529 3rd St NE Alabaster, AL 35007

Estimated Value: $306,000 - $322,000

--

Bed

1

Bath

2,212

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 529 3rd St NE, Alabaster, AL 35007 and is currently estimated at $315,402, approximately $142 per square foot. 529 3rd St NE is a home located in Shelby County with nearby schools including Thompson Intermediate School, Thompson Middle School, and Thompson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2010

Sold by

Wood James D

Bought by

Seavers Velvet L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,046

Outstanding Balance

$100,637

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$214,765

Purchase Details

Closed on

Aug 6, 2001

Sold by

Pennington Michelle L

Bought by

Wood James D

Purchase Details

Closed on

Sep 27, 2000

Sold by

Tomme John L

Bought by

Wood James D and Pennington Michelle L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,702

Interest Rate

7.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Seavers Velvet L | $169,000 | None Available | |

| Wood James D | -- | -- | |

| Wood James D | $97,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Seavers Velvet L | $148,046 | |

| Previous Owner | Wood James D | $96,702 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,503 | $27,840 | $0 | $0 |

| 2023 | $1,334 | $25,460 | $0 | $0 |

| 2022 | $1,280 | $24,460 | $0 | $0 |

| 2021 | $1,121 | $21,520 | $0 | $0 |

| 2020 | $1,054 | $20,280 | $0 | $0 |

| 2019 | $969 | $18,700 | $0 | $0 |

| 2017 | $859 | $16,660 | $0 | $0 |

| 2015 | $819 | $15,920 | $0 | $0 |

| 2014 | $799 | $15,560 | $0 | $0 |

Source: Public Records

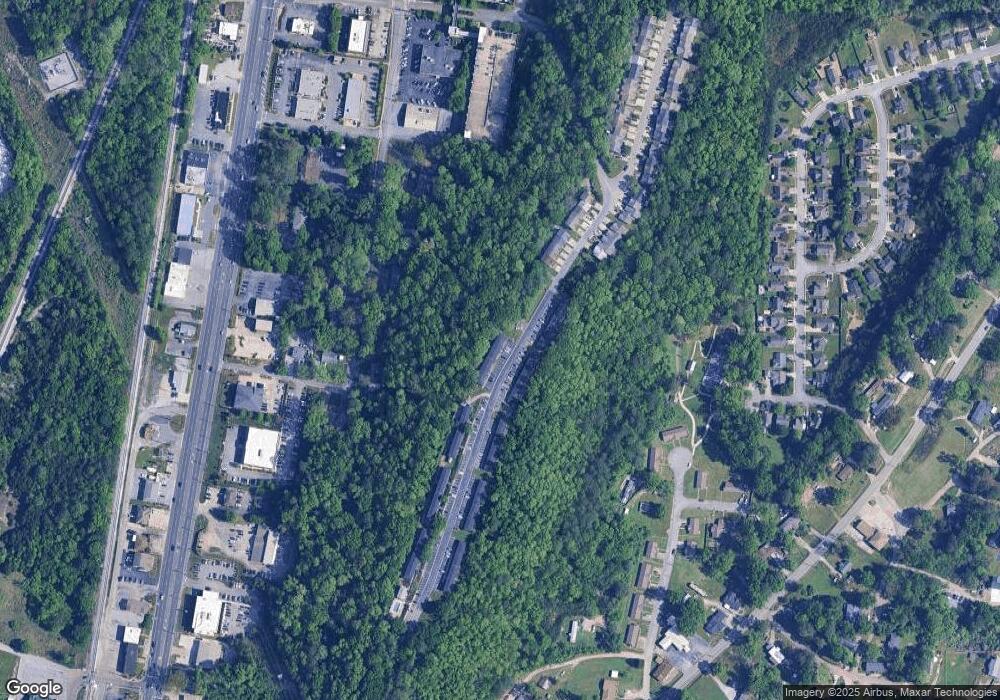

Map

Nearby Homes

- 718 3rd St NE

- 135 2nd Ave NE

- 108 Hickory Hills Dr

- 0 Simmsville Rd Unit 1326397

- 1314 1st St N

- 1324 Willow Creek Place

- 1381 1st St N

- 95 9th St NW

- 0002 Highway 68

- 608 Treymoor Lake Cir

- 104 Brent Way

- 644 Treymoor Lake Cir

- 955 3rd Ave NW

- 259 Warwick Ln

- 732 4th St SW

- 205 Willow Point Cir

- 122 High Ridge Trace

- 902 6th Ave SW

- 1923 Highway 68

- 000 9th St NW