515 Orchid Lights Ct Unit 56 Griffin, GA 30223

Spalding County NeighborhoodEstimated Value: $343,366 - $352,000

2

Beds

2

Baths

1,710

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 515 Orchid Lights Ct Unit 56, Griffin, GA 30223 and is currently estimated at $348,342, approximately $203 per square foot. 515 Orchid Lights Ct Unit 56 is a home located in Spalding County with nearby schools including Jordan Hill Road Elementary School, Kennedy Road Middle School, and Spalding High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 3, 2017

Sold by

Fetzer Larry

Bought by

Fetzer Larry and Fetzer Lynn

Current Estimated Value

Purchase Details

Closed on

Jan 30, 2017

Sold by

Conzalex Eliseo Alex Et

Bought by

Fetzer Larry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,920

Interest Rate

4.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 30, 2009

Sold by

Pulte Hm Corp

Bought by

Gonzalez Alex and Gonzalez Janis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,540

Interest Rate

4.98%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fetzer Larry | -- | -- | |

| Fetzer Larry | $214,900 | -- | |

| Gonzalez Alex | $194,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fetzer Larry | $171,920 | |

| Previous Owner | Gonzalez Alex | $155,540 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,772 | $133,260 | $16,000 | $117,260 |

| 2023 | $4,846 | $133,260 | $16,000 | $117,260 |

| 2022 | $3,961 | $107,961 | $16,000 | $91,961 |

| 2021 | $3,470 | $94,450 | $16,000 | $78,450 |

| 2020 | $3,285 | $89,049 | $16,000 | $73,049 |

| 2019 | $3,350 | $89,049 | $16,000 | $73,049 |

| 2018 | $3,172 | $82,089 | $16,000 | $66,089 |

| 2017 | $2,862 | $76,026 | $16,000 | $60,026 |

| 2016 | $2,913 | $76,026 | $16,000 | $60,026 |

| 2015 | $2,999 | $76,026 | $16,000 | $60,026 |

| 2014 | $2,631 | $76,826 | $16,800 | $60,026 |

Source: Public Records

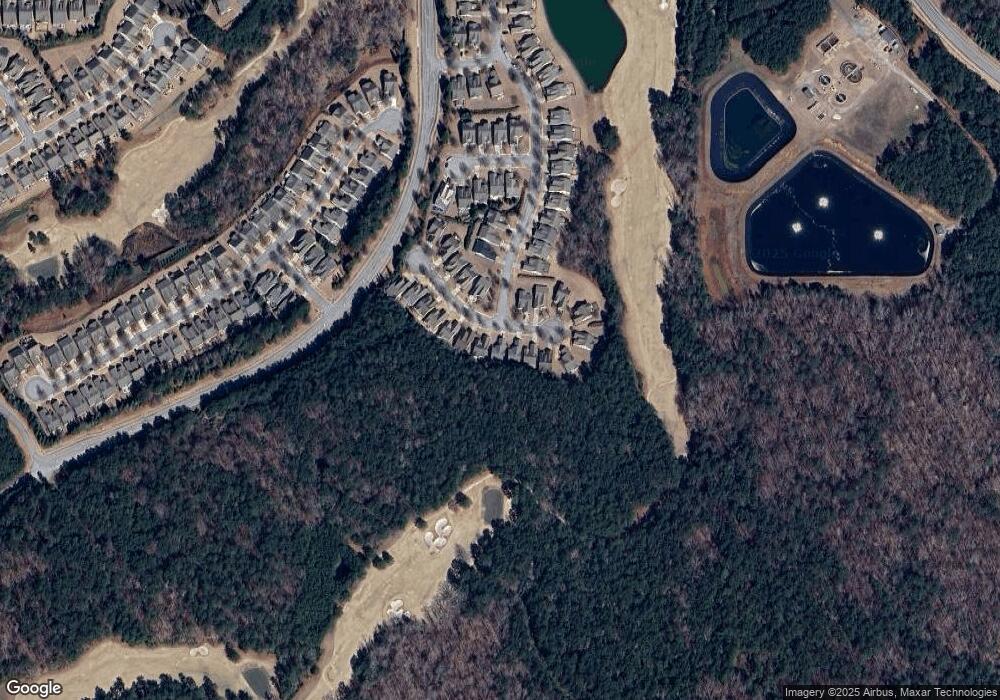

Map

Nearby Homes

- 506 Orchid Lights Ct

- 850 Dusky Sap Ct

- 421 Beacon Ct

- 811 Dusky Sap Ct

- 802 Dusky Sap Ct

- 402 Larch Looper Dr

- 312 Whispering Pines Way

- 1106 Satilla Ct

- 733 Firefly Ct

- 607 Larch Looper Dr

- 100 Crape Myrtle Dr

- 717 Bay Skipper Ct

- 800 Firefly Ct

- 624 Larch Looper Dr

- 754 Firefly Ct

- 305 Anna Ruby Ct

- 819 Firefly Ct

- 128 Crape Myrtle Dr

- 840 Peach Blossom Ct

- 901 Coffee Berry Ct

- 515 Orchid Lights Ct

- 517 Orchid Lights Ct

- 519 Orchid Lights Ct

- 511 Orchid Lights Ct

- 0 Orchid Lights Ct Unit 8230287

- 0 Orchid Lights Ct Unit 8127533

- 0 Orchid Lights Ct

- 521 Orchid Lights Ct

- 509 Orchid Lights Ct

- 510 Orchid Lights Ct

- 508 Orchid Lights Ct

- 512 Orchid Lights Ct

- 507 Orchid Lights Ct

- 520 Orchid Lights Ct

- 514 Orchid Lights Ct

- 505 Orchid Lights Ct

- 518 Orchid Lights Ct

- 401 Beacon Ct

- 516 Orchid Lights Ct

- 504 Orchid Lights Ct