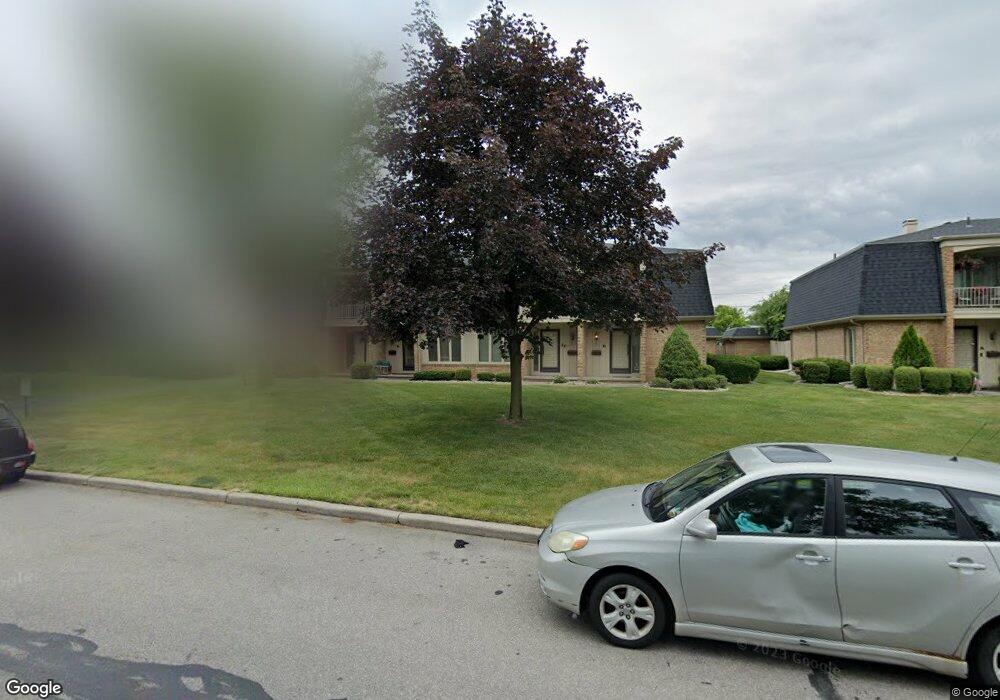

5212 Regency Dr Unit A Toledo, OH 43615

Estimated Value: $149,000 - $205,093

2

Beds

2

Baths

1,220

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 5212 Regency Dr Unit A, Toledo, OH 43615 and is currently estimated at $176,773, approximately $144 per square foot. 5212 Regency Dr Unit A is a home located in Lucas County with nearby schools including Whiteford Elementary School, Sylvania Arbor Hills Junior High School, and Sylvania Southview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2023

Sold by

Green Properties Llc

Bought by

Jat Llc

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2022

Sold by

Heffern Paul M

Bought by

Green Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

5%

Purchase Details

Closed on

Aug 4, 2019

Sold by

Estate Of Michael A Heffern

Bought by

Heffern Paul M

Purchase Details

Closed on

Aug 3, 2017

Sold by

Estate Of Paul M Heffern Sr

Bought by

Heffern Paul M and Heffern Michael A

Purchase Details

Closed on

Nov 10, 2005

Sold by

Fisher Robert R and Fisher Kay L

Bought by

Heffern Paul M

Purchase Details

Closed on

Aug 11, 2000

Sold by

Ohio Limited Par Shiff Family Limited Partn E and Shiff Jay

Bought by

Fisher Robert R and Fisher Kay L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Interest Rate

8.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jat Llc | $180,000 | Liberty Title | |

| Green Properties Llc | $75,000 | -- | |

| Heffern Paul M | -- | None Available | |

| Heffern Paul M | -- | None Available | |

| Heffern Paul M | $88,600 | -- | |

| Fisher Robert R | $88,500 | Midland Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Green Properties Llc | -- | |

| Previous Owner | Fisher Robert R | $63,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,224 | $36,575 | $4,480 | $32,095 |

| 2023 | $2,131 | $27,195 | $3,710 | $23,485 |

| 2022 | $2,127 | $27,195 | $3,710 | $23,485 |

| 2021 | $2,178 | $27,195 | $3,710 | $23,485 |

| 2020 | $2,076 | $22,925 | $2,940 | $19,985 |

| 2019 | $2,004 | $22,925 | $2,940 | $19,985 |

| 2018 | $1,883 | $22,925 | $2,940 | $19,985 |

| 2017 | $2,114 | $22,085 | $3,220 | $18,865 |

| 2016 | $2,075 | $63,100 | $9,200 | $53,900 |

| 2015 | $1,962 | $63,100 | $9,200 | $53,900 |

| 2014 | $1,892 | $21,880 | $3,190 | $18,690 |

| 2013 | $1,892 | $21,880 | $3,190 | $18,690 |

Source: Public Records

Map

Nearby Homes

- 5212 Regency Dr

- 2949 Secretariat Rd

- 2720 Derby Rd

- 5607 Dennison Rd

- 5204 W Bancroft St

- 2523 Briarwood Ln

- 2812 Quail Run Dr

- 5743 Candlestick Ct E

- 5331 Fleet Rd

- 3131 Van Fleet Pkwy

- 2113 Broadstone Rd

- 4545 Indian Rd

- 2206 Farm View Ct Unit 2206

- 405 N Holland Sylvania Rd

- 3555 Hill River Dr

- 1925 Olimphia Rd

- 3439 Shakespeare Ln

- 3207 Waldmar Rd

- 2026 Pautucket Rd

- 1930 Birkdale Rd

- 5204 Regency Dr Unit D

- 5204 Regency Dr Unit C

- 5204 Regency Dr Unit B

- 5204 Regency Dr Unit A

- 5204 Regency Dr

- 5204 Regency Dr Unit 5204-B

- 5212 Regency Dr Unit 5212-D

- 5212 Regency Dr Unit D

- 5212 Regency Dr Unit C

- 5212 Regency Dr Unit B

- 5212 Regency Dr Unit 5212-C

- 5222 Regency Dr

- 5156 Regency Dr Unit 4

- 5156 Regency Dr Unit 3

- 5156 Regency Dr Unit 2

- 5156 Regency Dr Unit 1

- 5156 Regency Dr

- 2624 Amara Dr

- 2625 Valley Brook Dr

- 5230 Regency Dr Unit 4