5225 Jean Rd Unit 401 Lake Oswego, OR 97035

Bryant NeighborhoodEstimated Value: $360,000 - $437,000

2

Beds

2

Baths

1,080

Sq Ft

$362/Sq Ft

Est. Value

About This Home

This home is located at 5225 Jean Rd Unit 401, Lake Oswego, OR 97035 and is currently estimated at $390,921, approximately $361 per square foot. 5225 Jean Rd Unit 401 is a home located in Clackamas County with nearby schools including River Grove Elementary School, Lakeridge Middle School, and Lakeridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2019

Sold by

Israelov Russell

Bought by

Morse Stephen E and Morse Linda M

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2013

Sold by

Oconnor Richard D

Bought by

Israelov Russell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,180

Interest Rate

4.46%

Mortgage Type

Commercial

Purchase Details

Closed on

Dec 19, 2000

Sold by

Brown Michael and Brown Judy M

Bought by

Oconnor Richard D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,800

Interest Rate

7.81%

Mortgage Type

Commercial

Purchase Details

Closed on

Jul 6, 1998

Sold by

Oswego Condominium Corp

Bought by

Brown Michael and Brown Judy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,950

Interest Rate

7.03%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morse Stephen E | $277,000 | Lawyers Title | |

| Israelov Russell | $144,400 | Chicago Title Co Oregon | |

| Oconnor Richard D | $136,000 | Transnation Title Insurance | |

| Brown Michael | $144,170 | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Israelov Russell | $137,180 | |

| Previous Owner | Oconnor Richard D | $108,800 | |

| Previous Owner | Brown Michael | $136,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,487 | $181,550 | -- | -- |

| 2024 | $3,394 | $176,263 | -- | -- |

| 2023 | $3,394 | $171,130 | $0 | $0 |

| 2022 | $3,196 | $166,146 | $0 | $0 |

| 2021 | $2,952 | $161,307 | $0 | $0 |

| 2020 | $2,878 | $156,609 | $0 | $0 |

| 2019 | $2,807 | $152,048 | $0 | $0 |

| 2018 | $2,669 | $147,619 | $0 | $0 |

| 2017 | $2,576 | $143,319 | $0 | $0 |

| 2016 | $2,329 | $139,145 | $0 | $0 |

| 2015 | $2,161 | $135,092 | $0 | $0 |

| 2014 | $1,996 | $126,350 | $0 | $0 |

Source: Public Records

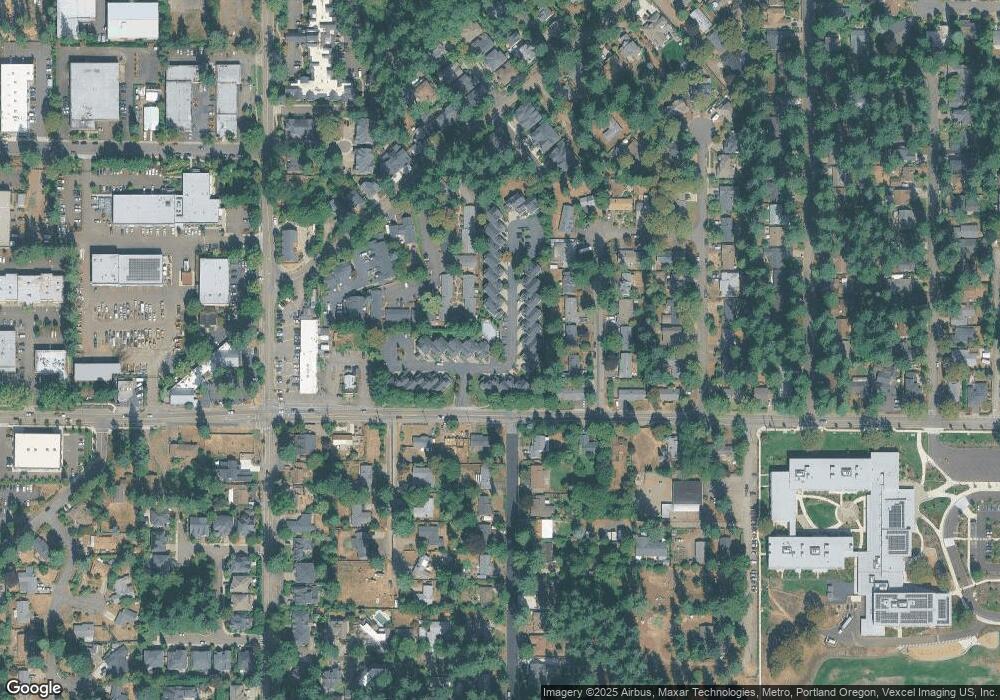

Map

Nearby Homes

- 5225 Jean Rd Unit 307

- 5513 Rachel Ln

- 5650 Lakeview Blvd

- 17239 Rebecca Ln

- 17401 Hill Way

- 4971 Lakeview Blvd

- 5328 Lower Dr

- 5189 Rosewood St

- 18541 Waxwing Way

- 5966 Frost Ln

- 18581 Timbergrove Ct

- 4280 Bernard St

- 16960 Denney Ct

- 18434 Sandpiper Cir

- 4640 Lower Dr

- 4224 Haven St

- 4241 Cobb Way

- 17810 Sarah Hill Ln

- 6244 Frost Ln

- 6050 Fernbrook St

- 5225 Jean Rd Unit 507

- 5225 Jean Rd Unit 603

- 5225 Jean Rd Unit 311

- 5225 Jean Rd Unit 512

- 5225 Jean Rd Unit 510

- 5225 Jean Rd Unit 314

- 5225 Jean Rd Unit 105

- 5225 Jean Rd Unit 404

- 5225 Jean Rd Unit 602

- 5225 Jean Rd Unit 313

- 5225 Jean Rd Unit 107

- 5225 Jean Rd Unit 403

- 5225 Jean Rd Unit 306

- 5225 Jean Rd Unit 504

- 5225 Jean Rd Unit 511

- 5225 Jean Rd Unit 104

- 5225 Jean Rd Unit 505

- 5225 Jean Rd Unit 310

- 5225 Jean Rd Unit 503

- 5225 Jean Rd Unit 203