5241 W Hattery Owens Rd Deer Park, WA 99006

Estimated Value: $487,335 - $512,000

3

Beds

2

Baths

2,407

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 5241 W Hattery Owens Rd, Deer Park, WA 99006 and is currently estimated at $499,668, approximately $207 per square foot. 5241 W Hattery Owens Rd is a home located in Stevens County with nearby schools including Deer Park Home Link Program, Arcadia Elementary School, and Deer Park Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2022

Sold by

Underwood Tina Harris and Underwood Lance Douglas

Bought by

Freeman Steven D and Freeman Lianna C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,000

Outstanding Balance

$346,749

Interest Rate

5.09%

Mortgage Type

VA

Estimated Equity

$152,919

Purchase Details

Closed on

Jul 16, 2021

Sold by

Fields Gary L and Fields Jane

Bought by

Underwood Tina Harris and Underwood Lance Douglas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$336,000

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 16, 2018

Sold by

Gherard James J and Gherard Patricia J

Bought by

Fields Gary L and Fields Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,169

Interest Rate

4.87%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Freeman Steven D | -- | Stevens County Title | |

| Underwood Tina Harris | $420,000 | Stevens County Title Co | |

| Fields Gary L | $239,438 | Stevens County Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Freeman Steven D | $365,000 | |

| Previous Owner | Underwood Tina Harris | $336,000 | |

| Previous Owner | Fields Gary L | $219,169 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,521 | $381,600 | $28,348 | $353,252 |

| 2023 | $3,505 | $427,619 | $74,080 | $353,539 |

| 2022 | $2,228 | $258,507 | $24,834 | $233,673 |

| 2021 | $2,188 | $185,175 | $24,834 | $160,341 |

| 2020 | $1,714 | $185,175 | $24,834 | $160,341 |

| 2019 | $1,350 | $141,911 | $28,323 | $113,588 |

| 2018 | $1,431 | $107,288 | $8,367 | $98,921 |

| 2017 | $1,351 | $103,927 | $5,083 | $98,844 |

| 2016 | $1,463 | $103,914 | $5,070 | $98,844 |

| 2015 | $1,464 | $109,640 | $5,045 | $104,595 |

| 2013 | -- | $109,634 | $5,039 | $104,595 |

Source: Public Records

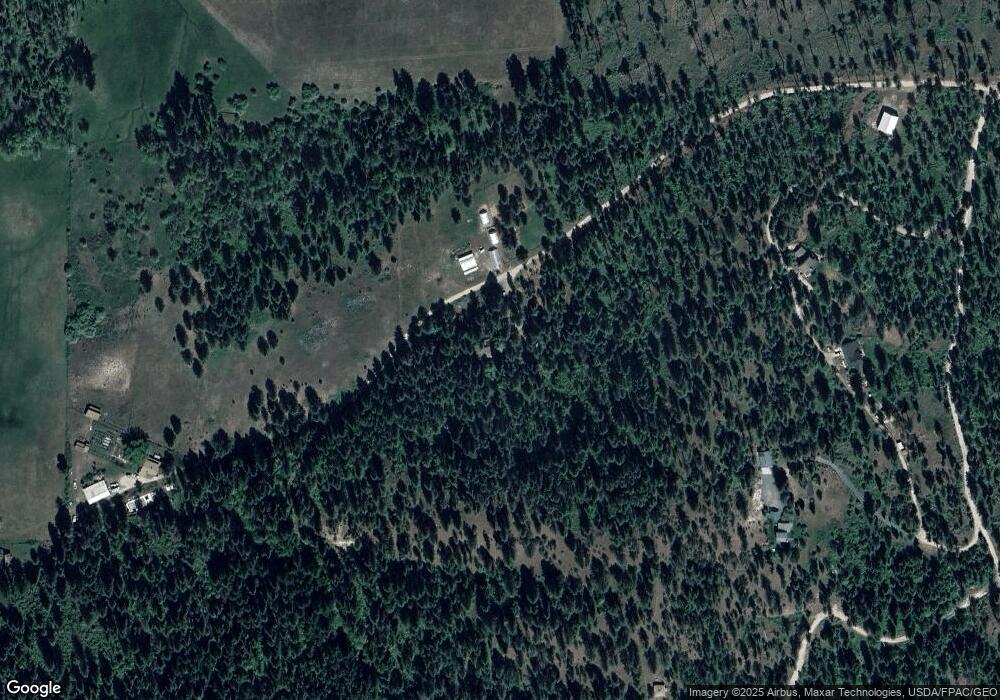

Map

Nearby Homes

- 5241 N F Hattery-Owens Rd

- 5161 W Mcdougal Rd

- XXXX Hattery-Owens Rd

- 52XX Lot 8 S Swenson Rd

- 52XX Lot 7 S Swenson Rd

- 52XX LOT 5 S Swenson Rd

- 52XX LOT 1 S Swenson Rd

- 5074 Casberg-Burroughs

- 5166 Hattery-Owens Rd Unit Parcel A

- 49XX S Swenson Rd

- 50XX W Casberg Burroughs Rd

- 4883 Bittrich-Antler Rd

- 6650 Blueridge Way

- 6671 Blueridge Way

- 0 Bittrich-Antler Rd

- 46XX Bittrich-Antler Rd

- 5043 Glen Grove-Staley Rd Unit B

- 5043 B Glen Grove-Staley Rd

- 4988 Wallbridge Rd

- xxx Casberg-Burroughs

- 5241 W Hattery-Owens Rd

- 5241 W Hattery Owens Rd

- 5241 W Hattery Owens Rd

- 5241 W Hattery Owens Rd

- 5241 W Hattery Owens Rd Unit E

- 5241A W Hattery Owens Rd

- 5241B W Hattery Owens Rd

- 5241F W Hattery-Owens Rd

- 5241F W Hattery Owens Rd

- 5239 W Hattery Owens Rd

- 5231 W Hattery Owens Rd

- 5208 B Hattery Owens Rd

- 5254 W Hattery Owens Rd

- 5278 W Hattery Owens Rd

- 5240 Quail Ridge Way

- 5226 W Hattery Owens Rd

- 5220 Quail Ridge Way

- 5281 W Hattery Owens Rd

- 5260 W Hattery Owens Rd

- 5258 Quail Ridge Way