503 Forest Ln Denison, TX 75021

Estimated Value: $184,088 - $203,000

3

Beds

2

Baths

1,653

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 503 Forest Ln, Denison, TX 75021 and is currently estimated at $193,544, approximately $117 per square foot. 503 Forest Ln is a home located in Grayson County with nearby schools including Scott Middle School, Denison High School, and St. Luke's Parish Day School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2015

Sold by

Robertson & Moore Investments Llc

Bought by

Mcbride Eric and Miller Sara

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,498

Outstanding Balance

$60,023

Interest Rate

4.03%

Mortgage Type

FHA

Estimated Equity

$133,521

Purchase Details

Closed on

Jun 4, 2008

Sold by

Gmac Mortgage Llc

Bought by

Robertson & Moore Investments Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,975

Interest Rate

6.05%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 1, 2007

Sold by

Ward Misty

Bought by

Gmac Mortgage Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcbride Eric | -- | Cole Title Co | |

| Robertson & Moore Investments Llc | -- | Chapin Title Co Inc | |

| Gmac Mortgage Llc | $58,018 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcbride Eric | $75,498 | |

| Previous Owner | Robertson & Moore Investments Llc | $32,975 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,568 | $159,327 | $39,276 | $120,051 |

| 2024 | $3,568 | $153,552 | $33,578 | $119,974 |

| 2023 | $3,336 | $147,224 | $33,578 | $113,646 |

| 2022 | $3,008 | $126,618 | $33,578 | $93,040 |

| 2021 | $2,864 | $113,575 | $16,487 | $97,088 |

| 2020 | $2,824 | $107,049 | $16,487 | $90,562 |

| 2019 | $2,857 | $103,826 | $10,963 | $92,863 |

| 2018 | $2,625 | $94,632 | $10,963 | $83,669 |

| 2017 | $2,187 | $78,187 | $10,963 | $67,224 |

| 2016 | $1,872 | $66,912 | $10,963 | $55,949 |

| 2015 | $1,556 | $55,099 | $6,474 | $48,625 |

| 2014 | $1,557 | $55,099 | $6,474 | $48,625 |

Source: Public Records

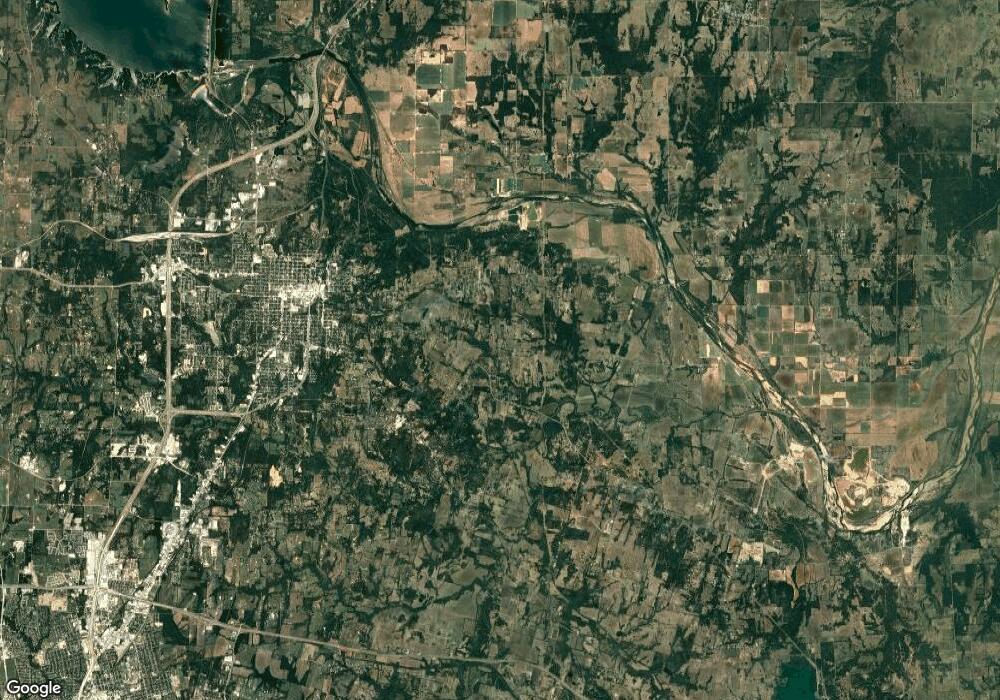

Map

Nearby Homes

- 515 Forrest Ln

- 227 Sheryl Ln

- 40 Sheryl Ln

- 700 Dubois St

- 618 Star St

- 903 Seymore Cir

- 711 Dubois St

- 905 Seymore Cir

- 701 W Star St

- 611 W Baker St

- 607 W Baker St

- 603 W Star St

- 2526 S Fannin Ave Unit 2600

- 614 Rice St

- 916 W Collins St

- 430 W Coffin St

- 513 W Coffin St

- 509 W Coffin St

- 3312 Vine Ln

- 1130 Amsden Cir