5040 Breezeway Dr Unit 6 Toledo, OH 43613

Whitmer-Trilby NeighborhoodEstimated Value: $92,101 - $115,000

3

Beds

2

Baths

1,256

Sq Ft

$80/Sq Ft

Est. Value

About This Home

This home is located at 5040 Breezeway Dr Unit 6, Toledo, OH 43613 and is currently estimated at $101,025, approximately $80 per square foot. 5040 Breezeway Dr Unit 6 is a home located in Lucas County with nearby schools including Hiawatha Elementary School, Jefferson Junior High School, and Washington Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 5, 2007

Sold by

Pierce Rebecca J

Bought by

Franks Dianna J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$45,743

Interest Rate

6.4%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$55,282

Purchase Details

Closed on

Apr 28, 2000

Sold by

Mary Baranski Rita

Bought by

Pierce Rebecca J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,000

Interest Rate

8.24%

Purchase Details

Closed on

Apr 6, 1995

Sold by

Burns Charles D

Bought by

Baranski Rita M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,255

Interest Rate

8.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 12, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Franks Dianna J | $75,000 | Chicago Title Insurance Co | |

| Pierce Rebecca J | $55,000 | Louisville Title Agency For | |

| Baranski Rita M | $52,900 | -- | |

| -- | $50,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Franks Dianna J | $75,000 | |

| Previous Owner | Pierce Rebecca J | $44,000 | |

| Previous Owner | Baranski Rita M | $50,255 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $499 | $16,660 | $2,485 | $14,175 |

| 2023 | $626 | $8,715 | $1,680 | $7,035 |

| 2022 | $625 | $8,715 | $1,680 | $7,035 |

| 2021 | $636 | $8,715 | $1,680 | $7,035 |

| 2020 | $1,176 | $14,350 | $1,575 | $12,775 |

| 2019 | $1,144 | $14,350 | $1,575 | $12,775 |

| 2018 | $1,043 | $14,350 | $1,575 | $12,775 |

| 2017 | $1,085 | $14,000 | $1,225 | $12,775 |

| 2016 | $1,078 | $40,000 | $3,500 | $36,500 |

| 2015 | $1,074 | $40,000 | $3,500 | $36,500 |

| 2014 | $955 | $14,010 | $1,230 | $12,780 |

| 2013 | $955 | $14,010 | $1,230 | $12,780 |

Source: Public Records

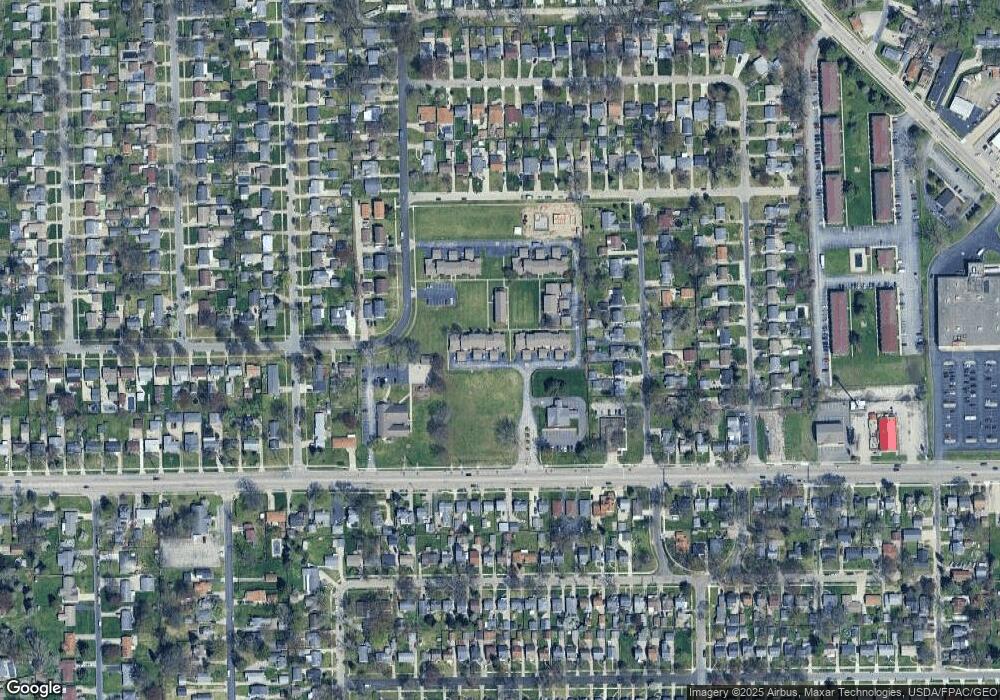

Map

Nearby Homes

- 2849 W Laskey Rd

- 5117 Fern Dr

- 2820 Claredale Rd

- 2623 W Laskey Rd

- 5111 Elaine Dr

- 4807 Brott Rd

- 5201 Elaine Dr

- 3065 Reen Dr

- 4823 Cedarhurst Rd

- 4924 Roywood Rd

- 2605 Wyndale Rd

- 5338 Amsden Ave

- 5211 Douglas Rd

- 5402 Sandra Ct

- 2842 Oak Grove Place

- 2433 Paradise Ave

- 2659 Oak Grove Place

- 5044 Secor Rd

- 2728 Castleton Ave

- 5264 Fairgreen Dr

- 5038 Breezeway Dr Unit 5

- 5036 Breezeway Dr Unit 4

- 5034 Breezeway Dr Unit 3

- 5044 Breezeway Dr Unit 7

- 5032 Breezeway Dr Unit 2

- 5074 Breezeway Dr Unit 22

- 5050 Breezeway Dr Unit 10

- 5048 Breezeway Dr Unit 9

- 5046 Breezeway Dr Unit 8

- 5030 Breezeway Dr Unit 1

- 5054 Breezeway Dr Unit 12

- 5052 Breezeway Dr Unit 11

- 5058 Breezeway Dr Unit 14

- 5056 Breezeway Dr Unit 13

- 5060 Breezeway Dr Unit 15

- 5062 Breezeway Dr Unit 16

- 5078 Breezeway Dr Unit 24

- 5076 Breezeway Dr Unit 23

- 5072 Breezeway Dr Unit 21

- 5082 Breezeway Dr Unit 26