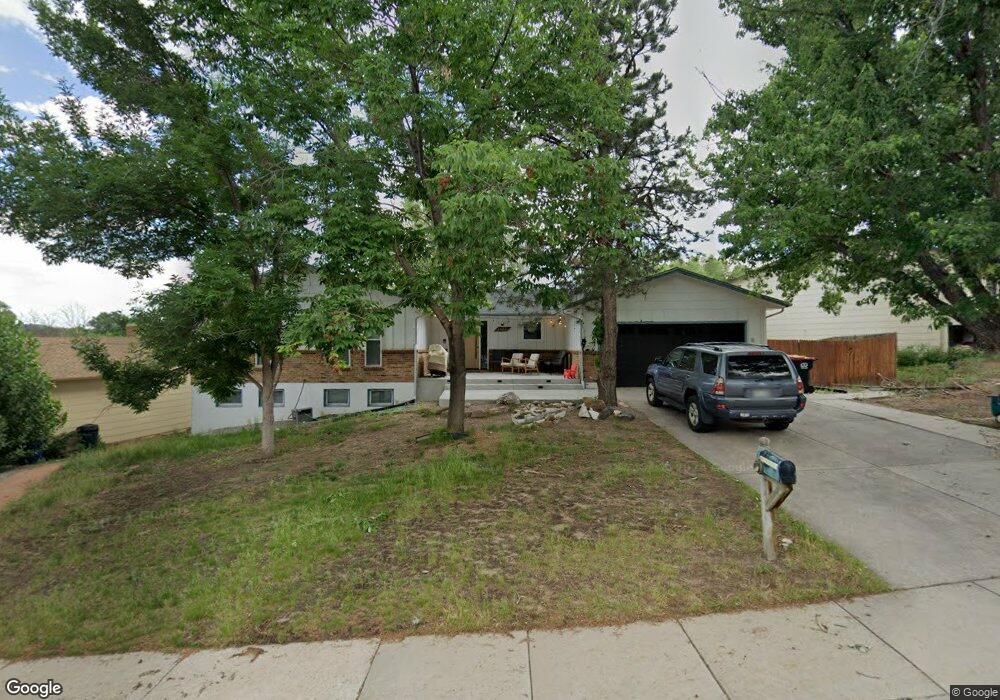

4965 Garden Trail Colorado Springs, CO 80918

Garden Ranch NeighborhoodEstimated Value: $457,413 - $514,000

3

Beds

2

Baths

1,813

Sq Ft

$269/Sq Ft

Est. Value

About This Home

This home is located at 4965 Garden Trail, Colorado Springs, CO 80918 and is currently estimated at $488,353, approximately $269 per square foot. 4965 Garden Trail is a home located in El Paso County with nearby schools including Fremont Elementary School, Mann Middle School, and Coronado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2021

Sold by

Wr Weiss Family Trust

Bought by

Privett Jason K and Privett Kirsten B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$356,250

Outstanding Balance

$318,073

Interest Rate

2.6%

Mortgage Type

New Conventional

Estimated Equity

$170,280

Purchase Details

Closed on

Feb 15, 2017

Sold by

Weiss William K and Weiss Rita L

Bought by

Wr Weiss Family Trust

Purchase Details

Closed on

Feb 2, 2011

Sold by

Bylund David W

Bought by

Weiss William K and Weiss Rita L

Purchase Details

Closed on

Sep 1, 1986

Bought by

Weiss William K Trustee

Purchase Details

Closed on

Jul 1, 1983

Bought by

Weiss Rita L Trustee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Privett Jason K | $375,000 | Capital Title | |

| Wr Weiss Family Trust | -- | None Available | |

| Weiss William K | -- | None Available | |

| Weiss William K Trustee | -- | -- | |

| Weiss Rita L Trustee | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Privett Jason K | $356,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,592 | $33,960 | -- | -- |

| 2024 | $1,477 | $33,070 | $4,820 | $28,250 |

| 2022 | $1,375 | $24,580 | $3,610 | $20,970 |

| 2021 | $1,493 | $25,300 | $3,720 | $21,580 |

| 2020 | $1,495 | $22,030 | $3,220 | $18,810 |

| 2019 | $1,487 | $22,030 | $3,220 | $18,810 |

| 2018 | $1,329 | $18,110 | $2,160 | $15,950 |

| 2017 | $1,259 | $18,110 | $2,160 | $15,950 |

| 2016 | $1,032 | $17,800 | $2,230 | $15,570 |

| 2015 | $1,028 | $17,800 | $2,230 | $15,570 |

| 2014 | $965 | $16,030 | $2,230 | $13,800 |

Source: Public Records

Map

Nearby Homes

- 2520 Hamlet Ln Unit A

- 2252 Conservatory Point

- 2195 Wake Forest Ct

- 2175 Wake Forest Ct

- 4876 Saint Augustine Ct

- 4506 Ridgecrest Dr

- 5419 Escondido Ct

- 2775 El Capitan Dr

- 5341 Fiesta Ln

- 2430 Blazek Loop

- 4623 Ranch Cir

- 2724 Montebello Dr W

- 2832 Ridgeglen Way

- 4454 Ranch Cir

- 5034 El Camino Dr Unit 36

- 5034 El Camino Dr Unit 31

- 5034 El Camino Dr Unit 42

- 5030 El Camino Dr Unit 8

- 5030 El Camino Dr Unit 1

- 4410 Campus Bluffs Ct

- 4949 Garden Trail

- 4979 Garden Trail

- 4939 Garden Trail

- 2469 Garden Way

- 2425 Garden Way

- 2441 Garden Way

- 4968 Garden Trail

- 4960 Garden Trail

- 4976 Garden Trail

- 4986 Garden Trail

- 2453 Garden Way

- 4929 Garden Trail

- 4952 Garden Trail

- 2473 Garden Way

- 4944 Garden Trail

- 4936 Garden Trail

- 2385 Garden Way

- 2465 Garden Way

- 4917 Garden Trail

- 4928 Garden Trail