979 S Camino Real

- 875 E Arrowhead Ln Unit 34

- 5028 S Del Rio St

- 4978 S Del Prado St Unit B006

- 832 E Three Fountains Dr Unit 182

- 1177 S 1140 E

- 4981 La Contessa St

- 1175 E Del Rio St

- 1187 E Del Rio St Unit E003

- 745 E Three Fountains Cir Unit 41

- 1114 E 5190 S

- 1107 E Brigadoon Ct

- 5092 S El Sendero Cir E

- 5100 S El Sendero Cir

- 5016 S 1034 E Unit 58

- 4944 S 1021 E Unit 22

- 4940 S 1021 E Unit 23

- 1064 E 5000 S

- 5010 S 1034 E

- 1051 E 5000 S

- 1055 E 5000 S

- 4939 S 975 E

- 4936 S 1021 E

- 1013 Eastgate Rd

- 4943 S 975 E

- 4943 S 975 E Unit 15

- 1017 Eastgate Rd

- 1017 Eastgate Rd Unit 20

- 1049 E 5000 S

- 4941 S 1021 E

- 4937 S 1021 E

- 4937 S 1021 E Unit 25

- 5008 S 1034 E

- 5008 S 1034 E Unit 60