5191 SE Burning Tree Cir Stuart, FL 34997

Estimated Value: $604,000 - $671,000

3

Beds

2

Baths

2,056

Sq Ft

$309/Sq Ft

Est. Value

About This Home

This home is located at 5191 SE Burning Tree Cir, Stuart, FL 34997 and is currently estimated at $636,318, approximately $309 per square foot. 5191 SE Burning Tree Cir is a home located in Martin County with nearby schools including Sea Wind Elementary School, Murray Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2022

Sold by

Bustillo and Marlene

Bought by

Bustillo George and Bustillo Danielle E

Current Estimated Value

Purchase Details

Closed on

Jul 8, 2013

Sold by

White Walter H

Bought by

Bustillo George and Bustillo Marlene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

3.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 18, 2004

Sold by

Butwid Sybil R

Bought by

White Walter H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

4.87%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 29, 1994

Sold by

Butwid Sybil R and Hicinbothem Sibil L

Bought by

Butwid John and Butwid Sybil R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bustillo George | -- | Pawluc Sonia M | |

| Bustillo George | $100 | Pawluc Sonia M | |

| Bustillo George | $255,000 | Attorney | |

| White Walter H | $285,000 | -- | |

| Butwid John | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bustillo George | $204,000 | |

| Previous Owner | White Walter H | $190,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,364 | $128,709 | -- | -- |

| 2024 | $4,270 | $280,033 | -- | -- |

| 2023 | $4,270 | $271,877 | $0 | $0 |

| 2022 | $4,115 | $263,959 | $0 | $0 |

| 2021 | $4,117 | $256,271 | $0 | $0 |

| 2020 | $4,014 | $252,733 | $0 | $0 |

| 2019 | $3,948 | $247,051 | $0 | $0 |

| 2018 | $3,850 | $242,445 | $0 | $0 |

| 2017 | $3,316 | $237,458 | $0 | $0 |

| 2016 | $3,580 | $232,574 | $0 | $0 |

| 2015 | $3,320 | $217,640 | $145,000 | $72,640 |

| 2014 | $3,320 | $224,310 | $150,000 | $74,310 |

Source: Public Records

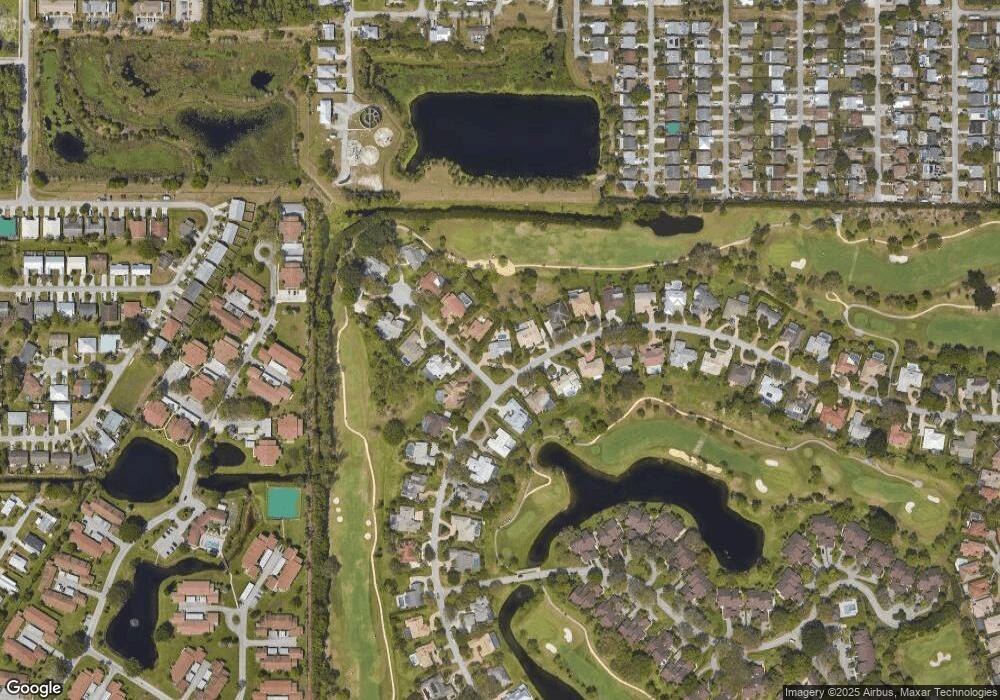

Map

Nearby Homes

- 5201 SE Burning Tree Cir

- 6061 SE Medinah Ln

- 5220 SE Burning Tree Cir

- 5151 SE Burning Tree Cir

- 5929 SE Collins Ave

- 5011 SE Brandywine Way

- 5071 SE Brandywine Way Unit 8

- 5101 SE Burning Tree Cir

- 6531 SE Federal Hwy Unit K-202

- 6531 SE Federal Hwy Unit 101

- 6531 SE Federal Hwy Unit N106

- 6531 SE Federal Hwy Unit Q 107

- 6531 SE Federal Hwy Unit F-107

- 6531 SE Federal Hwy Unit J202

- 6531 SE Federal Hwy Unit S201

- 6531 SE Federal Hwy Unit M111

- 6531 SE Federal Hwy Unit D112

- 5081 SE Burning Tree Cir

- 5879 SE Wilsie Dr

- 5311 SE Brandywine Way Unit 28

- 6081 SE Medinah Ln

- 5190 SE Burning Tree Cir

- 6071 SE Medinah Ln

- 5205 SE Burning Tree Cir

- 6082 SE Medinah Ln

- 5180 SE Burning Tree Cir

- 5200 SE Burning Tree Cir

- 6072 SE Medinah Ln

- 5170 SE Burning Tree Cir

- 5210 SE Burning Tree Cir

- 5211 SE Burning Tree Cir

- 5171 SE Burning Tree Cir

- 5221 SE Burning Tree Cir

- 6051 SE Medinah Ln

- 5161 SE Burning Tree Cir

- 5150 SE Burning Tree Cir

- 6050 SE Medinah Ln

- 5231 SE Burning Tree Cir