500 Glen Hollow Cir Unit 76 Aurora, OH 44202

Estimated Value: $383,454 - $435,000

3

Beds

3

Baths

1,628

Sq Ft

$246/Sq Ft

Est. Value

About This Home

This home is located at 500 Glen Hollow Cir Unit 76, Aurora, OH 44202 and is currently estimated at $400,614, approximately $246 per square foot. 500 Glen Hollow Cir Unit 76 is a home located in Portage County with nearby schools including Miller Elementary School, Craddock/Miller Elementary School, and Leighton Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2011

Sold by

Eyring Lucinda

Bought by

Eyring Lucas A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,691

Interest Rate

5.12%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 2, 2006

Sold by

Shepherd Ross M and Shepherd Bonnie L

Bought by

Eyring Lucinda and Eyring Lucas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,800

Interest Rate

8%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 22, 2005

Sold by

Laudicino Stephan and Laudicino Deborah H

Bought by

Shepherd Ross M and Shepherd Bonnie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,800

Interest Rate

4.75%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 21, 2002

Sold by

Reserves Of Aurora Condominium Ltd

Bought by

Laudicino Stephan and Laudicino Deborah H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eyring Lucas A | -- | Attorney | |

| Eyring Lucinda | $281,000 | Revere Title Summit County | |

| Shepherd Ross M | $291,000 | Revere Title | |

| Laudicino Stephan | $304,700 | Midland Commerce Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Eyring Lucas A | $256,691 | |

| Closed | Eyring Lucinda | $224,800 | |

| Closed | Shepherd Ross M | $232,800 | |

| Closed | Laudicino Stephan | $135,000 | |

| Closed | Shepherd Ross M | $29,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,465 | $122,260 | $12,250 | $110,010 |

| 2023 | $5,218 | $95,030 | $12,250 | $82,780 |

| 2022 | $4,725 | $95,030 | $12,250 | $82,780 |

| 2021 | $4,752 | $95,030 | $12,250 | $82,780 |

| 2020 | $4,870 | $90,340 | $12,250 | $78,090 |

| 2019 | $4,893 | $90,340 | $12,250 | $78,090 |

| 2018 | $5,152 | $78,860 | $12,250 | $66,610 |

| 2017 | $4,684 | $78,860 | $12,250 | $66,610 |

| 2016 | $4,220 | $78,860 | $12,250 | $66,610 |

| 2015 | $4,339 | $78,860 | $12,250 | $66,610 |

| 2014 | $4,428 | $78,860 | $12,250 | $66,610 |

| 2013 | $4,400 | $78,860 | $12,250 | $66,610 |

Source: Public Records

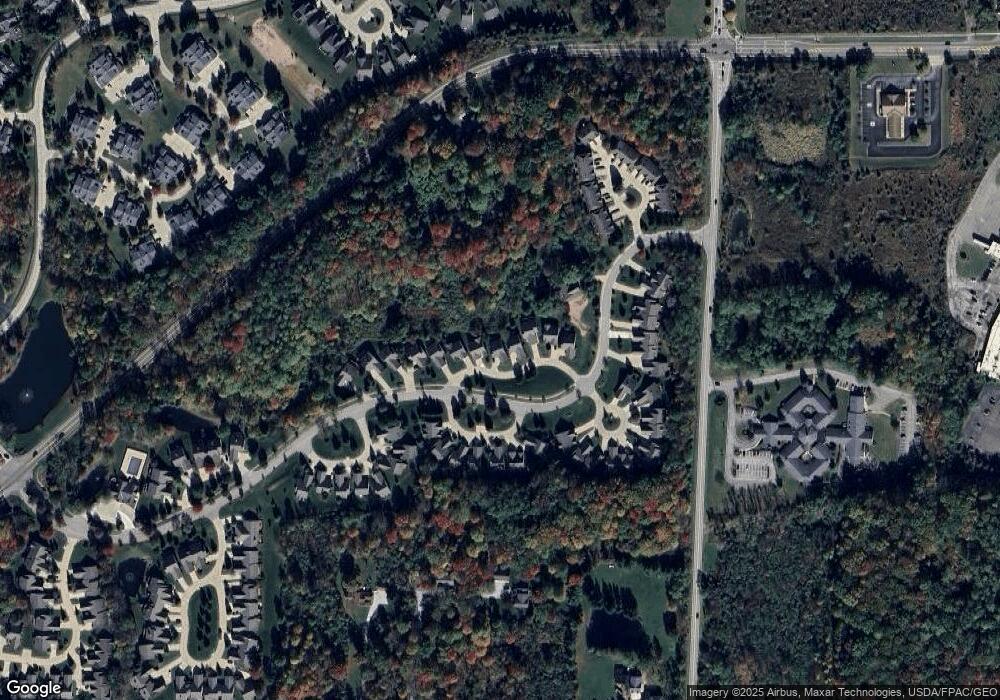

Map

Nearby Homes

- V/L W Garfield Rd

- 540 Bent Creek Oval

- 185 N Bissell Rd

- 225 Linwood Ln

- 316 High Bluff

- 350 Aspen Ct

- 461 Ravine Dr Unit 2

- 180 Beaumont Trail

- 0 Aurora Hill Dr Unit 3956102

- 504-9 Concord Downs Cir Unit 9

- 436 Cochran Rd

- 109 S Chillicothe Rd

- 794 Robinhood Dr

- 405 Club Dr W

- 682 Arbor Way

- 982 W Garfield Rd

- 702-22 Fairington Dr

- 270 Parkview Dr

- 339 Aberdeen Ln

- 159 Royal Oak Dr

- 496 Glen Hollow Cir

- 496 Glen Hollow Cir Unit 77

- 504 Glen Hollow Cir Unit 75

- 492 Glen Hollow Cir Unit 78

- 508 Glen Hollow Cir

- 484 Glen Hollow Cir Unit 79

- 480 Glen Hollow Cir

- 491 Oak Lawn Ct Unit 87

- 512 Glen Hollow Cir Unit 73

- 479 Shadowbrook Cir

- 495 Oak Lawn Ct

- 499 Oak Lawn Ct Unit 85

- 516 E Parkway Blvd Unit 72

- 515 Oak Lawn Ct

- 515 Oak Lawn Ct Unit 81

- 503 Oak Lawn Ct Unit 84

- 507 Oak Lawn Ct Unit 38

- 520 E Parkway Blvd Unit 71

- 443 Shadowbrook Cir Unit 98

- 441 E Parkway Blvd Unit 99