521 Jordan Way Brighton, CO 80603

Estimated Value: $710,000 - $871,000

4

Beds

5

Baths

2,774

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 521 Jordan Way, Brighton, CO 80603 and is currently estimated at $758,850, approximately $273 per square foot. 521 Jordan Way is a home located in Weld County with nearby schools including Weld Central Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 22, 2008

Sold by

Overman Christina

Bought by

Miles Christina and Miles Daniel

Current Estimated Value

Purchase Details

Closed on

Feb 9, 2006

Sold by

Overman Gordon W and Overman Christina A

Bought by

Overman Christina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,000

Interest Rate

6.05%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 25, 2002

Sold by

Daylight Builders Llc

Bought by

Overman Gordon W and Overman Christina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

6.62%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miles Christina | -- | None Available | |

| Overman Christina A | -- | Stewart Title Of Denver | |

| Overman Gordon W | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Overman Christina A | $228,000 | |

| Previous Owner | Overman Gordon W | $220,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,871 | $40,080 | $15,430 | $24,650 |

| 2024 | $1,871 | $40,080 | $15,430 | $24,650 |

| 2023 | $1,755 | $39,220 | $15,970 | $23,250 |

| 2022 | $1,658 | $31,030 | $11,780 | $19,250 |

| 2021 | $1,803 | $31,920 | $12,120 | $19,800 |

| 2020 | $1,191 | $22,320 | $5,310 | $17,010 |

| 2019 | $1,253 | $22,320 | $5,310 | $17,010 |

| 2018 | $1,136 | $19,610 | $4,730 | $14,880 |

| 2017 | $1,071 | $19,610 | $4,730 | $14,880 |

| 2015 | $921 | $20,320 | $7,160 | $13,160 |

| 2014 | $732 | $15,870 | $3,980 | $11,890 |

Source: Public Records

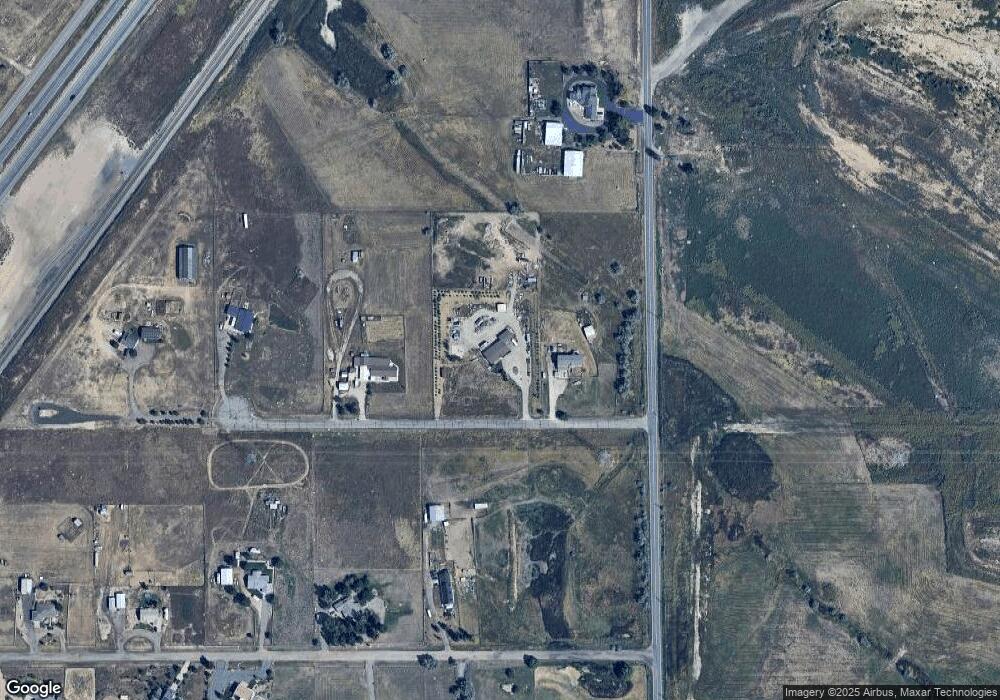

Map

Nearby Homes

- 603 Locust Ave

- 422 Willow Dr

- 1219 Lilac Dr

- 634 County Road 37

- 218 Poplar St

- 724 County Road 37

- 135 Poplar St

- 107 Spruce Ave

- 103 Wenatchee St

- 105 Stampede Place

- 325 Ravine Way

- 219 Valley Ave

- 209 Vista Blvd

- 704 Willow Dr

- 177 Westin Ave

- 244 Chipeta Way

- Ponderosa Plan at Lochbuie Station

- Maple Plan at Lochbuie Station

- 13 Chipeta Way

- Ruby Plan at Lochbuie Station - Jewel

- 525 Jordan Way

- 0 Jordan Dr Unit 831581

- 0 Jordan Dr Unit 614122

- 517 Jordan Way

- 513 Jordan Way

- 18961 Foxhaven Ct

- 18837 Foxhaven Ct

- 695 County Road 39

- 18775 Foxhaven Ct

- 509 Jordan Way

- 0 Fox Haven Ct Unit 1125513

- 0 Fox Haven Ct Unit 684610

- 18711 Foxhaven Ct

- 18888 Foxhaven Ct

- 18764 Foxhaven Ct

- 251 Cherokee Place Unit 39

- 795 County Road 39

- 18888 Fox Haven Ct

- 18700 Foxhaven Ct

- 815 County Road 39