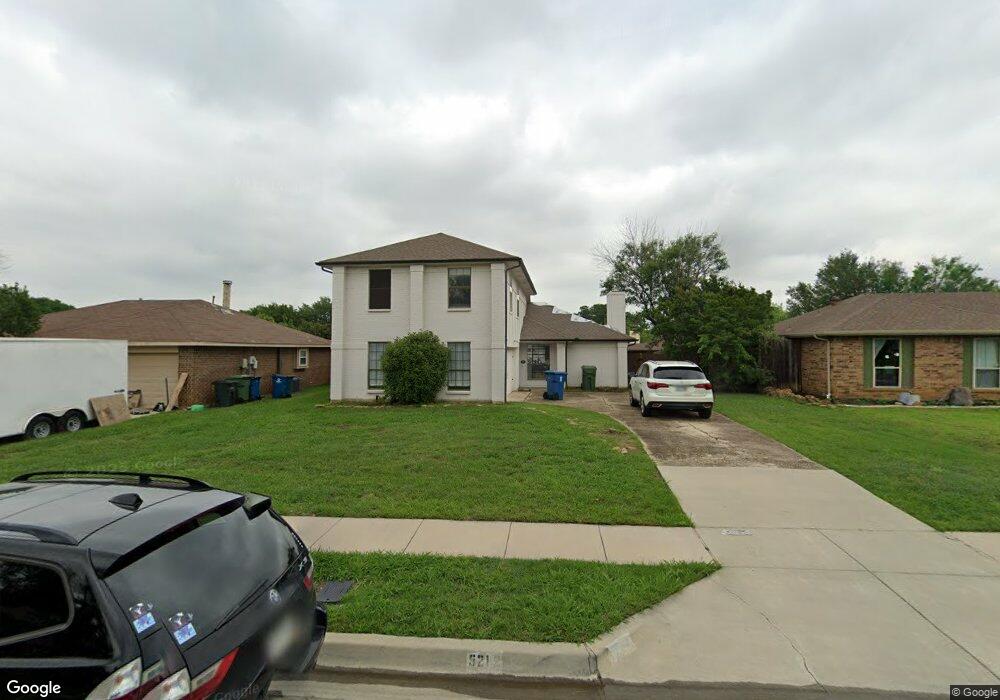

5212 Colonial Dr Flower Mound, TX 75028

Prairie Creek NeighborhoodEstimated Value: $393,000 - $426,000

--

Bed

3

Baths

1,990

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 5212 Colonial Dr, Flower Mound, TX 75028 and is currently estimated at $406,366, approximately $204 per square foot. 5212 Colonial Dr is a home located in Denton County with nearby schools including Prairie Trail Elementary School, Lamar Middle School, and Marcus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 13, 2017

Sold by

Davis Candace Caryle

Bought by

Davis Candace Caryle and Candace Davis Trust

Current Estimated Value

Purchase Details

Closed on

Feb 25, 2005

Sold by

Friendly Family #1 Lp

Bought by

Davis Candace Caryle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,400

Outstanding Balance

$52,395

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$353,971

Purchase Details

Closed on

Jan 1, 1998

Sold by

Peterson Arthur W

Bought by

The Friendly Family #1 Ltd Partnership

Purchase Details

Closed on

Jan 27, 1997

Sold by

Hud

Bought by

Peterson Arthur W

Purchase Details

Closed on

Jul 2, 1996

Sold by

Jenkins David S and Jenkins Sandra L

Bought by

Midfirst Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Candace Caryle | -- | None Available | |

| Davis Candace Caryle | -- | Fnt | |

| The Friendly Family #1 Ltd Partnership | -- | -- | |

| Peterson Arthur W | -- | Safeco Land Title | |

| Midfirst Bank | $83,635 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Candace Caryle | $102,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,738 | $384,160 | $86,912 | $297,248 |

| 2024 | $6,738 | $398,000 | $86,912 | $311,088 |

| 2023 | $3,926 | $230,000 | $86,912 | $143,088 |

| 2022 | $4,091 | $220,000 | $72,944 | $147,056 |

| 2021 | $4,959 | $246,845 | $44,698 | $202,147 |

| 2020 | $5,318 | $266,000 | $49,664 | $216,336 |

| 2019 | $5,056 | $244,000 | $49,664 | $194,336 |

| 2018 | $4,377 | $210,000 | $49,664 | $160,336 |

| 2017 | $4,215 | $200,000 | $49,664 | $150,336 |

| 2016 | $4,548 | $215,809 | $49,664 | $166,145 |

| 2015 | $3,414 | $156,000 | $33,862 | $122,138 |

| 2013 | -- | $156,000 | $33,862 | $122,138 |

Source: Public Records

Map

Nearby Homes

- 5329 Ponder Place

- 1208 Homestead St

- 5400 Carriage Ct

- 5309 Buckner Dr

- 1105 Coker Dr

- 4925 Marcus Dr

- 1617 Oak Creek Dr

- 1204 Marcus Ct

- 1554 N Valley Pkwy

- 1682 Shannon Dr

- 1602 Autumn Breeze Ln

- 1661 Crosshaven Dr

- 5324 Peterson Ct

- 1613 Autumn Breeze Ln

- 1601 Autumn Breeze Ln

- 1534 Autumn Breeze Ln

- 1845 Tiburon Bend

- 593 King Cir

- 1837 Meyerwood Ln N

- 1581 Glenmore Dr

- 5216 Colonial Dr

- 5208 Colonial Dr

- 1324 Colony Ct

- 1320 Colony Ct

- 5204 Colonial Dr

- 5220 Colonial Dr

- 1325 Ponder Way

- 5213 Colonial Dr

- 1321 Colony Ct

- 5209 Colonial Dr

- 5217 Colonial Dr

- 5205 Colonial Dr

- 1316 Colony Ct

- 1328 Homestead St

- 5221 Colonial Dr

- 1324 Homestead St

- 1319 Colony Ct

- 1317 Ponder Way

- 5300 Colonial Dr

- 1320 Homestead St