52721 Hunters Pointe Ct Unit 35 Macomb, MI 48042

Estimated Value: $276,000 - $363,000

2

Beds

2

Baths

1,573

Sq Ft

$208/Sq Ft

Est. Value

About This Home

This home is located at 52721 Hunters Pointe Ct Unit 35, Macomb, MI 48042 and is currently estimated at $327,250, approximately $208 per square foot. 52721 Hunters Pointe Ct Unit 35 is a home located in Macomb County with nearby schools including Beck Centennial Elementary School, Shelby Junior High School, and Eisenhower High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2017

Sold by

Hopkins Judith K

Bought by

Hopkins Judith K and Shaffer Kristie

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2010

Sold by

Stefango John E and Stefango Paula Watts

Bought by

Hopkins Judith K

Purchase Details

Closed on

Mar 2, 2009

Sold by

Cesaro Joseph

Bought by

Stefango John E and Stefango Paula Watts

Purchase Details

Closed on

Aug 10, 2007

Sold by

Hubert David and Hubert Carrie A

Bought by

Standard Federal Bank

Purchase Details

Closed on

Jan 5, 2007

Sold by

Hubert David and Hubert Carrie A

Bought by

Sterling Bank & Trust Equity

Purchase Details

Closed on

Feb 10, 1997

Sold by

J D Chase Dev Inc

Bought by

Hubert D and Hubert C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hopkins Judith K | -- | None Available | |

| Hopkins Judith K | $149,900 | Sterling Title Agency | |

| Stefango John E | $125,000 | Sterling Title Agency | |

| Stefango John E | -- | Title Connect Llc | |

| Standard Federal Bank | $147,441 | None Available | |

| Sterling Bank & Trust Equity | $10,714 | None Available | |

| Hubert D | $158,680 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,713 | $164,900 | $0 | $0 |

| 2024 | $17 | $158,100 | $0 | $0 |

| 2023 | $1,579 | $127,800 | $0 | $0 |

| 2022 | $2,281 | $124,500 | $0 | $0 |

| 2021 | $2,221 | $121,600 | $0 | $0 |

| 2020 | $1,454 | $115,200 | $0 | $0 |

| 2019 | $2,037 | $104,100 | $0 | $0 |

| 2018 | $2,008 | $95,100 | $0 | $0 |

| 2017 | $1,981 | $88,890 | $18,500 | $70,390 |

| 2016 | $1,864 | $88,930 | $0 | $0 |

| 2015 | $1,841 | $85,180 | $0 | $0 |

| 2014 | $1,841 | $72,940 | $12,500 | $60,440 |

| 2013 | -- | $72,940 | $0 | $0 |

Source: Public Records

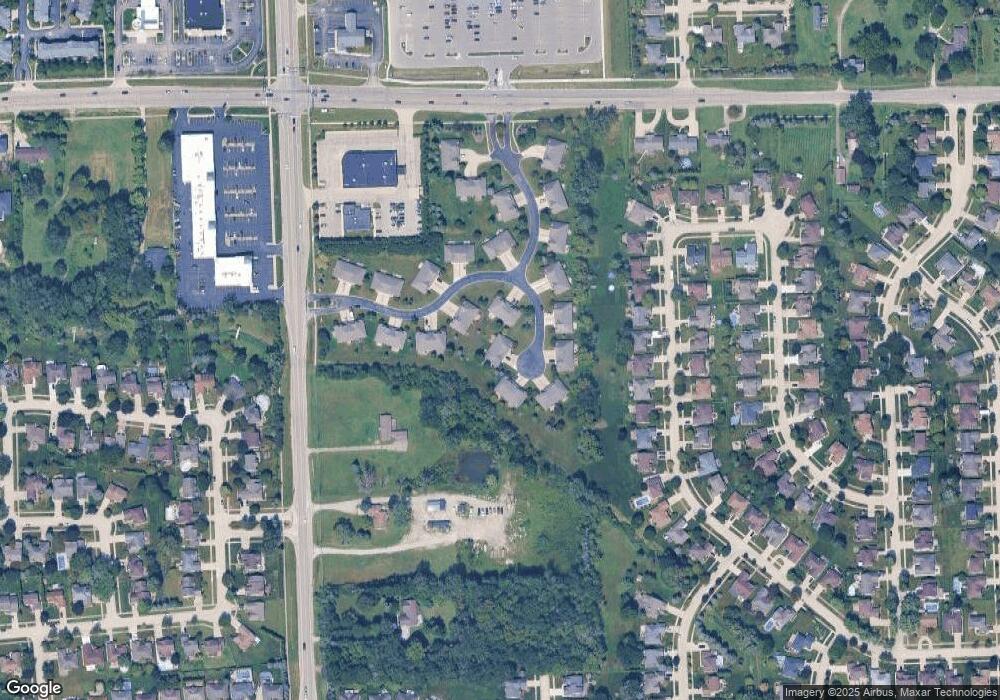

Map

Nearby Homes

- 52531 Lasalle Dr

- 53456 Fitzgerald Dr

- 16040 Violet Dr

- 52522 Charing Way

- 53027 Gregory Dr

- 14345 24 Mile Rd

- 53428 Gregory Dr

- 16655 Pearlcreek Ct Unit 31

- 16738 Fieldstone Ridge Unit 11

- 16448 Trailway Dr

- 52163 Heatherstone Ave

- 16767 Cobblestone West Blvd

- 52192 Southview Ridge

- 13874 Grandeur Ave

- 54680 Chickasaw Dr

- 52458 Westfield Dr

- 13848 Woodsett Ct

- 13676 Timberwyck Dr

- 54676 Carnation Dr

- 17404 Timber Dr

- 52697 Hunters Pointe Ct

- 52721 Hunters Pte Ct

- 52721 Hunters Pte Ct Unit 35

- 52649 Hunters Pte Unit 38

- 52649 Hunters Pte

- 52793 Hunters Pointe Ct

- 52673 Hunters Pointe Ct Unit 37

- 52649 Hunters Pointe Ct

- 52673 Hunters Pointe Ct

- 52673 Hunters Pointe Ct Unit 460 37

- 15298 E Hunters Pointe Dr Unit 32

- 15286 E Hunters Pointe Dr

- 52774 Hunters Pte Crt

- 52649 Hunters Pte Crt Unit 16, 38

- 52726 Hunters Pointe Ct Unit 42

- 15229 E Hunters Pointe Dr Unit 22

- 52894 S Hunters Pointe Dr Unit 4

- 52678 Hunters Pointe Ct

- 52654 Hunters Pointe Ct

- 52678 Hunters Pointe Ct Unit 40