4949 Samantha Ct Unit 40 Liberty Township, OH 45011

Estimated Value: $428,143 - $488,000

4

Beds

3

Baths

2,400

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 4949 Samantha Ct Unit 40, Liberty Township, OH 45011 and is currently estimated at $460,786, approximately $191 per square foot. 4949 Samantha Ct Unit 40 is a home located in Butler County with nearby schools including Heritage Early Childhood School, Cherokee Elementary School, and Lakota Plains Junior School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2021

Sold by

Lad Properties Of Ohio Llc

Bought by

Rands Philip B and Coon Caitlin M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$235,704

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$225,082

Purchase Details

Closed on

Jun 12, 2015

Sold by

First Financial Collateral Inc

Bought by

Lad Properties Of Ohio Llc

Purchase Details

Closed on

Sep 26, 2014

Sold by

Cassinelli Peter J and Cassinelli Deborah S

Bought by

First Financial Bank Na and First Financial Collateral Inc

Purchase Details

Closed on

Aug 26, 2011

Sold by

Hut 1 Llc

Bought by

First Financial Collateral Inc and First Financial Bank Na

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rands Philip B | $325,000 | Prodigy Title Agency | |

| Rands Philip D | $325,000 | None Listed On Document | |

| Lad Properties Of Ohio Llc | $15,000 | Attorney | |

| First Financial Bank Na | $10,000 | None Available | |

| First Financial Collateral Inc | $26,600 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rands Philip D | $260,000 | |

| Closed | Rands Philip D | $260,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,609 | $113,650 | $17,590 | $96,060 |

| 2023 | $4,550 | $114,370 | $17,590 | $96,780 |

| 2022 | $4,103 | $80,190 | $17,590 | $62,600 |

| 2021 | $4,082 | $80,190 | $17,590 | $62,600 |

| 2020 | $4,184 | $80,190 | $17,590 | $62,600 |

| 2019 | $7,297 | $75,750 | $15,650 | $60,100 |

| 2018 | $4,415 | $75,750 | $15,650 | $60,100 |

| 2017 | $371 | $5,250 | $5,250 | $0 |

| 2016 | $367 | $5,250 | $5,250 | $0 |

| 2015 | $310 | $5,250 | $5,250 | $0 |

| 2014 | $7,957 | $10,960 | $10,960 | $0 |

| 2013 | $7,957 | $12,170 | $12,170 | $0 |

Source: Public Records

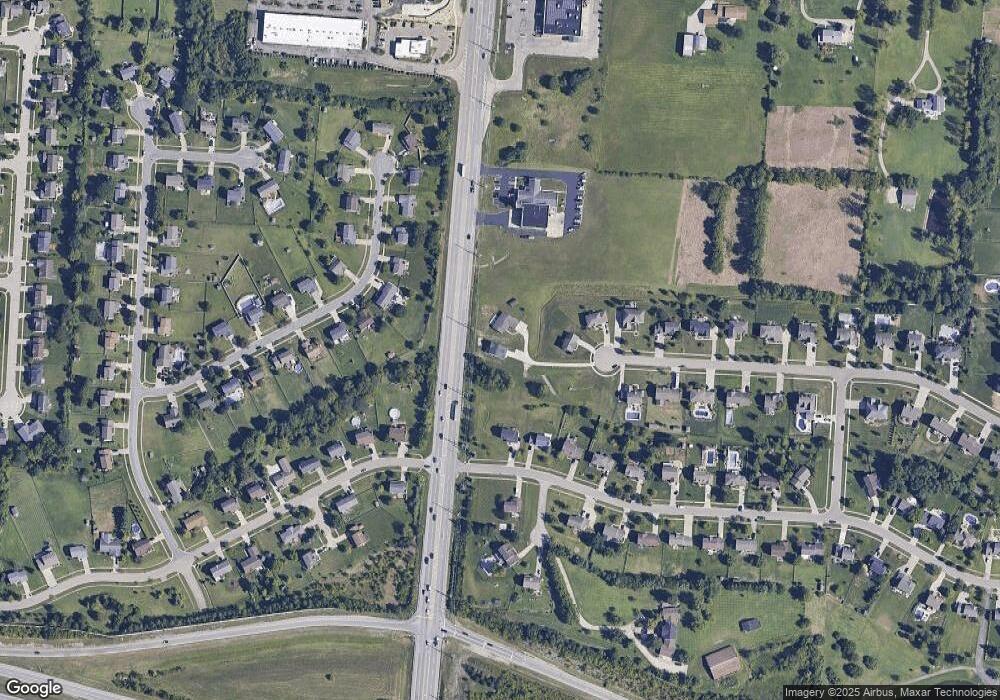

Map

Nearby Homes

- 5108 Grandin Ridge Dr

- 4520 Logsdons Meadow Dr

- 4871 Imperial Dr

- 5168 Grandin Ridge Dr

- 5146 Mountview Ct

- 7077 Parliament Place

- 6993 Clawson Ridge Ct

- 5003 Arena Ct

- 5053 Maiden Way

- 5011 Arena Ct

- 5038 Maiden Way

- 4991 Arena Ct

- 4893 Arena Ct

- 6940 Crown Pointe Dr

- 7144 Lookout Ct

- 0 Walnut Creek Dr Unit 1850153

- 6406 Whippoorwill Dr

- 7229 W Hartford Ct

- 4949 Samantha Ct

- 4940 Samantha Ct Unit 41

- 4940 Samantha Ct

- 4950 Samantha Ct Unit 39

- 4950 Samantha Ct

- 4962 Grandin Ridge Dr

- 4968 Grandin Ridge Dr

- 21 Samantha Ct

- 39 Samantha Ct Unit 39

- 18 Samantha Ct Unit 18

- 4960 Samantha Ct

- 4978 Grandin Ridge Dr

- 4936 Logsdons Meadow Dr

- 4969 Samantha Ct

- 4988 Grandin Ridge Dr

- 4970 Samantha Ct

- 4945 Meadow Vista Ct

- 4921 Meadow Vista Ct

- 0 Samantha Ct

- 4933 Meadow Vista Ct