505 W 43rd St Shadyside, OH 43947

Estimated Value: $75,000 - $120,000

3

Beds

2

Baths

1,491

Sq Ft

$59/Sq Ft

Est. Value

About This Home

This home is located at 505 W 43rd St, Shadyside, OH 43947 and is currently estimated at $87,961, approximately $58 per square foot. 505 W 43rd St is a home located in Belmont County with nearby schools including Jefferson Avenue Elementary School, Leona Avenue Middle School, and Shadyside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2022

Sold by

Mcatee Sr Charles R

Bought by

Meade Madison R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Outstanding Balance

$43,080

Interest Rate

5.51%

Mortgage Type

New Conventional

Estimated Equity

$44,881

Purchase Details

Closed on

Feb 16, 2005

Sold by

Beneficial Ohio Inc

Bought by

Mcatee Charles R

Purchase Details

Closed on

Dec 1, 2004

Bought by

Beneficial Ohio Inc

Purchase Details

Closed on

Jan 1, 1986

Sold by

Berry Barbara G

Bought by

Berry Barbara G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meade Madison R | $50,000 | Northwest Title & Escrow | |

| Meade Madison R | $50,000 | Northwest Title & Escrow | |

| Mcatee Charles R | $25,125 | None Available | |

| Beneficial Ohio Inc | $30,700 | -- | |

| Berry Barbara G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meade Madison R | $45,000 | |

| Closed | Meade Madison R | $45,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $787 | $19,180 | $4,640 | $14,540 |

| 2023 | $800 | $17,610 | $4,520 | $13,090 |

| 2022 | $1,095 | $33,166 | $4,515 | $28,651 |

| 2021 | $1,089 | $33,166 | $4,515 | $28,651 |

| 2020 | $860 | $27,640 | $3,760 | $23,880 |

| 2019 | $863 | $27,640 | $3,760 | $23,880 |

| 2018 | $740 | $27,640 | $3,760 | $23,880 |

| 2017 | $647 | $21,630 | $3,220 | $18,410 |

| 2016 | $652 | $21,630 | $3,220 | $18,410 |

| 2015 | $1,086 | $21,630 | $3,220 | $18,410 |

| 2014 | $1,166 | $22,730 | $2,930 | $19,800 |

| 2013 | $987 | $22,730 | $2,930 | $19,800 |

Source: Public Records

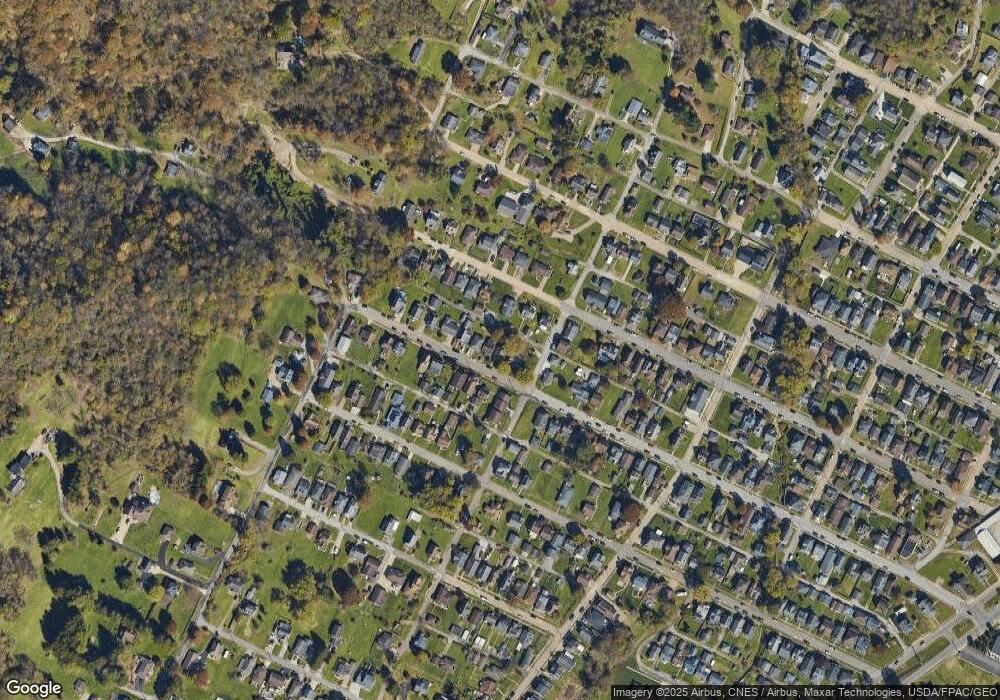

Map

Nearby Homes

- 560 W 44th St

- 411 W 45th St

- 466 W 45th St

- 271-REAR W 43rd St

- 3927 Daisyview St

- 473 W 39th St

- 3971 Grandview Ave

- 0 Wegee Ln

- 105 W 40th St

- 4410 Lincoln Ave

- 3970 Central Ave

- 4470 Grand Ave

- 3841 Highland Ave

- 52 E 37th St

- 3810 Grand Ave

- 3608 Lincoln Ave

- 3480 Central Ave

- 56612 McGee Rd

- 3450 Elk Ave

- 410 Alta Vista Ave