5022 Santa Elena Ct Granbury, TX 76049

Estimated Value: $443,000 - $511,000

3

Beds

2

Baths

2,345

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 5022 Santa Elena Ct, Granbury, TX 76049 and is currently estimated at $464,463, approximately $198 per square foot. 5022 Santa Elena Ct is a home located in Hood County with nearby schools including Acton Elementary School, Acton Middle School, and Granbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2019

Sold by

Kirkland Mike

Bought by

Weldon Kim and Dow Melaney

Current Estimated Value

Purchase Details

Closed on

Oct 12, 2011

Sold by

Viselli Albert Lawrence and Viselli Laurie Ann

Bought by

Kim Weldon Ted and Kim Weldon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,500

Interest Rate

4.28%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 7, 1999

Sold by

Williams John F and Williams Charlein L

Bought by

Weldon Ted Et Ux Kim

Purchase Details

Closed on

Sep 15, 1995

Sold by

Ttj Corporation

Bought by

Weldon Ted Et Ux Kim

Purchase Details

Closed on

Jan 4, 1984

Bought by

Weldon Ted Et Ux Kim

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weldon Kim | -- | None Available | |

| Kim Weldon Ted | $12,000 | Central Texas Title | |

| Weldon Ted Et Ux Kim | -- | -- | |

| Weldon Ted Et Ux Kim | -- | -- | |

| Weldon Ted Et Ux Kim | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kim Weldon Ted | $226,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $980 | $407,010 | $40,000 | $367,010 |

| 2024 | $986 | $411,257 | $40,000 | $376,430 |

| 2023 | $4,549 | $425,840 | $40,000 | $385,840 |

| 2022 | $2,670 | $396,870 | $40,000 | $356,870 |

| 2021 | $4,744 | $308,990 | $20,000 | $288,990 |

| 2020 | $4,417 | $287,160 | $20,000 | $267,160 |

| 2019 | $4,203 | $258,540 | $20,000 | $238,540 |

| 2018 | $3,970 | $244,210 | $20,000 | $224,210 |

| 2017 | $3,851 | $230,290 | $20,000 | $210,290 |

| 2016 | $3,679 | $219,980 | $20,000 | $199,980 |

| 2015 | $2,796 | $207,250 | $20,000 | $187,250 |

| 2014 | $2,796 | $217,100 | $20,000 | $197,100 |

Source: Public Records

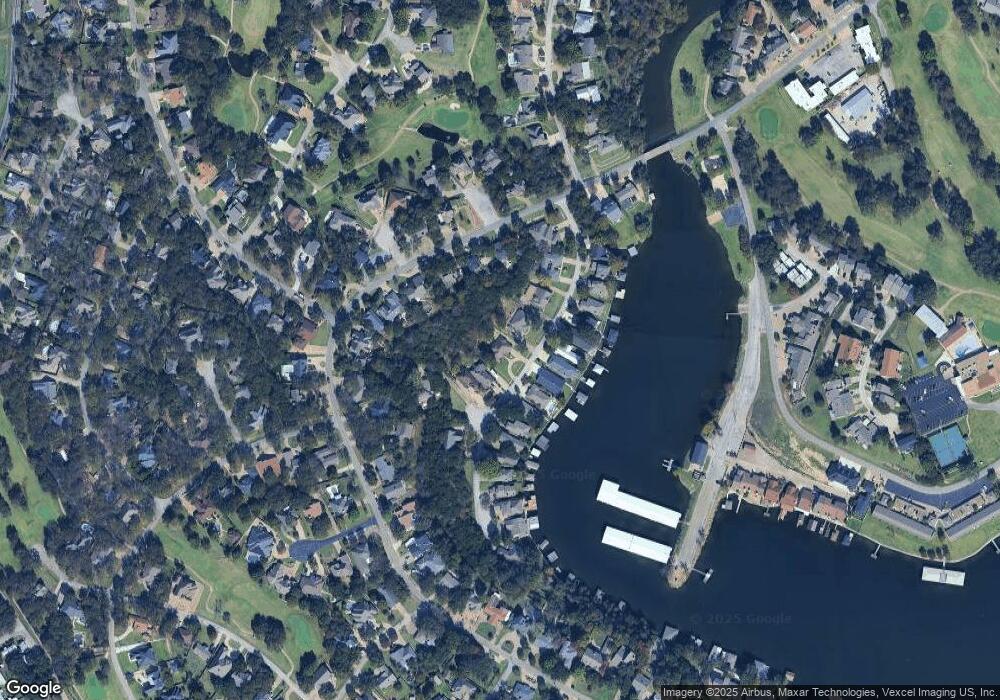

Map

Nearby Homes

- 4901 Fairway Ct

- 5040 Santa Elena Ct

- 4900 Del Rio Ct

- 5128 Country Club Dr

- 4009 Scenic Way

- 4902 Boquillas Ct E

- 5200 Country Club Dr

- 4904 Fairway Place Ct

- 4900 Rio Vista Dr

- 5102 Largo Dr

- 5207 Fairway Cir

- 5515 Club Cove Ct

- 3620 Montgomery Dr

- 3625 Montego Blvd

- 4116 Fairway Dr

- 5003 Bueno Dr

- 4512 Cimmaron Trail

- 6118 Laredo Ct

- 4017 Fairway Dr

- 3905 Montgomery Dr

- 5024 Santa Elena Ct

- 5018 Santa Elena Ct

- 5026 Santa Elena Ct

- 5014 Santa Elena Ct

- 5021 Santa Elena Ct

- 5023 Santa Elena Ct

- 5019 Santa Elena Ct

- 5025 Santa Elena Ct

- 5017 Santa Elena Ct

- 5028 Santa Elena Ct

- 5012 Santa Elena Ct

- 4309 Fairway Dr

- 5027 Santa Elena Ct

- 5015 Santa Elena Ct

- 4311 Fairway Dr

- 5013 Santa Elena Ct

- 5029 Santa Elena Ct

- 5032 Santa Elena Ct

- 4305 Fairway Dr

- 5011 Santa Elena Ct