526 S 40th Ave Unit D212 West Richland, WA 99353

Estimated Value: $218,000 - $227,000

2

Beds

1

Bath

896

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 526 S 40th Ave Unit D212, West Richland, WA 99353 and is currently estimated at $223,109, approximately $249 per square foot. 526 S 40th Ave Unit D212 is a home located in Benton County with nearby schools including Tapteal Elementary School, Hanford High School, and Liberty Christian School of the Tri-Cities.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2019

Sold by

Marshall Earl

Bought by

Johnson Walter S and Johnson Carol L

Current Estimated Value

Purchase Details

Closed on

Sep 1, 2017

Sold by

Fritz Luke R and Saueressig Jessica L

Bought by

Marshall Earl

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,000

Interest Rate

3.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 20, 2010

Sold by

Westview Gardens Llc

Bought by

Fritz Luke R and Saueressig Jessica L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,090

Interest Rate

5.21%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Walter S | $130,000 | Columbia Title Company | |

| Marshall Earl | $120,993 | Columbia Title Company | |

| Fritz Luke R | $99,900 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Marshall Earl | $78,000 | |

| Previous Owner | Fritz Luke R | $98,090 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,333 | $239,800 | -- | $239,800 |

| 2023 | $2,333 | $207,100 | $0 | $207,100 |

| 2022 | $1,763 | $152,600 | $0 | $152,600 |

| 2021 | $1,618 | $136,250 | $0 | $136,250 |

| 2020 | $1,677 | $119,900 | $0 | $119,900 |

| 2019 | $1,200 | $119,900 | $0 | $119,900 |

| 2018 | $1,372 | $90,820 | $0 | $90,820 |

| 2017 | $1,227 | $90,820 | $0 | $90,820 |

| 2016 | $1,167 | $90,820 | $0 | $90,820 |

| 2015 | $1,289 | $90,820 | $0 | $90,820 |

| 2014 | -- | $90,820 | $0 | $90,820 |

| 2013 | -- | $90,820 | $0 | $90,820 |

Source: Public Records

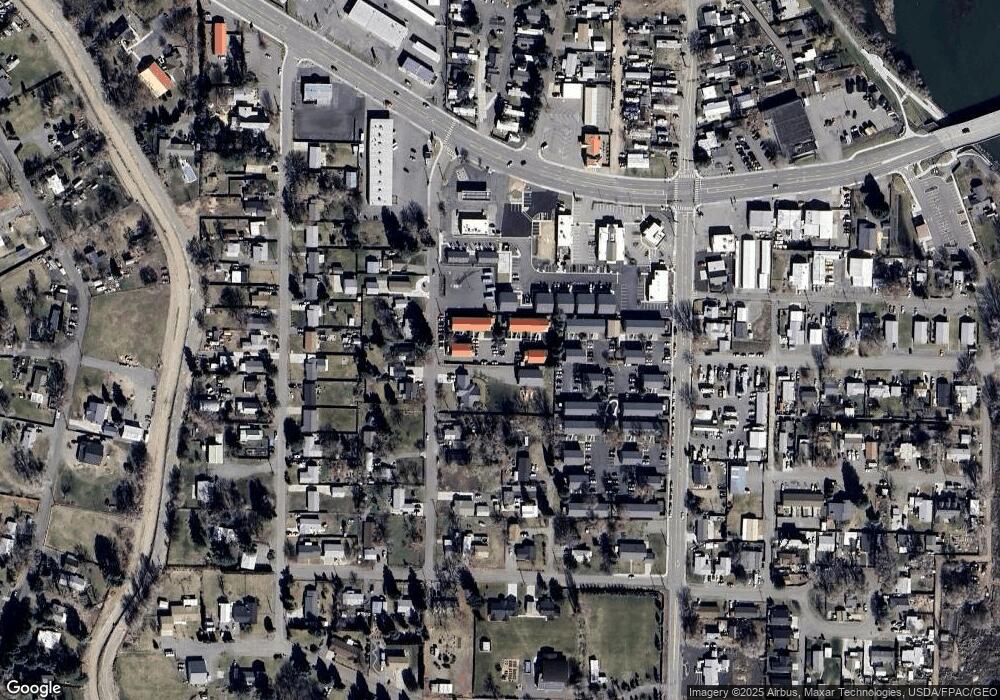

Map

Nearby Homes

- 526 S 40th Ave Unit A203

- 526 S 40th Ave Unit A102

- 526 S 40th Ave Unit D210

- 393 S 41st Ave

- 8 Royal Crest Loop

- 212 S 39th Ave

- 3706 Grant Loop

- 3738 Grant Loop

- 4417 King Dr

- 4019 Queen St

- 3721 Cherry Ct

- 3710 Orchard St

- 3560 Orchard St

- 3905 Orchard St

- 1336 S 50th Ave

- 3395 Nicholas Ln

- 1334 Kalani Ct

- 1313 Kalani Ct

- 1374 Kalani Ct

- 1325 Kalani Ct

- 526 S 40th Ave Unit IE

- 526 S 40th Ave

- 526 S 40th Ave Unit C207

- 526 S 40th Ave Unit B205

- 526 S 40th Ave Unit A201

- 526 S 40th Ave Unit D209

- 526 S 40th Ave Unit A104

- 526 S 40th Ave Unit A103

- 526 S 40th Ave Unit A101

- 526 S 40th Ave Unit D211

- 526 S 40th Ave Unit C208

- 526 S 40th Ave Unit B206

- 526 S 40th Ave Unit A204

- 526 S 40th Ave Unit D112

- 526 S 40th Ave Unit D111

- 526 S 40th Ave Unit D110

- 526 S 40th Ave Unit C108

- 526 S 40th Ave Unit C107

- 526 S 40th Ave Unit B105

- 526 S 40th D-212