4968 Highland Oaks Way SE Unit 2 Mableton, GA 30126

Vinings Estates NeighborhoodEstimated Value: $709,000 - $864,000

5

Beds

4

Baths

3,060

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 4968 Highland Oaks Way SE Unit 2, Mableton, GA 30126 and is currently estimated at $790,039, approximately $258 per square foot. 4968 Highland Oaks Way SE Unit 2 is a home located in Cobb County with nearby schools including Nickajack Elementary School, Griffin Middle School, and Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2014

Sold by

Schuster Terence K

Bought by

Schuster Cheryl D

Current Estimated Value

Purchase Details

Closed on

Aug 30, 1999

Sold by

Mieskoski Edmundf J and Mieskoski Mary F

Bought by

Smith Margaret M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

7.58%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 31, 1998

Sold by

John Wieland Homes & Neighborhoods

Bought by

Mieskoski Edmund J and Mieskoski Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,300

Interest Rate

6.95%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schuster Cheryl D | -- | -- | |

| Smith Margaret M | $335,900 | -- | |

| Mieskoski Edmund J | $290,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Smith Margaret M | $180,000 | |

| Previous Owner | Mieskoski Edmund J | $276,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,153 | $271,624 | $46,000 | $225,624 |

| 2023 | $1,001 | $271,624 | $46,000 | $225,624 |

| 2022 | $1,153 | $201,952 | $46,000 | $155,952 |

| 2021 | $1,178 | $192,908 | $46,000 | $146,908 |

| 2020 | $1,178 | $192,908 | $46,000 | $146,908 |

| 2019 | $4,287 | $174,596 | $46,000 | $128,596 |

| 2018 | $3,920 | $155,332 | $46,000 | $109,332 |

| 2017 | $3,688 | $155,332 | $46,000 | $109,332 |

| 2016 | $3,517 | $146,284 | $46,000 | $100,284 |

| 2015 | $3,602 | $146,284 | $46,000 | $100,284 |

| 2014 | $3,636 | $146,284 | $0 | $0 |

Source: Public Records

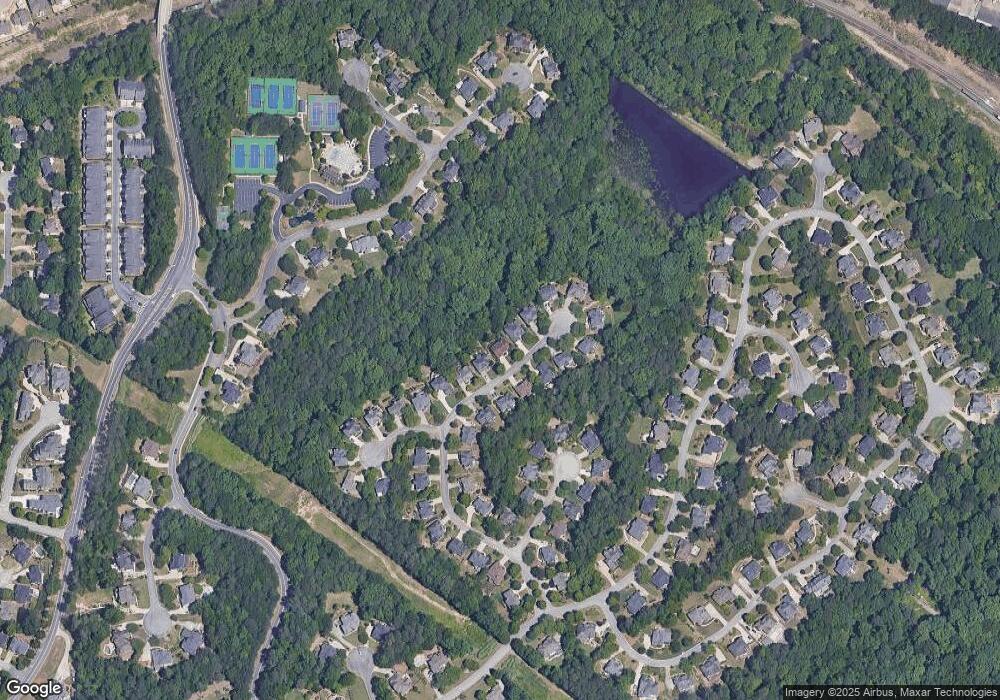

Map

Nearby Homes

- 5010 Highland Oaks Ct SE

- 767 Vinings Estates Dr SE

- 4204 Hardy Ave

- 5071 Vinings Estates Ct SE

- 658 Vinings Estates Dr SE

- 478 Vinings Estates Dr SE Unit B02

- 4559 Wilkerson Place SE

- 498 Vinings Estates Dr SE Unit B03

- 476 Cooper Lake Rd SE

- 5106 Vinings Estates Way SE

- 1101 Parkland Run SE

- 560 Cool Creek Trail SE

- 540 Cool Creek Trail SE

- 387 Nickajack Rd SE

- 1181 Parkland Run SE

- 4461 Derby Ln SE

- 212 Highlands Ridge Place SE Unit 3

- 4398 King Valley 3-5 Dr SE

- 4970 Highland Oaks Way SE

- 4966 Highland Oaks Way SE

- 4969 Highland Oaks Way SE Unit IIB

- 4967 Highland Oaks Way SE

- 4964 Highland Oaks Way SE

- 4971 Highland Oaks Way SE Unit 2B

- 4972 Highland Oaks Way SE

- 4973 Highland Oaks Way SE

- 4965 Highland Oaks Way SE

- 4962 Highland Oaks Way SE Unit 2B

- 4974 Highland Oaks Way SE

- 4963 Highland Oaks Way SE

- 4975 Highland Oaks Way SE Unit B

- 699 Highland Oaks Ln SE

- 5004 Highland Oaks Ct SE

- 5002 Highland Oaks Ct SE

- 4960 Highland Oaks Way SE

- 5004 SE Highlands Oak Ct

- 4961 Highland Oaks Way SE

- 0 Highland Oaks Ln SE Unit 7449853