Estimated Value: $240,373 - $610,000

--

Bed

--

Bath

2,140

Sq Ft

$214/Sq Ft

Est. Value

About This Home

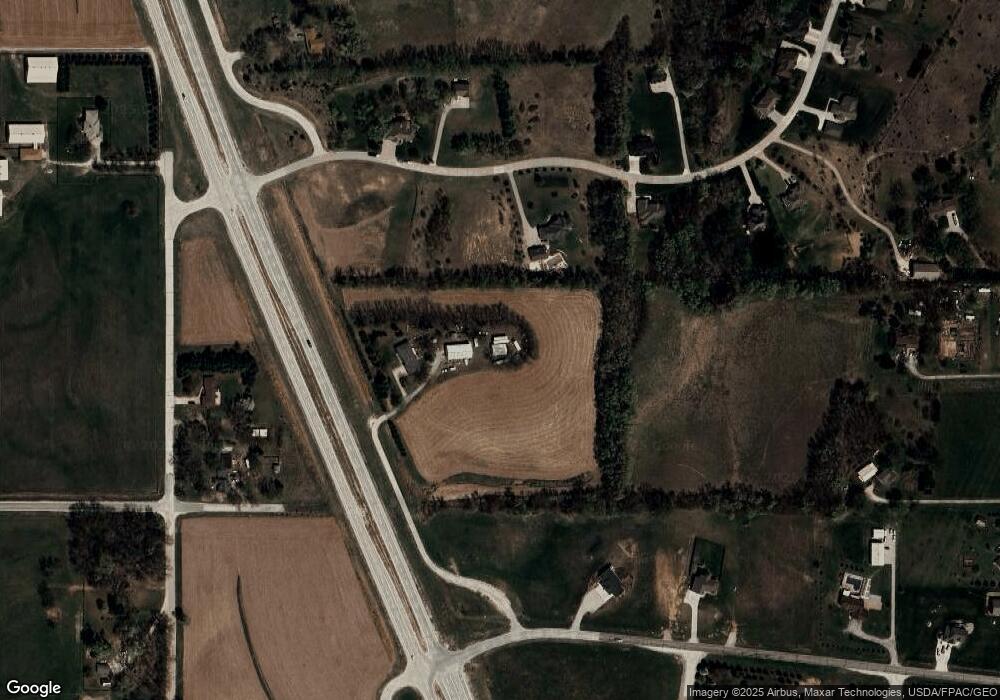

This home is located at 5052 State Highway 133, Blair, NE 68008 and is currently estimated at $457,124, approximately $213 per square foot. 5052 State Highway 133 is a home located in Washington County with nearby schools including Blair High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2025

Sold by

Kirkpatrick Gary D

Bought by

Kirkpatrick Ryan D

Current Estimated Value

Purchase Details

Closed on

Nov 11, 2024

Sold by

Kirkpatrick Gary D

Bought by

Kirkpatrick Gary D

Purchase Details

Closed on

Mar 7, 2024

Sold by

Kirkpatrick Gary D

Bought by

Kirkpatrick Gary D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kirkpatrick Ryan D | -- | None Listed On Document | |

| Kirkpatrick Gary D | -- | None Listed On Document | |

| Kirkpatrick Gary D | -- | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kirkpatrick Gary D | $152,166 | |

| Previous Owner | Kirkpatrick Gary D | $139,452 | |

| Previous Owner | Kirkpatrick Gary D | $46,902 | |

| Previous Owner | Kirkpatrick Gary D | $25,000 | |

| Previous Owner | Kirkpatrick Gary D | $44,000 | |

| Previous Owner | Xirkpatrick Gary D | $15,000 | |

| Previous Owner | Kirkpatrick Gary D | $124,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $477 | $112,015 | $109,015 | $3,000 |

| 2023 | $5,761 | $456,575 | $113,000 | $343,575 |

| 2022 | $5,975 | $391,120 | $72,690 | $318,430 |

| 2021 | $5,745 | $373,550 | $72,690 | $300,860 |

| 2020 | $5,641 | $353,785 | $72,690 | $281,095 |

| 2019 | $5,563 | $331,345 | $71,945 | $259,400 |

| 2018 | $5,091 | $301,660 | $71,945 | $229,715 |

| 2017 | $4,632 | $285,890 | $72,895 | $212,995 |

| 2016 | $4,614 | $285,890 | $72,895 | $212,995 |

| 2015 | $4,093 | $262,435 | $71,940 | $190,495 |

| 2014 | $4,093 | $260,295 | $69,800 | $190,495 |

Source: Public Records

Map

Nearby Homes

- Lot 21 Block 8 Hiland Dr

- 11153 N Lakeshore Dr

- Lot 21 Block 3 Sunset Dr

- 11846 County Road 36

- Parcel 2 Road 34

- 6170 Hidden Valley Ln

- 6318 Sundown Dr

- 12425 Keri Cir

- Allen Hills Lot 9 Cir

- County Road 32 Old Oak Ln Unit Tax Lot 95

- 2923 County Road 33 County Rd

- 6361 County Road P35

- 24 Acres County Road 33 County Rd

- 14558 County Road 36

- 6063 Glen Oaks Dr

- 3125 Hilltop Dr

- TBD County Road P32 & P39

- TBD County Road P36 Tract 1 Rd

- 108 E 3rd St

- 2857 Ravae Ln

- 5064 County Road 33

- 11785 Todd Dr

- 11978 County Road 34 County Rd

- 11978 County Road 34

- 11850 Todd Dr

- 11735 Todd Dr

- Lot 26 & 27 Crest Ridge

- 11786 County Road 34

- 11734 Todd Dr

- 11728 County Road 34

- 11685 Todd Dr

- 5263 County Road 33

- 11679 Todd Dr

- 5360 State Highway 133

- 4955 County Road 33 County Rd

- 4955 County Road 33

- 4955 County Road 33

- 4955 County Road 33

- 11670 Todd Dr

- 4883 Crest Ridge Loop