510 E 9th St Auburn, IN 46706

Estimated Value: $146,000 - $182,546

5

Beds

1

Bath

1,600

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 510 E 9th St, Auburn, IN 46706 and is currently estimated at $170,637, approximately $106 per square foot. 510 E 9th St is a home located in DeKalb County with nearby schools including DeKalb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2021

Sold by

Andrew Stine

Bought by

Stineco Llc

Current Estimated Value

Purchase Details

Closed on

Dec 9, 2021

Sold by

Andrew Stine

Bought by

Stine Matt

Purchase Details

Closed on

Sep 21, 2021

Sold by

Stineco Llc

Bought by

Stranahan Jessica and Stranahan Carl

Purchase Details

Closed on

Sep 19, 2008

Sold by

Hilkey Matthew D and Hikey Shawnna M

Bought by

Ogden Kelley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,700

Interest Rate

6.52%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 5, 1998

Sold by

Thomas Anne B

Bought by

Hilkey Matthew

Purchase Details

Closed on

Sep 21, 1995

Sold by

Davidson Joseph D and Davidson Leona H

Bought by

Thomas Anne B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stineco Llc | -- | None Listed On Document | |

| Stine Matt | -- | None Listed On Document | |

| Stranahan Jessica | $115,000 | -- | |

| Ogden Kelley | $85,000 | Metropolitan Title | |

| Ogden Kelley | -- | None Available | |

| Hilkey Matthew | $66,000 | -- | |

| Thomas Anne B | $66,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ogden Kelley | $86,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $980 | $144,600 | $21,300 | $123,300 |

| 2023 | $857 | $136,800 | $20,000 | $116,800 |

| 2022 | $837 | $123,200 | $17,500 | $105,700 |

| 2021 | $785 | $115,400 | $15,000 | $100,400 |

| 2020 | $607 | $100,900 | $13,700 | $87,200 |

| 2019 | $621 | $100,900 | $13,700 | $87,200 |

| 2018 | $527 | $91,200 | $13,700 | $77,500 |

| 2017 | $490 | $87,500 | $13,700 | $73,800 |

| 2016 | $467 | $84,700 | $13,700 | $71,000 |

| 2014 | $374 | $74,300 | $9,800 | $64,500 |

Source: Public Records

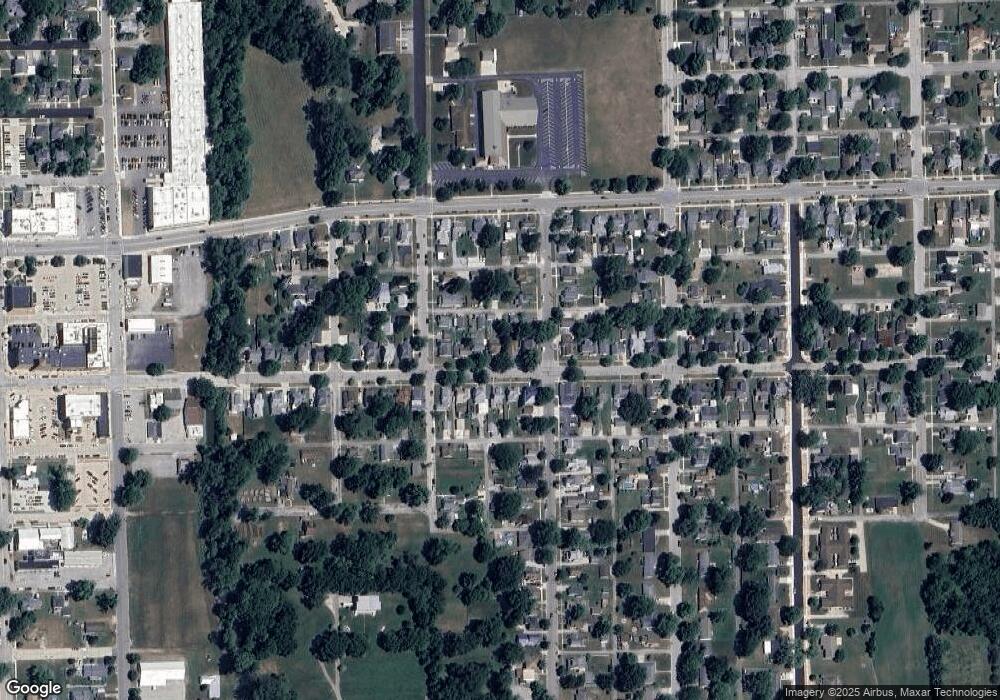

Map

Nearby Homes

- 110 Center St

- 300 E 7th St

- 271 N Mcclellan St Unit 105

- 213 E 5th St

- TBD S Union St

- 410 N Cedar St

- 218 Iwo St

- 703 S Main St

- 901 S Van Buren St

- 331 W 15th St

- 350 W 9th St

- 1102 Riviera Ct

- TBD Douglas St

- 1301 Superior Dr

- 518 S Indiana Ave

- 1309 Hiawatha Place

- 1404 Chestnut Ct

- 1501 Foley Ct

- 1412 Duesenberg Dr

- 1604 Allison Blvd