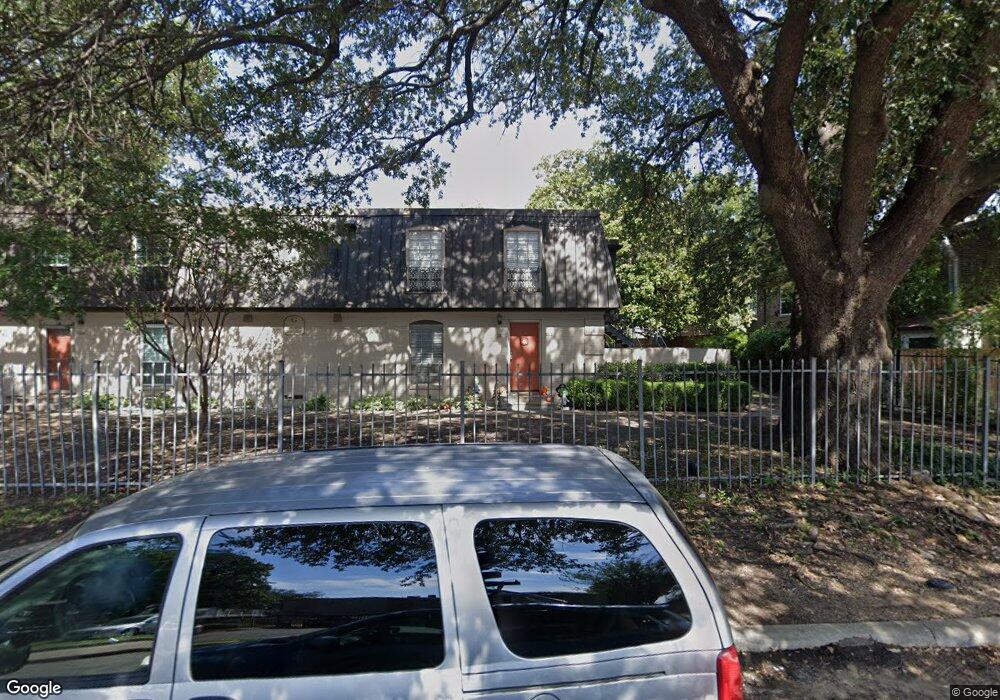

5212 Fleetwood Oaks Ave Unit 101G Dallas, TX 75235

Southwestern Medical District NeighborhoodEstimated Value: $140,569 - $152,000

1

Bed

1

Bath

710

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 5212 Fleetwood Oaks Ave Unit 101G, Dallas, TX 75235 and is currently estimated at $145,892, approximately $205 per square foot. 5212 Fleetwood Oaks Ave Unit 101G is a home located in Dallas County with nearby schools including Maple Lawn Elementary School, Thomas J. Rusk Middle School, and North Dallas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2021

Sold by

Wilmore David E and Colbert Kenneth T

Bought by

Hoedebeck Charles E

Current Estimated Value

Purchase Details

Closed on

Sep 18, 2017

Sold by

Dynasty Property Id 3 Llc

Bought by

Wilmore David E and Hoedebeck Charles E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

3.93%

Mortgage Type

Commercial

Purchase Details

Closed on

Feb 15, 2017

Sold by

Dynasty Alpha Llc

Bought by

Dynasty Property Id 3 Llc

Purchase Details

Closed on

Mar 21, 2016

Sold by

Harris Cynthia L and Corder Cynthia

Bought by

Dynasty Alpha Llc

Purchase Details

Closed on

Dec 3, 2007

Sold by

Coyle Grady E

Bought by

Crow Brynn L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,850

Interest Rate

6.4%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hoedebeck Charles E | -- | Providence Title Company | |

| Wilmore David E | -- | None Available | |

| Dynasty Property Id 3 Llc | -- | Chicago Title | |

| Dynasty Alpha Llc | -- | Attorney | |

| Crow Brynn L | -- | Hftc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilmore David E | $88,000 | |

| Previous Owner | Crow Brynn L | $40,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,915 | $130,420 | $42,360 | $88,060 |

| 2024 | $2,915 | $130,420 | $42,360 | $88,060 |

| 2023 | $2,915 | $124,250 | $42,360 | $81,890 |

| 2022 | $3,107 | $124,250 | $42,360 | $81,890 |

| 2021 | $2,809 | $106,500 | $42,360 | $64,140 |

| 2020 | $2,889 | $106,500 | $42,360 | $64,140 |

| 2019 | $3,030 | $106,500 | $42,360 | $64,140 |

| 2018 | $2,857 | $105,080 | $26,620 | $78,460 |

| 2017 | $2,703 | $99,400 | $26,620 | $72,780 |

| 2016 | $2,606 | $95,850 | $24,200 | $71,650 |

| 2015 | $1,374 | $67,450 | $6,050 | $61,400 |

| 2014 | $1,374 | $67,450 | $6,050 | $61,400 |

Source: Public Records

Map

Nearby Homes

- 5214 Fleetwood Oaks Ave Unit 206

- 5226 Fleetwood Oaks Ave Unit 115

- 5234 Fleetwood Oaks Ave Unit 120E

- 5305 Fleetwood Oaks Ave Unit 274

- 5308 Parkland Ave

- 5323 Fleetwood Oaks Ave Unit 256

- 5005 Denton Dr

- 5111 Stoneleigh Ave

- 5106 Stoneleigh Ave

- 2814 Hedgerow Dr

- 5122 Maple Springs Blvd

- 2934 Maple Springs Blvd

- 5049 Cedar Springs Rd Unit 120K

- 5031 Cedar Springs Rd Unit 202

- 2811 Carlson Dr

- 2842 Carlson Dr

- 4804 Bradford Dr

- 3031 Mahanna Springs Dr Unit D Bldg B

- 4711 Sylvester St

- 2602 Kings Rd

- 5212 Fleetwood Oaks Ave Unit 202G

- 5212 Fleetwood Oaks Ave Unit 203

- 5212 Fleetwood Oaks Ave Unit 201G

- 5212 Fleetwood Oaks Ave Unit 103

- 5212 Fleetwood Oaks Ave Unit 102G

- 5212 Fleetwood Oaks Ave Unit 201 Bldg G

- 5212 Fleetwood Oaks Ave Unit 201G

- 5212 Fleetwood Oaks Ave Unit 102

- 5212 Fleetwood Oaks Ave Unit 201 Bldg G

- 5212 Fleetwood Oaks Ave Unit 103

- 5212 Fleetwood Oaks Ave

- 5212 Fleetwood Oaks Ave Unit 101G

- 5212 Fleetwood Oaks Ave Unit 101G

- 5212 Fleetwood Oaks Ave Unit 203

- 5212 Fleetwood Oaks Ave Unit 202G

- 5212 Fleetwood Oaks Ave Unit 103

- 5212 Fleetwood Oaks Ave Unit 202

- 5218 Fleetwood Oaks Ave Unit 207

- 5218 Fleetwood Oaks Ave Unit 108

- 5218 Fleetwood Oaks Ave Unit 207F