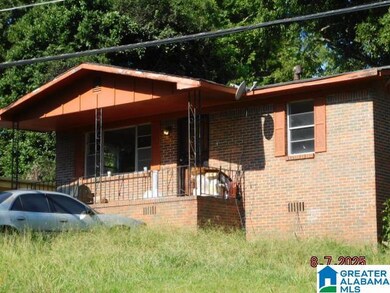

508 9th St Midfield, AL 35228

Estimated payment $327/month

Total Views

10,411

2

Beds

1

Bath

825

Sq Ft

$67

Price per Sq Ft

Highlights

- Porch

- Three Sided Brick Exterior Elevation

- Central Heating and Cooling System

- Bathtub with Shower

About This Home

Brick one level on corner lot, convenient location. Needs some updating but would be a great rental property or first time homebuyer home. Driveway parking and wooded back yard. Front porch is covered.

Home Details

Home Type

- Single Family

Year Built

- Built in 1963

Parking

- Driveway

Home Design

- Three Sided Brick Exterior Elevation

Bedrooms and Bathrooms

- 2 Bedrooms

- 1 Full Bathroom

- Bathtub with Shower

Schools

- Midfield Elementary School

- Rutledge Middle School

- Midfield High School

Utilities

- Central Heating and Cooling System

- Electric Water Heater

- Septic System

Additional Features

- Laminate Countertops

- Porch

- 6,970 Sq Ft Lot

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $511 | $7,180 | -- | -- |

| 2022 | $467 | $6,290 | $1,110 | $5,180 |

| 2021 | $411 | $5,620 | $1,110 | $4,510 |

| 2020 | $416 | $5,620 | $1,110 | $4,510 |

| 2019 | $411 | $5,620 | $0 | $0 |

| 2018 | $351 | $4,900 | $0 | $0 |

| 2017 | $351 | $4,900 | $0 | $0 |

| 2016 | $351 | $4,900 | $0 | $0 |

| 2015 | $351 | $4,900 | $0 | $0 |

| 2014 | $677 | $4,840 | $0 | $0 |

| 2013 | $677 | $4,840 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 01/26/2026 01/26/26 | Price Changed | $55,200 | -8.0% | $67 / Sq Ft |

| 12/02/2025 12/02/25 | Price Changed | $60,000 | -14.3% | $73 / Sq Ft |

| 11/05/2025 11/05/25 | Price Changed | $70,000 | -10.3% | $85 / Sq Ft |

| 09/22/2025 09/22/25 | For Sale | $78,000 | -- | $95 / Sq Ft |

Source: Greater Alabama MLS

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Quit Claim Deed | $500 | -- | |

| Warranty Deed | $57,000 | None Available | |

| Warranty Deed | $49,900 | -- | |

| Foreclosure Deed | $38,250 | -- |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $57,000 | Purchase Money Mortgage | |

| Previous Owner | $49,200 | No Value Available |

Source: Public Records

Source: Greater Alabama MLS

MLS Number: 21432050

APN: 30-00-22-3-010-001.000

Nearby Homes

- 511 12th St

- 500 Swann Dr

- 832 Alden Ave

- 5221 Jefferson St

- 210 1st Ave Unit 1`

- 921 Garywood Place

- 109 60th St

- 340 Mcpherson Ave

- 6429 Court f

- 608 Jerry Coleman St

- 1324 Creel St

- 324 57th St

- 208 Kentwood Ave

- 201 Opal Ave

- 328 54th St Unit B

- 1112 S Gale Dr

- 5517 Avenue I Unit 1

- 518 Oak Place

- 1272 Meadow Ln

- 4920 Ave I

Your Personal Tour Guide

Ask me questions while you tour the home.