5028 Rebecca Fell Dr Unit 226 Doylestown, PA 18902

Plumstead NeighborhoodEstimated Value: $332,000 - $349,678

2

Beds

2

Baths

1,197

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 5028 Rebecca Fell Dr Unit 226, Doylestown, PA 18902 and is currently estimated at $341,420, approximately $285 per square foot. 5028 Rebecca Fell Dr Unit 226 is a home located in Bucks County with nearby schools including Groveland Elementary School, Tohickon Middle School, and Central Bucks High School-West.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2008

Sold by

Waltz Edith C

Bought by

Lodge Gary W and Lodge Nancy A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,446

Outstanding Balance

$148,330

Interest Rate

6.29%

Mortgage Type

FHA

Estimated Equity

$193,090

Purchase Details

Closed on

Apr 18, 2008

Sold by

Talaba Mark S and Waltz Edith C

Bought by

Waltz Edith C

Purchase Details

Closed on

Sep 28, 2001

Sold by

Dear William S

Bought by

Talaba Mark S and Waltz Edith C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,500

Interest Rate

6.89%

Purchase Details

Closed on

Sep 27, 1996

Sold by

Patriots Ridge Ltd Partnership

Bought by

Dear William S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,700

Interest Rate

7.83%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lodge Gary W | $230,000 | None Available | |

| Waltz Edith C | -- | None Available | |

| Talaba Mark S | $130,000 | -- | |

| Dear William S | $108,195 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lodge Gary W | $226,446 | |

| Previous Owner | Talaba Mark S | $123,500 | |

| Previous Owner | Dear William S | $102,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,760 | $21,640 | -- | $21,640 |

| 2024 | $3,760 | $21,640 | $0 | $21,640 |

| 2023 | $3,641 | $21,640 | $0 | $21,640 |

| 2022 | $3,600 | $21,640 | $0 | $21,640 |

| 2021 | $3,560 | $21,640 | $0 | $21,640 |

| 2020 | $3,560 | $21,640 | $0 | $21,640 |

| 2019 | $3,538 | $21,640 | $0 | $21,640 |

| 2018 | $3,538 | $21,640 | $0 | $21,640 |

| 2017 | $3,489 | $21,640 | $0 | $21,640 |

| 2016 | $3,489 | $21,640 | $0 | $21,640 |

| 2015 | -- | $21,640 | $0 | $21,640 |

| 2014 | -- | $21,640 | $0 | $21,640 |

Source: Public Records

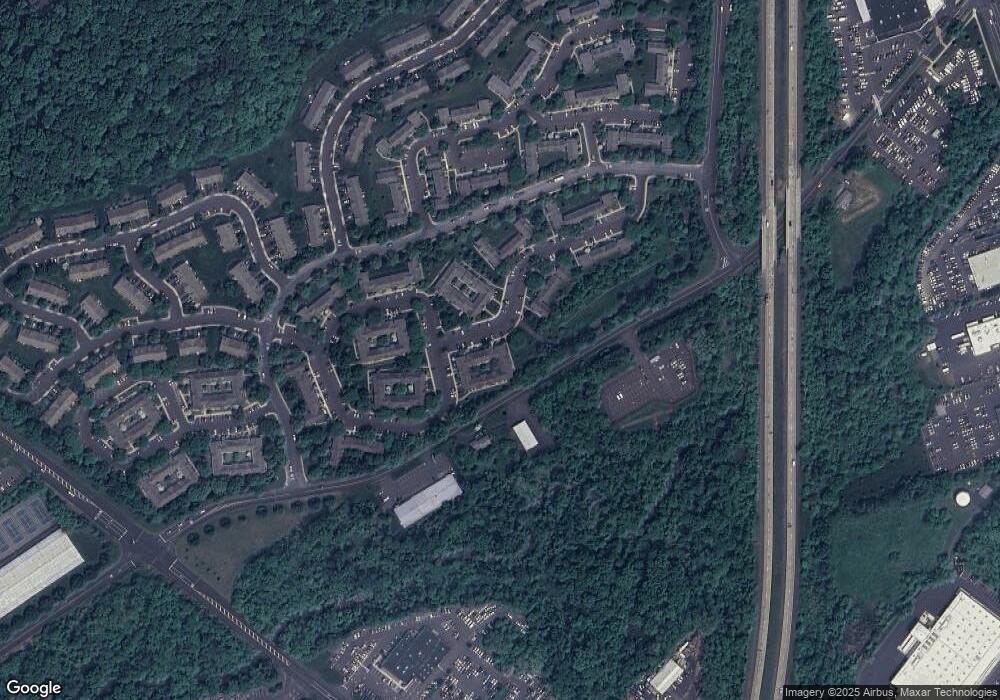

Map

Nearby Homes

- 5415 Rinker Cir Unit 256

- 5513 Rinker Cir Unit 349

- 3769 Swetland Dr

- 3765 William Daves Rd

- 3723 William Daves Rd

- 85 Trafalgar Rd Unit 52

- 3688 Christopher Day Rd

- 21 Greenway Dr

- 3822 Jacob Stout Rd

- 3600 Jacob Stout Rd Unit 3

- 3669 Jacob Stout Rd Unit 8

- 301 Windy Run Rd

- 4893 W Swamp Rd Unit A

- 1 Stacey Dr

- 5 Broadale Rd

- 14 Broadale Rd

- 16 John Dyer Way

- 4223 Ferguson Dr

- 925 E Sandy Ridge Rd

- 90 Chapman Ave

- 5026 Rebecca Fell Dr Unit 225

- 5024 Rebecca Fell Dr Unit 224

- 5032 Rebecca Fell Dr Unit 228

- 5034 Rebecca Fell Dr Unit 229

- 5022 Rebecca Fell Dr Unit 223

- 5036 Rebecca Fell Dr Unit 230

- 5018 Rebecca Fell Dr Unit 221

- 5020 Rebecca Fell Dr Unit 222

- 5016 Rebecca Fell Dr Unit 220

- 5038 Rebecca Fell Dr Unit 231

- 5014 Rebecca Fell Dr Unit 219

- 5012 Rebecca Fell Dr Unit 218

- 5002 Rebecca Fell Dr

- 5002 Rebecca Fell Dr Unit 213

- 5000 Rebecca Fell Dr Unit 212

- 5010 Rebecca Fell Dr

- 5010 Rebecca Fell Dr Unit 217

- 5004 Rebecca Fell Dr Unit 214

- 5029 Rebecca Fell Dr Unit 182

- 5006 Rebecca Fell Dr Unit 215