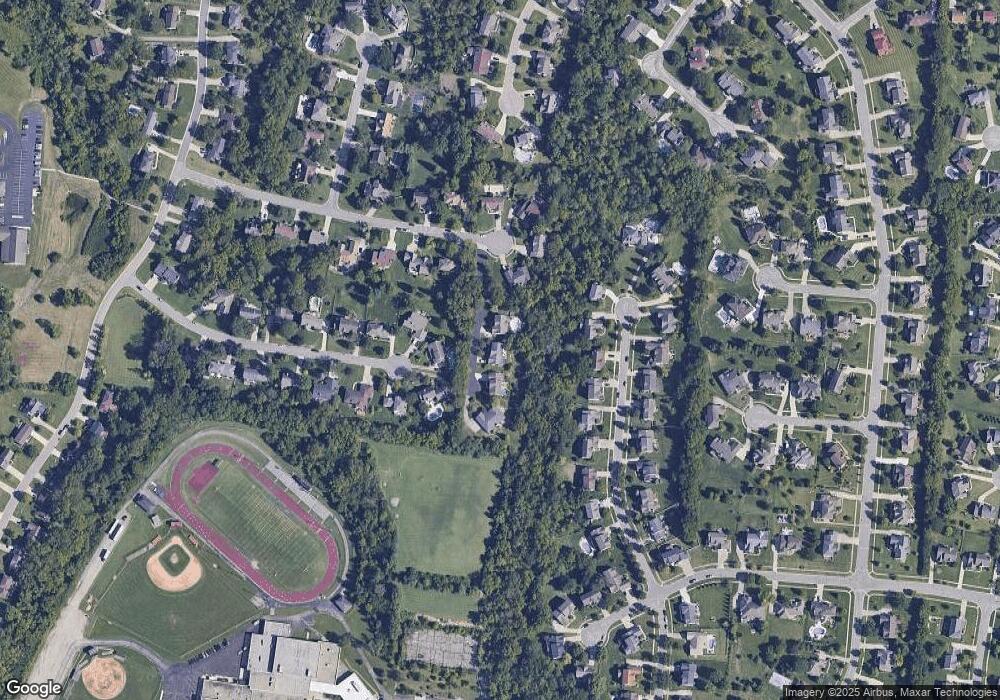

5099 Westsand Ct West Chester, OH 45069

West Chester Township NeighborhoodEstimated Value: $551,000 - $634,000

4

Beds

4

Baths

4,031

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 5099 Westsand Ct, West Chester, OH 45069 and is currently estimated at $592,756, approximately $147 per square foot. 5099 Westsand Ct is a home located in Butler County with nearby schools including Endeavor Elementary School, Lakota Plains Junior School, and Lakota West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2009

Sold by

Adeogba Saint

Bought by

West Ryan M and West Melinda K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,400

Interest Rate

4.94%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 31, 2008

Sold by

Adeogba Saint and Roig Bryan

Bought by

Adeogba Saint

Purchase Details

Closed on

May 7, 2006

Sold by

Curtis Curt B and Curtis Janet D

Bought by

Adeogba Saint and Roig Bryan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$329,000

Interest Rate

6.42%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 30, 2000

Sold by

Zasa Doreen

Bought by

Curtis Curt B and Curtis Janet D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

7.7%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 4, 2000

Sold by

Zasa Frank and Zasa Doreen A

Bought by

Zasa Doreen and The Doreen Zasa Trust

Purchase Details

Closed on

Sep 30, 1998

Sold by

Dixon Builders & Dev Inc

Bought by

Zasa Frank and Zasa Doreen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,400

Interest Rate

6.97%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| West Ryan M | $318,000 | Chicago Title Insurance Co | |

| Adeogba Saint | -- | Attorney | |

| Adeogba Saint | $329,000 | Attorney | |

| Curtis Curt B | $293,500 | -- | |

| Zasa Doreen | -- | -- | |

| Zasa Frank | $241,810 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | West Ryan M | $254,400 | |

| Previous Owner | Adeogba Saint | $329,000 | |

| Previous Owner | Curtis Curt B | $170,000 | |

| Previous Owner | Zasa Frank | $219,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,542 | $158,590 | $19,670 | $138,920 |

| 2023 | $6,496 | $155,160 | $19,670 | $135,490 |

| 2022 | $6,700 | $120,020 | $19,670 | $100,350 |

| 2021 | $6,074 | $115,240 | $19,670 | $95,570 |

| 2020 | $6,219 | $115,240 | $19,670 | $95,570 |

| 2019 | $10,004 | $104,390 | $18,150 | $86,240 |

| 2018 | $5,908 | $104,390 | $18,150 | $86,240 |

| 2017 | $6,013 | $104,390 | $18,150 | $86,240 |

| 2016 | $5,983 | $97,820 | $18,150 | $79,670 |

| 2015 | $5,980 | $97,820 | $18,150 | $79,670 |

| 2014 | $6,145 | $97,820 | $18,150 | $79,670 |

| 2013 | $6,145 | $97,790 | $18,150 | $79,640 |

Source: Public Records

Map

Nearby Homes

- 7392 Wheatland Meadow Ct

- 8330 Park Place

- 5241 Hamilton Mason Rd

- 7229 W Hartford Ct

- 0 Walnut Creek Dr Unit 1850153

- 7350 Keltner Dr

- 7695 Fox Chase Dr

- 5577 Dove Ln

- 7213 Quail Run Dr

- 7956 Bobtail Ct

- 8050 Tollbridge Ct

- 8135 Timbertree Way Unit 3

- 7908 Pinnacle Point Dr

- 6674 Southampton Ln

- 4625 Guildford Dr

- 7257 Clawson Ct

- 7625 Foxchase Dr

- 6993 Clawson Ridge Ct

- 7712 Whitehall Cir E

- 8003 Pinnacle Point Dr

- 5097 Westsand Ct

- 5101 Westsand Ct

- 5084 Park Ridge Ct

- 5103 Westsand Ct

- 7497 Providence Woods Ct

- 7507 Providence Woods Ct

- 7487 Providence Woods Ct

- 7517 Providence Woods Ct

- 5105 Westsand Ct

- 5069 Park Ridge Ct

- 7477 Providence Woods Ct

- 5093 Westsand Ct

- 5064 Park Ridge Ct

- 7527 Providence Woods Ct

- 7467 Providence Woods Ct

- 5059 Park Ridge Ct

- 5079 Westsand Ct

- 5114 Westsand Ct

- 7537 Providence Woods Ct

- 5052 Park Ridge Ct