5051 SE Burning Tree Cir Stuart, FL 34997

Estimated Value: $575,000 - $744,189

3

Beds

2

Baths

2,324

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 5051 SE Burning Tree Cir, Stuart, FL 34997 and is currently estimated at $666,047, approximately $286 per square foot. 5051 SE Burning Tree Cir is a home located in Martin County with nearby schools including Sea Wind Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 31, 2017

Sold by

Hanks Robert J

Bought by

Hanks Katharine and Hanks Robert J

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2012

Sold by

Grand Cru Management Llc

Bought by

Hanks Robert J

Purchase Details

Closed on

Jun 30, 2010

Sold by

Carvelli Vincent and Carvelli Diana

Bought by

Grand Cru Management Llc

Purchase Details

Closed on

Mar 25, 2005

Sold by

James James M

Bought by

Carvelli Vincent and Carvelli Diana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

5.5%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 22, 2004

Sold by

Cavallo Joseph V and Cavallo Mary Ann

Bought by

James James M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,800

Interest Rate

5.36%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 21, 2001

Sold by

Insurance Brown & Hurst I

Bought by

Cavallo Joseph and Cavallo Mary A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.02%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanks Katharine | -- | Attorney | |

| Hanks Robert J | -- | Attorney | |

| Grand Cru Management Llc | $395,000 | Attorney | |

| Carvelli Vincent | $390,000 | -- | |

| James James M | $331,000 | -- | |

| Cavallo Joseph | $170,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carvelli Vincent | $225,000 | |

| Previous Owner | James James M | $264,800 | |

| Previous Owner | Cavallo Joseph | $50,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,800 | $315,521 | -- | -- |

| 2024 | $4,700 | $306,629 | -- | -- |

| 2023 | $4,700 | $297,699 | $0 | $0 |

| 2022 | $4,532 | $289,029 | $0 | $0 |

| 2021 | $4,538 | $280,611 | $0 | $0 |

| 2020 | $4,433 | $276,737 | $0 | $0 |

| 2019 | $4,361 | $270,515 | $0 | $0 |

| 2018 | $4,253 | $265,471 | $0 | $0 |

| 2017 | $3,696 | $260,011 | $0 | $0 |

| 2016 | $3,955 | $254,664 | $0 | $0 |

| 2015 | $3,757 | $252,894 | $0 | $0 |

| 2014 | $3,757 | $250,887 | $0 | $0 |

Source: Public Records

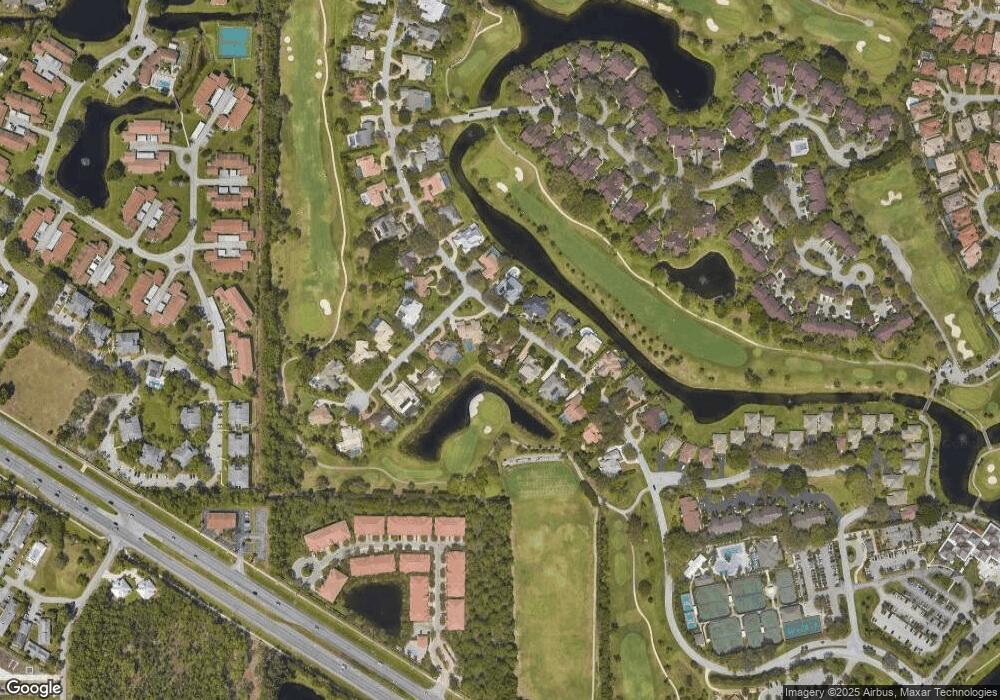

Map

Nearby Homes

- 5061 SE Burning Tree Cir

- 5081 SE Burning Tree Cir

- 5101 SE Burning Tree Cir

- 5011 SE Burning Tree Cir

- 6675 SE Woodmill Pond Ln

- 6635 SE Woodmill Pond Ln

- 6693 SE Woodmill Pond Ln Unit 5

- 6549 SE Federal Hwy Unit 204

- 5143 SE Club Way

- 6537 SE Federal Hwy Unit 202

- 5011 SE Brandywine Way

- 5071 SE Brandywine Way Unit 8

- 5152 SE Club Way Unit 104

- 6403 SE Brandywine Ct Unit 223

- 6404 SE Brandywine Ct Unit 104

- 5151 SE Burning Tree Cir

- 5172 SE Club Way Unit 108

- 6531 SE Federal Hwy Unit K-202

- 6531 SE Federal Hwy Unit 101

- 6531 SE Federal Hwy Unit N106

- 5041 SE Burning Tree Cir

- 6463 SE Spy Glass Ln

- 5050 SE Burning Tree Cir

- 5031 SE Burning Tree Cir

- 5060 SE Burning Tree Cir

- 5040 SE Burning Tree Cir

- 6473 SE Spy Glass Ln

- 5030 SE Burning Tree Cir

- 5021 SE Burning Tree Cir

- 5020 SE Burning Tree Cir

- 5080 SE Burning Tree Cir

- 5010 SE Burning Tree Cir

- 6493 SE Spy Glass Ln

- 6484 SE Spy Glass Ln

- 5090 SE Burning Tree Cir

- 5001 SE Burning Tree Cir

- 5091 SE Burning Tree Cir

- 5000 SE Burning Tree Cir

- 6494 SE Spy Glass Ln

Your Personal Tour Guide

Ask me questions while you tour the home.