5 Caleridge Ct Highlands Ranch, CO 80130

Eastridge NeighborhoodEstimated Value: $737,791 - $843,000

2

Beds

2

Baths

1,924

Sq Ft

$416/Sq Ft

Est. Value

About This Home

This home is located at 5 Caleridge Ct, Highlands Ranch, CO 80130 and is currently estimated at $800,448, approximately $416 per square foot. 5 Caleridge Ct is a home located in Douglas County with nearby schools including Fox Creek Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2020

Sold by

Hrincevich Stanley and Brincevich Carol A

Bought by

Hrincevich Stanley and Cevich Carol Ann

Current Estimated Value

Purchase Details

Closed on

Jul 30, 2008

Sold by

Cook Steven M

Bought by

Hrincevich Stanley and Hrincevich Carol A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$180,769

Interest Rate

6%

Mortgage Type

Unknown

Estimated Equity

$619,679

Purchase Details

Closed on

Jan 26, 2007

Sold by

Rosack Bobbi J

Bought by

Meldrum Lorraine

Purchase Details

Closed on

Dec 3, 1999

Sold by

Richmond American Homes Of Colorado Inc

Bought by

Rosack Bobbi J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.95%

Purchase Details

Closed on

Apr 19, 1999

Sold by

Shea Homes

Bought by

Richmond American Homes Colo Inc

Purchase Details

Closed on

Oct 1, 1997

Sold by

Mission Viejo Co

Bought by

Shea Homes

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hrincevich Stanley | -- | None Available | |

| Hrincevich Stanley | $350,000 | Security Title | |

| Meldrum Lorraine | $410,000 | -- | |

| Rosack Bobbi J | $250,326 | Land Title | |

| Richmond American Homes Colo Inc | $117,500 | -- | |

| Shea Homes | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hrincevich Stanley | $280,000 | |

| Previous Owner | Rosack Bobbi J | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,051 | $53,370 | $10,000 | $43,370 |

| 2023 | $4,044 | $53,370 | $10,000 | $43,370 |

| 2022 | $3,077 | $40,630 | $6,830 | $33,800 |

| 2021 | $3,200 | $40,630 | $6,830 | $33,800 |

| 2020 | $2,957 | $39,020 | $6,510 | $32,510 |

| 2019 | $2,968 | $39,020 | $6,510 | $32,510 |

| 2018 | $3,442 | $36,420 | $5,710 | $30,710 |

| 2017 | $3,134 | $36,420 | $5,710 | $30,710 |

| 2016 | $2,952 | $33,670 | $5,260 | $28,410 |

| 2015 | $3,016 | $33,670 | $5,260 | $28,410 |

| 2014 | $2,765 | $28,510 | $5,330 | $23,180 |

Source: Public Records

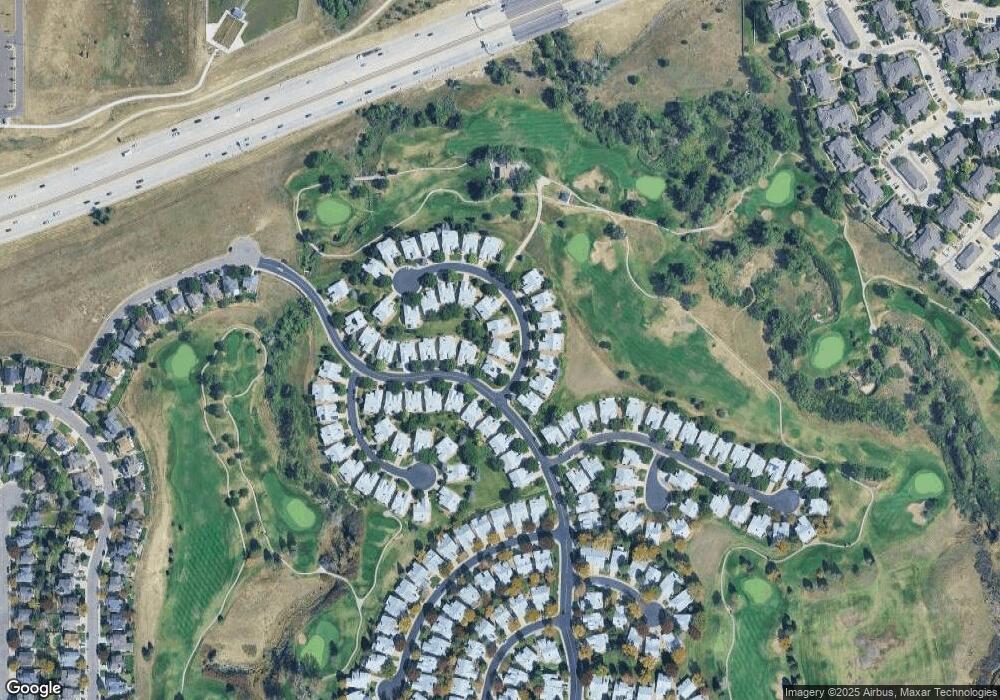

Map

Nearby Homes

- 102 Canongate Ln

- 41 Canongate Ln

- 8766 Cresthill Ln

- 5126 Tuscany Ct

- 8734 Pochard St

- 8547 Gold Peak Dr Unit G

- 8555 Gold Peak Dr Unit A

- 6404 Silver Mesa Dr Unit E

- 4605 Copeland Loop Unit 204

- 6418 Silver Mesa Dr Unit C

- 14 Stonehaven Ct

- 8611 Gold Peak Dr Unit D

- 8643 Gold Peak Dr Unit E

- 4927 Greenwich Way

- 8617 Gold Peak Dr Unit G

- 6428 Silver Mesa Dr Unit C

- 8524 Gold Peak Dr Unit D

- 6434 Silver Mesa Dr Unit C

- 6 Abernathy Ct

- 6444 Silver Mesa Dr Unit A

- 11 Caleridge Ct

- 1 Caleridge Ct

- 88 Canongate Ln

- 15 Caleridge Ct

- 6 Caleridge Ct

- 8 Caleridge Ct

- 4 Caleridge Ct

- 10 Caleridge Ct

- 90 Canongate Ln

- 2 Caleridge Ct

- 12 Caleridge Ct

- 19 Caleridge Ct

- 85 Canongate Ln

- 14 Caleridge Ct

- 92 Canongate Ln

- 83 Canongate Ln

- 23 Caleridge Ct

- 91 Canongate Ln

- 25 Caleridge Ct

- 94 Canongate Ln