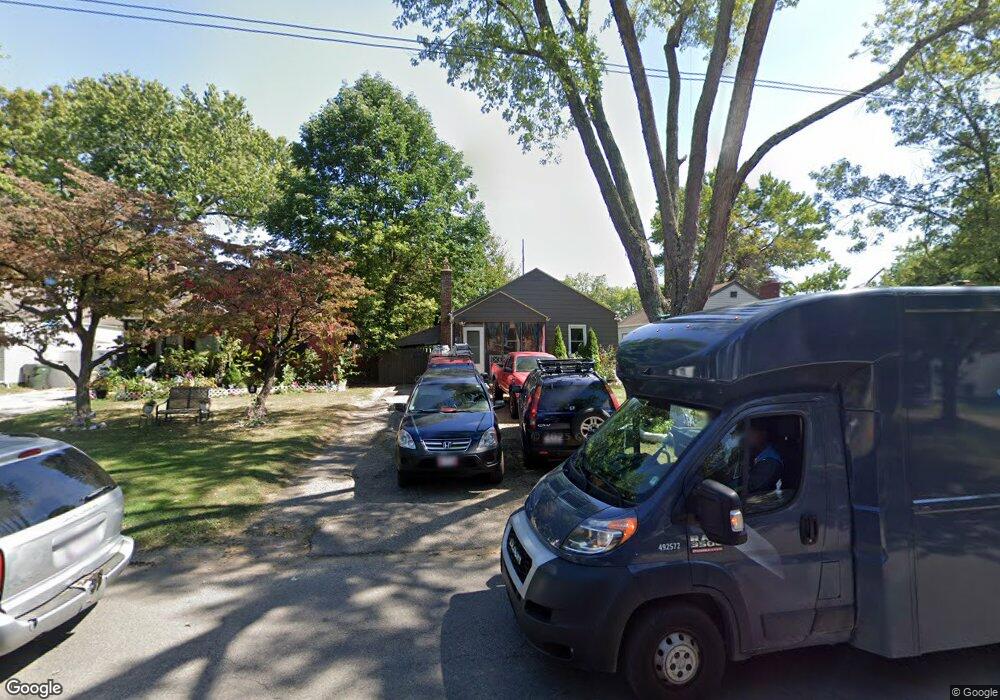

526 S Napoleon Ave Columbus, OH 43213

Eastmoor NeighborhoodEstimated Value: $125,668 - $148,000

2

Beds

1

Bath

720

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 526 S Napoleon Ave, Columbus, OH 43213 and is currently estimated at $135,917, approximately $188 per square foot. 526 S Napoleon Ave is a home located in Franklin County with nearby schools including Fairmoor Elementary School, Johnson Park Middle School, and Walnut Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2019

Sold by

Balalovski Andrew A

Bought by

Balalovski Philip A

Current Estimated Value

Purchase Details

Closed on

Mar 13, 2019

Sold by

Rodriguez German and Fifth Third Mortgage Company

Bought by

Balalovski Andrew A

Purchase Details

Closed on

Feb 15, 2008

Sold by

Elizondo Shawn D and Elizondo Valerie

Bought by

Rodriguez German

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,000

Interest Rate

6.11%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 22, 2007

Sold by

The Cit Group/Consumer Finance Inc

Bought by

Elizondo Shawn D

Purchase Details

Closed on

Dec 18, 2006

Sold by

Byrne Charles R and Case #06Cve03 4464

Bought by

The Cit Group/Consumer Finance Inc

Purchase Details

Closed on

Sep 20, 1990

Bought by

Byrne Charles R and Byrne Carla R

Purchase Details

Closed on

Jul 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Balalovski Philip A | $31,100 | Crown Search Services Box | |

| Balalovski Andrew A | $30,100 | None Available | |

| Rodriguez German | $48,000 | Arrow Title | |

| Elizondo Shawn D | $28,000 | Trident | |

| The Cit Group/Consumer Finance Inc | $38,000 | Ohio Title | |

| Byrne Charles R | $41,500 | -- | |

| -- | $27,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rodriguez German | $48,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,007 | $43,790 | $11,660 | $32,130 |

| 2023 | $1,982 | $43,785 | $11,655 | $32,130 |

| 2022 | $1,433 | $26,960 | $5,080 | $21,880 |

| 2021 | $1,435 | $26,960 | $5,080 | $21,880 |

| 2020 | $1,519 | $26,960 | $5,080 | $21,880 |

| 2019 | $1,459 | $22,270 | $4,240 | $18,030 |

| 2018 | $1,220 | $22,270 | $4,240 | $18,030 |

| 2017 | $1,350 | $22,270 | $4,240 | $18,030 |

| 2016 | $1,204 | $18,170 | $3,780 | $14,390 |

| 2015 | $1,093 | $18,170 | $3,780 | $14,390 |

| 2014 | $1,095 | $18,170 | $3,780 | $14,390 |

| 2013 | $569 | $19,145 | $3,990 | $15,155 |

Source: Public Records

Map

Nearby Homes

- 647 S Napoleon Ave

- 646 S Weyant Ave

- 526 Collingwood Ave

- 733 S Napoleon Ave

- 708 S Waverly St

- 711 S Waverly St

- 635 Elizabeth Ave

- 201 S Weyant Ave

- 430 S James Rd

- 320 Collingwood Ave

- 178 S Weyant Ave

- 622 S Ashburton Rd

- 3160 Fair Ave

- 3814 Elbern Ave

- 836 S Weyant Ave

- 277 S James Rd

- 247 S James Rd

- 871 Ruby Ave

- 3811 Brentwood Ct

- 892 Ruby Ave

- 530 S Napoleon Ave

- 520 S Napoleon Ave

- 536 S Napoleon Ave

- 514 S Napoleon Ave

- 542 S Napoleon Ave

- 510 S Napoleon Ave

- 531 Barnett Rd Unit 533

- 531-533 Barnett Rd

- 537 Barnett Rd Unit 539

- 541 Barnett Rd Unit 543

- 523 Barnett Rd

- 544 S Napoleon Ave

- 504 S Napoleon Ave

- 509 Barnett Rd

- 545-551 Barnett Rd

- 545 Barnett Rd

- 517 S Napoleon Ave

- 527 S Napoleon Ave

- 509 S Napoleon Ave

- 500 S Napoleon Ave