5112 Kerns Rd Springfield, OH 45502

Estimated Value: $190,686 - $280,000

3

Beds

2

Baths

1,296

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 5112 Kerns Rd, Springfield, OH 45502 and is currently estimated at $222,672, approximately $171 per square foot. 5112 Kerns Rd is a home located in Clark County with nearby schools including Possum Elementary School, Shawnee Middle School/High School, and Twin Oaks Sda Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2021

Sold by

Baisden Christine

Bought by

Baisden Brandon Michael and Baisden Angel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,085

Outstanding Balance

$64,258

Interest Rate

2.8%

Mortgage Type

FHA

Estimated Equity

$158,414

Purchase Details

Closed on

Feb 29, 2012

Sold by

Frost Melvin L and Frost Edith M

Bought by

Baisden Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,092

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 10, 1997

Sold by

Jones Jennifer K

Bought by

Frost Melvin L and Frost Edith M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$22,000

Interest Rate

8.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baisden Brandon Michael | $120,000 | Amrock Inc | |

| Baisden Christine | $55,500 | Ohio Real Estate Title | |

| Frost Melvin L | $85,000 | -- | |

| -- | $29,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Baisden Brandon Michael | $71,085 | |

| Previous Owner | Baisden Christine | $54,092 | |

| Previous Owner | Frost Melvin L | $22,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,483 | $62,690 | $15,900 | $46,790 |

| 2024 | $2,419 | $49,470 | $11,510 | $37,960 |

| 2023 | $2,419 | $49,470 | $11,510 | $37,960 |

| 2022 | $2,399 | $49,470 | $11,510 | $37,960 |

| 2021 | $1,501 | $27,700 | $8,930 | $18,770 |

| 2020 | $1,514 | $27,700 | $8,930 | $18,770 |

| 2019 | $1,459 | $26,290 | $8,930 | $17,360 |

| 2018 | $1,309 | $23,270 | $8,110 | $15,160 |

| 2017 | $1,342 | $23,272 | $8,113 | $15,159 |

| 2016 | $1,211 | $23,272 | $8,113 | $15,159 |

| 2015 | $1,228 | $22,813 | $8,113 | $14,700 |

| 2014 | $1,231 | $22,813 | $8,113 | $14,700 |

| 2013 | $1,070 | $22,813 | $8,113 | $14,700 |

Source: Public Records

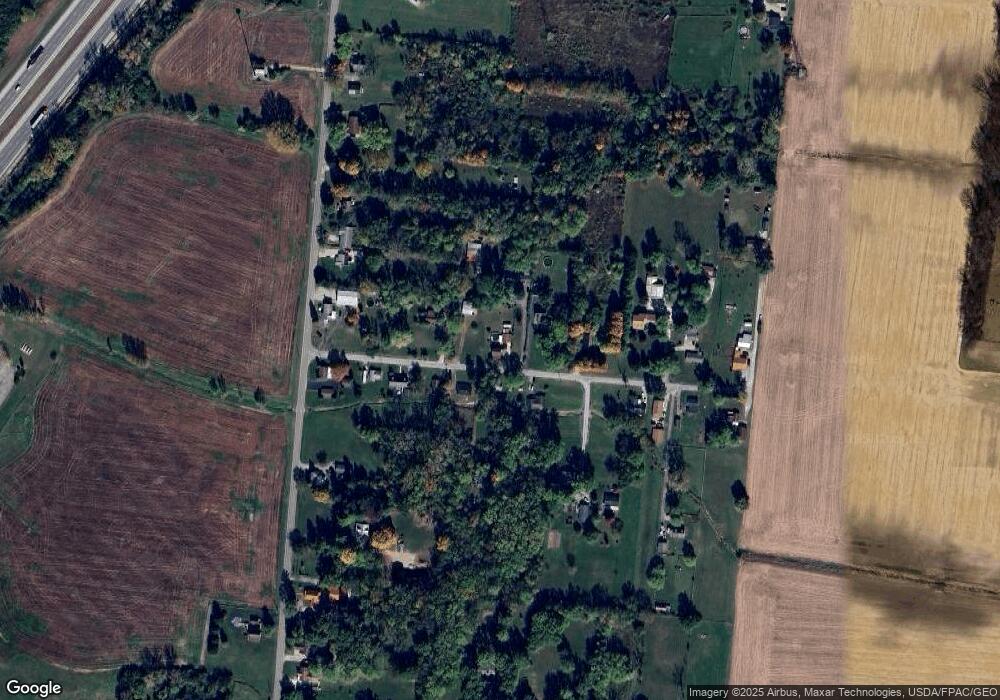

Map

Nearby Homes

- 5073 Kerns Rd

- 5210 Kerns Rd

- 0 Fletcher Chapel Rd Unit 1042048

- 2164 Ridge Rd

- 2212 Ridge Rd

- 414 S Landon Ln

- 413 S Landon Ln

- 410 S Landon Ln

- 405 S Landon Ln

- 4205 Altman Ave

- Emmett Plan at Melody Parks - Designer Collection

- Carrington Plan at Melody Parks - Designer Collection

- Wyatt Plan at Melody Parks - Designer Collection

- Grandin Plan at Melody Parks - Designer Collection

- Avery Plan at Melody Parks - Designer Collection

- Calvin Plan at Melody Parks - Designer Collection

- Charles Plan at Melody Parks - Designer Collection

- Blair Plan at Melody Parks - Designer Collection

- Winston Plan at Melody Parks - Designer Collection

- Magnolia Plan at Melody Parks - Designer Collection

Your Personal Tour Guide

Ask me questions while you tour the home.