514 Trace 5 West Lafayette, IN 47906

Estimated Value: $261,000 - $274,000

--

Bed

2

Baths

1,448

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 514 Trace 5, West Lafayette, IN 47906 and is currently estimated at $267,967, approximately $185 per square foot. 514 Trace 5 is a home located in Tippecanoe County with nearby schools including West Lafayette Intermediate School, West Lafayette Elementary School, and West Lafayette Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2022

Sold by

Patrick Gery Douglas

Bought by

Elizabettnartin Anne Elizabeth and Martin James Michael

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,000

Outstanding Balance

$174,104

Interest Rate

5.09%

Mortgage Type

New Conventional

Estimated Equity

$93,863

Purchase Details

Closed on

Nov 15, 2021

Sold by

Koelzer Joyce D

Bought by

Gery Douglas Patrick and Gery Carolyn Schilling

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,575

Interest Rate

2.99%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Elizabettnartin Anne Elizabeth | -- | None Listed On Document | |

| Gery Douglas Patrick | $179,500 | Reiling Teder & Schrier Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Elizabettnartin Anne Elizabeth | $183,000 | |

| Previous Owner | Gery Douglas Patrick | $152,575 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,331 | $200,100 | $27,400 | $172,700 |

| 2023 | $1,995 | $186,700 | $27,400 | $159,300 |

| 2022 | $1,871 | $162,700 | $27,400 | $135,300 |

| 2021 | $1,667 | $143,300 | $27,400 | $115,900 |

| 2020 | $1,470 | $132,700 | $27,400 | $105,300 |

| 2019 | $1,414 | $130,700 | $27,400 | $103,300 |

| 2018 | $1,260 | $120,200 | $16,900 | $103,300 |

| 2017 | $1,222 | $117,800 | $16,900 | $100,900 |

| 2016 | $1,101 | $114,500 | $16,900 | $97,600 |

| 2014 | $1,096 | $112,000 | $16,900 | $95,100 |

| 2013 | $1,093 | $110,900 | $16,900 | $94,000 |

Source: Public Records

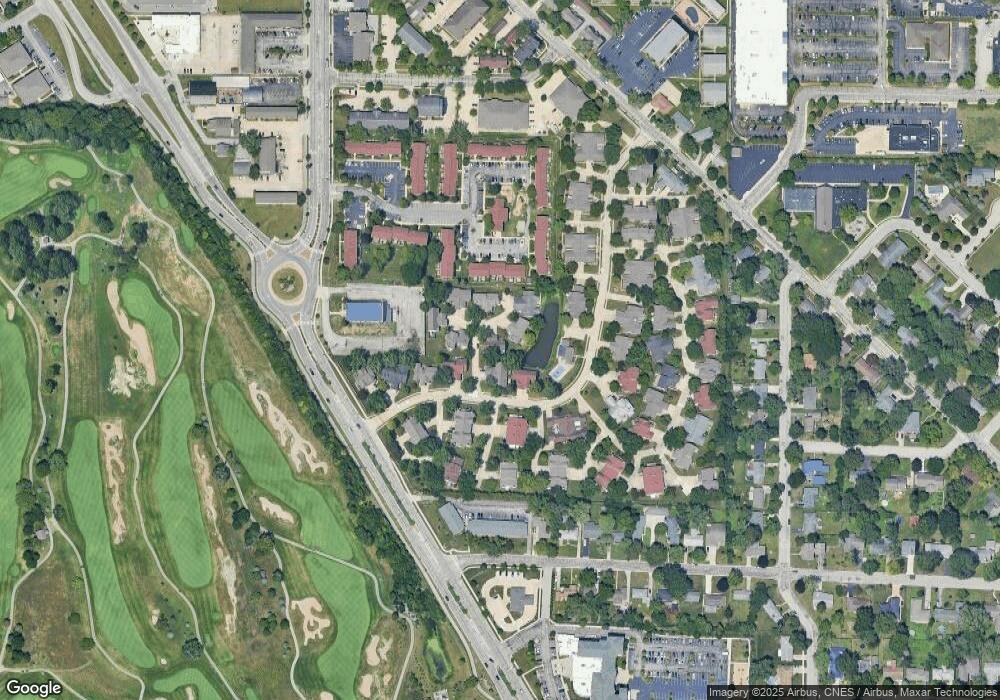

Map

Nearby Homes

- 1190 Camelback Blvd

- 1201 Lindberg Rd

- 2306 Carmel Dr

- 2212 Sycamore Ln

- 1912 Indian Trail Dr

- 1909 Indian Trail Dr

- 701 Carrolton Blvd

- 500 Carrolton Blvd

- 106 W Navajo St

- 509 Carrolton Blvd

- 631 Kent Ave

- 624 Kent Ave

- 618 Northridge Dr

- 1744 Sandpiper Dr

- 2843 Barlow St

- 987 Marwyck St

- 2801 Henderson St

- 1220 Ravinia Rd

- 448 Westview Cir

- 2825 Henderson St