52 Tall Trees Dr Unit 2F Amelia, OH 45102

Estimated Value: $181,000 - $198,000

2

Beds

2

Baths

1,128

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 52 Tall Trees Dr Unit 2F, Amelia, OH 45102 and is currently estimated at $191,838, approximately $170 per square foot. 52 Tall Trees Dr Unit 2F is a home located in Clermont County with nearby schools including Amelia Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 22, 2009

Sold by

Ratliff Elizabeth J and Combs William L

Bought by

German April R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,224

Outstanding Balance

$63,784

Interest Rate

5.62%

Mortgage Type

FHA

Estimated Equity

$128,054

Purchase Details

Closed on

May 10, 2007

Sold by

Walden Judith G

Bought by

Heakel Elizabeth J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,000

Interest Rate

6.2%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 6, 2006

Sold by

Hood Kathy Jo

Bought by

Hood Kathy Jo and The Kathy Hood Living Trust

Purchase Details

Closed on

Aug 1, 2003

Sold by

Holbrook John E and Holbrook Bernice

Bought by

Lafferty Clyde

Purchase Details

Closed on

Jul 24, 2001

Sold by

Drees Co

Bought by

Holbrook John E and Holbrook Bernice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| German April R | $98,000 | Attorney | |

| Heakel Elizabeth J | $115,000 | None Available | |

| Hood Kathy Jo | -- | Attorney | |

| Lafferty Clyde | $118,000 | -- | |

| Holbrook John E | $115,066 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | German April R | $96,224 | |

| Previous Owner | Heakel Elizabeth J | $97,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,389 | $51,210 | $8,370 | $42,840 |

| 2023 | $2,395 | $51,210 | $8,370 | $42,840 |

| 2022 | $2,041 | $38,610 | $6,300 | $32,310 |

| 2021 | $2,052 | $38,610 | $6,300 | $32,310 |

| 2020 | $2,060 | $38,610 | $6,300 | $32,310 |

| 2019 | $1,586 | $29,860 | $4,200 | $25,660 |

| 2018 | $1,602 | $29,860 | $4,200 | $25,660 |

| 2017 | $1,642 | $29,860 | $4,200 | $25,660 |

| 2016 | $1,774 | $29,860 | $4,200 | $25,660 |

| 2015 | $1,658 | $29,860 | $4,200 | $25,660 |

| 2014 | $1,657 | $29,860 | $4,200 | $25,660 |

| 2013 | $1,628 | $29,060 | $4,170 | $24,890 |

Source: Public Records

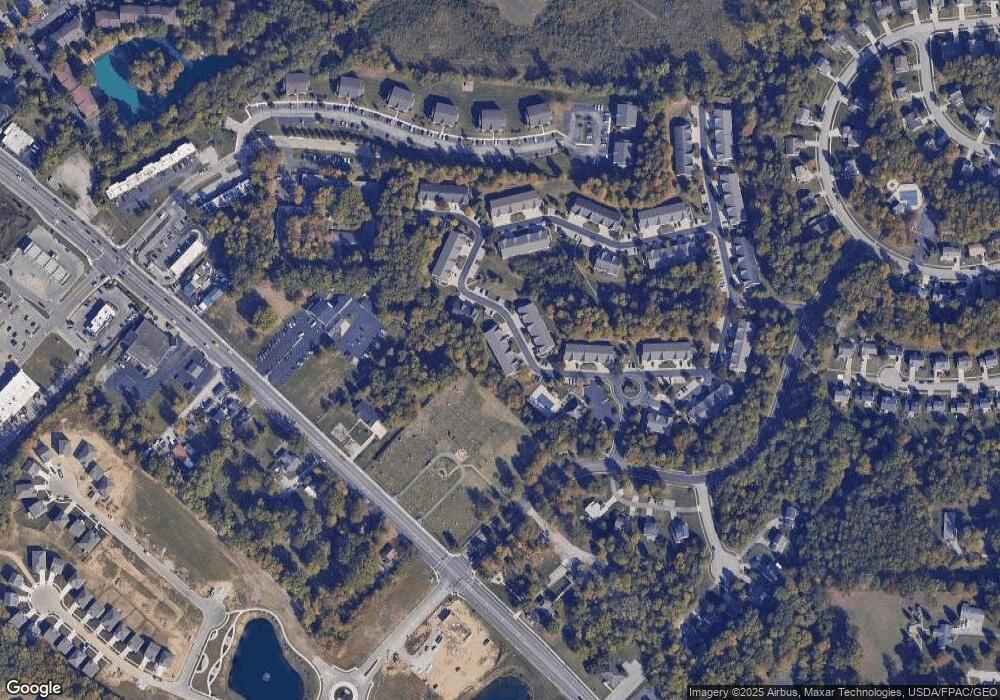

Map

Nearby Homes

- 14 Broadwood Ln Unit 11D

- 57 Marigold Ln

- 67 Snapdragon Dr

- 1511 Thornberry Rd

- 3583 S Heartwood Rd

- 61 Goldfish Ln

- 85 Glen Mary Dr

- 53 Gladiola Way

- 3559 S Heartwood Rd

- 3611 Burnham Woods Dr

- 1438 Locust Lake Rd

- 3735 Maplebrooke Ln

- 3664 Lewis Rd

- 9 Letitia Ave

- 1969 Ohio 125

- 1190 Twin Gate Run

- 1335 Lakefront Ct

- 3478 Hickory Ln

- 3693 Foxdale Ct

- 4 Gumbert Dr

- 58 Tall Trees Dr

- 54 Tall Trees Dr Unit 2G

- 48 Tall Trees Dr Unit 2D

- 50 Tall Trees Dr Unit 2E

- 56 Tall Trees Dr

- 60 Tall Trees Dr

- 44 Tall Trees Dr

- 46 Tall Trees Dr

- 42 Tall Trees Dr

- 42 Tall Trees Dr Unit 2A

- 51 Tall Trees Dr

- 47 Tall Trees Dr

- 64 Tall Trees Dr

- 45 Tall Trees Dr Unit 4H

- 55 Tall Trees Dr Unit 4C

- 62 Tall Trees Dr Unit 3A

- 53 Tall Trees Dr

- 68 Tall Trees Dr Unit 3D

- 43 Tall Trees Dr Unit 4I

- 57 Tall Trees Dr Unit 4B