5038 Fallen Oaks Dr Houston, TX 77091

Oak Forest-Garden Oaks NeighborhoodEstimated Value: $490,121 - $594,000

4

Beds

3

Baths

3,358

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 5038 Fallen Oaks Dr, Houston, TX 77091 and is currently estimated at $565,780, approximately $168 per square foot. 5038 Fallen Oaks Dr is a home located in Harris County with nearby schools including Clifton Middle, Scarborough High School, and Southwest Schools Mangum El Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2015

Sold by

Korb Stephanie Anne

Bought by

Korb Eric S

Current Estimated Value

Purchase Details

Closed on

Jul 21, 2007

Sold by

Davis Shawn P and Harding David H

Bought by

Korb Stephanie Anne and Korb Eric Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,500

Outstanding Balance

$125,423

Interest Rate

6.71%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$440,357

Purchase Details

Closed on

Jul 31, 2006

Sold by

Kadlubar R John and Kadlubar Rhonda

Bought by

Davis Shawn P and Harding David H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,600

Interest Rate

6.66%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 27, 2006

Sold by

Grantom Mark S and Estate Of Gary M Hess

Bought by

Kadlubar R John

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Korb Eric S | -- | None Available | |

| Korb Stephanie Anne | -- | American Title Co | |

| Davis Shawn P | -- | Etc | |

| Kadlubar R John | -- | Partners Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Korb Stephanie Anne | $198,500 | |

| Previous Owner | Davis Shawn P | $153,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,686 | $384,510 | $128,971 | $255,539 |

| 2024 | $4,686 | $331,245 | $128,971 | $202,274 |

| 2023 | $4,686 | $342,781 | $113,798 | $228,983 |

| 2022 | $6,941 | $319,242 | $113,798 | $205,444 |

| 2021 | $6,679 | $286,586 | $75,865 | $210,721 |

| 2020 | $6,619 | $273,321 | $75,865 | $197,456 |

| 2019 | $7,168 | $283,270 | $75,865 | $207,405 |

| 2018 | $5,050 | $263,072 | $75,865 | $187,207 |

| 2017 | $7,110 | $281,199 | $75,865 | $205,334 |

| 2016 | $6,697 | $285,009 | $75,865 | $209,144 |

| 2015 | $4,346 | $254,151 | $75,865 | $178,286 |

| 2014 | $4,346 | $225,952 | $53,106 | $172,846 |

Source: Public Records

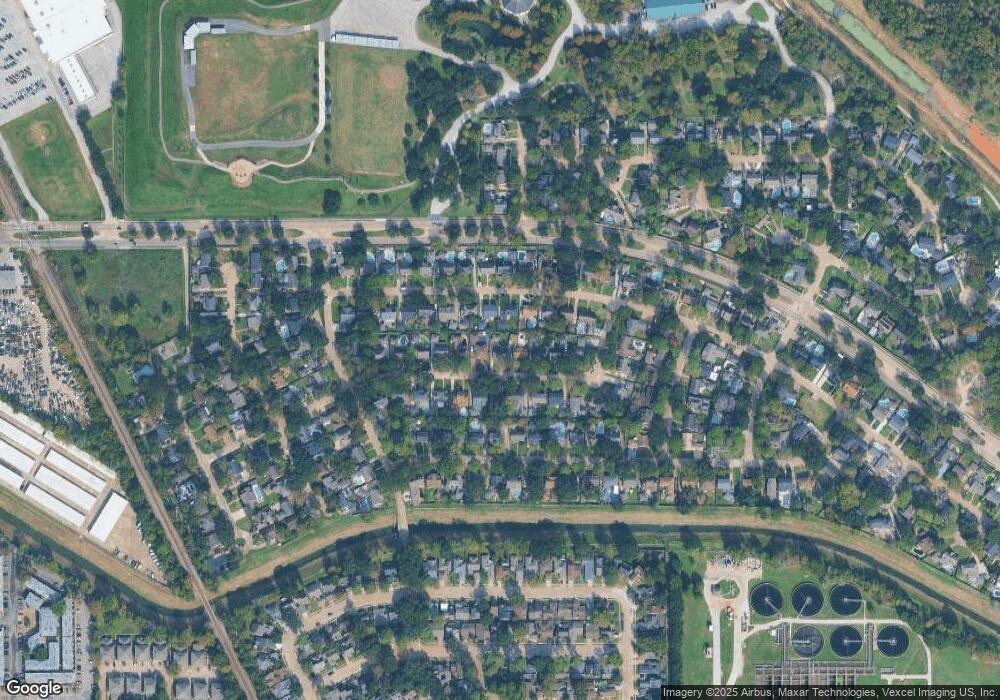

Map

Nearby Homes

- 5010 Oak Shadows Dr

- 5610 Oak Trail Ln

- 5511 Oak Trail Ln

- 4906 Droddy St

- 5451 Oakhaven Ln

- 5670 Birchmont Dr Unit C

- 5036 Golden Forest Dr

- 5114 Golden Forest Dr Unit B

- 5018 Golden Forest Dr

- 5016 Golden Forest Dr

- 5014 Golden Forest Dr

- 5013 Golden Forest Dr

- 5036 Creekmont Dr

- 5116 Creekmont Dr

- 5662 Birchmont Dr Unit A

- 4923 Golden Forest Dr

- 4923 Golden Forest Dr Unit A

- 5666 Birchmont Dr Unit 3

- 4702 Bayou Vista Dr

- 5019 Creekmont Dr

- 5042 Fallen Oaks Dr

- 5034 Fallen Oaks Dr

- 5027 Bayou Vista Dr

- 5030 Fallen Oaks Dr

- 5046 Fallen Oaks Dr

- 5019 Bayou Vista Dr

- 5031 Bayou Vista Dr

- 5039 Fallen Oaks Dr

- 5043 Fallen Oaks Dr

- 5035 Fallen Oaks Dr

- 5050 Fallen Oaks Dr

- 5026 Fallen Oaks Dr

- 5035 Bayou Vista Dr

- 5031 Fallen Oaks Dr

- 5047 Fallen Oaks Dr

- 5007 Bayou Vista Dr

- 5027 Fallen Oaks Dr

- 5051 Fallen Oaks Dr

- 5039 Bayou Vista Dr

- 5054 Fallen Oaks Dr