5225 Las Cruces Dr Las Vegas, NV 89130

North Cheyenne NeighborhoodEstimated Value: $332,000 - $373,000

2

Beds

2

Baths

1,571

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 5225 Las Cruces Dr, Las Vegas, NV 89130 and is currently estimated at $351,822, approximately $223 per square foot. 5225 Las Cruces Dr is a home located in Clark County with nearby schools including Ernest May Elementary School, Theron L Swainston Middle School, and Shadow Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 5, 2010

Sold by

Weaver Kent L and Weaver Donna J

Bought by

Weaver Kent Lee and Weaver Donna Jean

Current Estimated Value

Purchase Details

Closed on

Apr 27, 2001

Sold by

Weaver Kent L and Weaver Donna J

Bought by

Weaver Kent L and Weaver Donna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,350

Interest Rate

6.92%

Purchase Details

Closed on

Apr 6, 1995

Sold by

Mazzola Rose A and Mazzola John

Bought by

Weaver Kent L and Weaver Donna Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

8.32%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weaver Kent Lee | -- | None Available | |

| Weaver Kent L | -- | Fidelity National Title | |

| Weaver Kent L | $111,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Weaver Kent L | $126,350 | |

| Previous Owner | Weaver Kent L | $88,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,237 | $70,421 | $26,460 | $43,961 |

| 2024 | $1,201 | $70,421 | $26,460 | $43,961 |

| 2023 | $1,201 | $64,874 | $23,888 | $40,986 |

| 2022 | $1,166 | $61,292 | $22,050 | $39,242 |

| 2021 | $1,132 | $51,645 | $19,250 | $32,395 |

| 2020 | $1,096 | $53,302 | $19,250 | $34,052 |

| 2019 | $1,064 | $50,182 | $16,100 | $34,082 |

| 2018 | $1,033 | $46,230 | $13,300 | $32,930 |

| 2017 | $1,511 | $45,724 | $12,950 | $32,774 |

| 2016 | $980 | $42,892 | $9,100 | $33,792 |

| 2015 | $977 | $35,683 | $6,650 | $29,033 |

| 2014 | $948 | $27,684 | $5,250 | $22,434 |

Source: Public Records

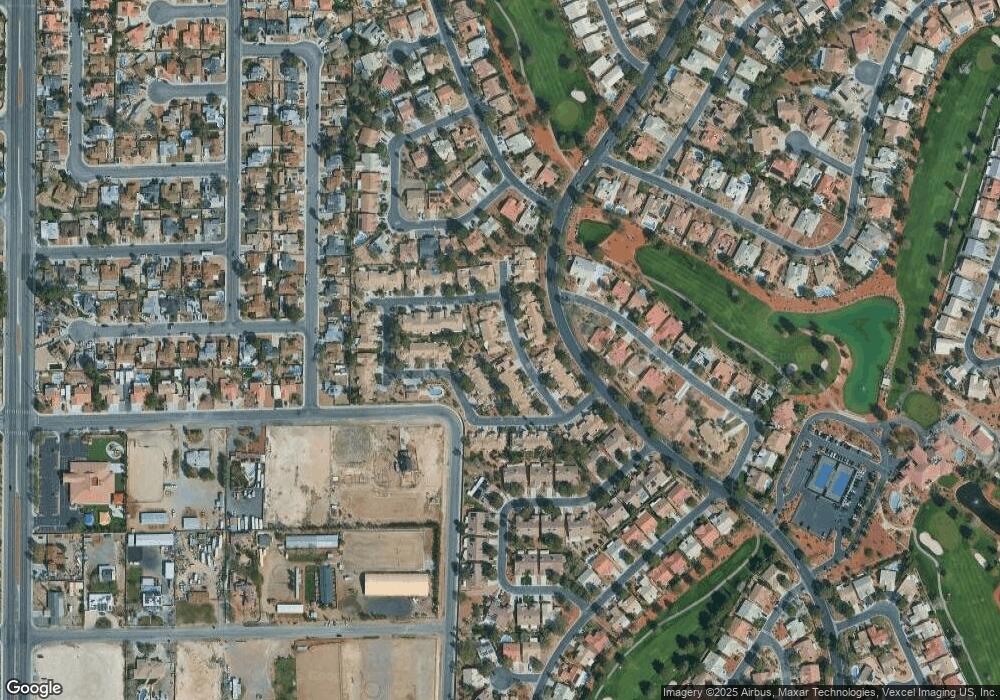

Map

Nearby Homes

- 5229 Shady Grove Ln

- 5600 Segolilly Cir

- 5876 Filmore Ave

- 5876 Tippin Dr

- 5620 N Jones Blvd

- 5408 Fountain Palm St

- 5605 Bay Shore Cir

- 5004 Rancho Bernardo Way

- 5204 Rim View Ln

- 5877 April Ln

- 5260 N Jones Blvd

- 5433 Honey Mesquite Ln

- 5505 Excelsior Springs Ln Unit 1

- 4905 Ocean Shores Way

- 6112 Browning Way

- 5513 Excelsior Springs Ln

- 5333 Rim View Ln

- 6113 Desert Haven Rd

- 5416 Lochmor Ave

- 5133 Burr Oak Dr

- 5229 Las Cruces Dr

- 5221 Las Cruces Dr

- 5233 Las Cruces Dr

- 5656 Divot Place Unit 1

- 5217 Las Cruces Dr

- 5652 Divot Place

- 5237 Las Cruces Dr

- 5648 Divot Place

- 5213 Las Cruces Dr

- 5224 Las Cruces Dr

- 5220 Las Cruces Dr

- 5228 Las Cruces Dr

- 5660 Divot Place

- 5644 Divot Place

- 5232 Las Cruces Dr

- 5209 Las Cruces Dr

- 5713 Colwood Ln

- 5236 Las Cruces Dr

- 5212 Las Cruces Dr

- 5664 Divot Place