5354 Shannon Ln Unit 71 Columbus, OH 43235

The Gables NeighborhoodEstimated Value: $240,000 - $246,644

2

Beds

2

Baths

1,296

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 5354 Shannon Ln Unit 71, Columbus, OH 43235 and is currently estimated at $243,161, approximately $187 per square foot. 5354 Shannon Ln Unit 71 is a home located in Franklin County with nearby schools including Daniel Wright Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2001

Sold by

Imber Betty L

Bought by

Kessler Stephen G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$27,839

Interest Rate

6.95%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$215,322

Purchase Details

Closed on

Mar 12, 2001

Sold by

Pickney Nicole M

Bought by

Imber Betty L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$27,839

Interest Rate

6.95%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$215,322

Purchase Details

Closed on

Oct 8, 1996

Sold by

Poston Franklin D

Bought by

Imber Betty L and Imber Nicole

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kessler Stephen G | $95,000 | Chicago Title | |

| Imber Betty L | $90,000 | -- | |

| Pickney Nicole M | -- | -- | |

| Imber Betty L | $73,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kessler Stephen G | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,444 | $66,750 | $17,500 | $49,250 |

| 2023 | $3,433 | $66,745 | $17,500 | $49,245 |

| 2022 | $2,753 | $51,660 | $6,370 | $45,290 |

| 2021 | $2,798 | $51,660 | $6,370 | $45,290 |

| 2020 | $2,781 | $51,660 | $6,370 | $45,290 |

| 2019 | $2,268 | $39,730 | $4,900 | $34,830 |

| 2018 | $1,867 | $39,730 | $4,900 | $34,830 |

| 2017 | $2,094 | $39,730 | $4,900 | $34,830 |

| 2016 | $1,449 | $28,880 | $5,110 | $23,770 |

| 2015 | $1,458 | $28,880 | $5,110 | $23,770 |

| 2014 | $1,459 | $28,880 | $5,110 | $23,770 |

| 2013 | $741 | $28,875 | $5,110 | $23,765 |

Source: Public Records

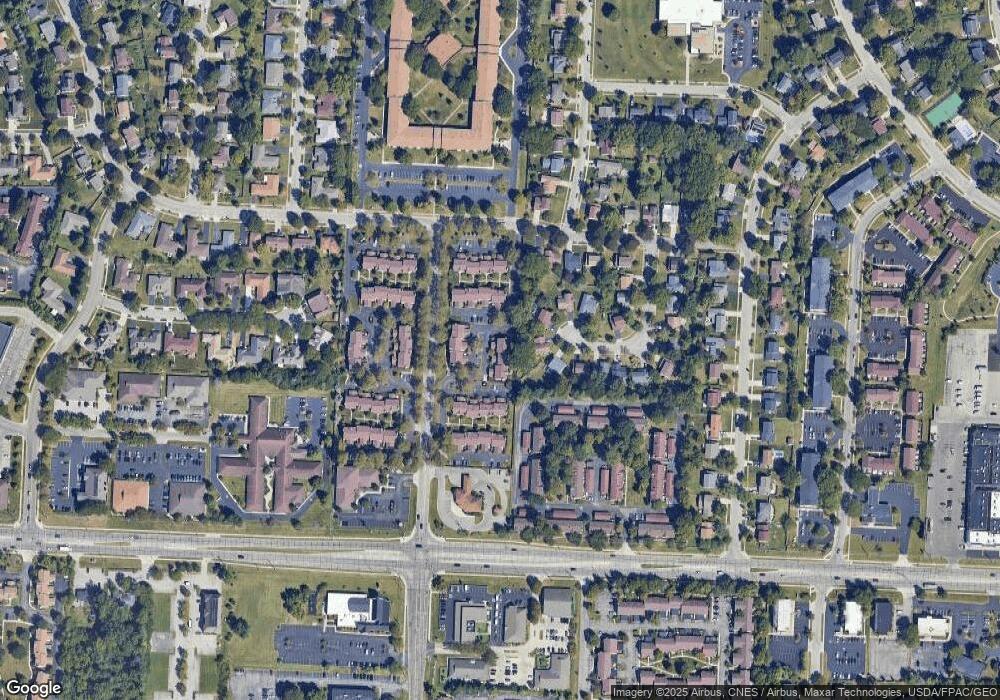

Map

Nearby Homes

- 5111 Schuylkill St

- 1540 Slade Ave Unit 303

- 5111 Portland St

- 1961 Ramble Branch Dr Unit 30

- 1739 Paula Dr Unit 1739

- 5470 Baneberry Ave

- 5268 Captains Ct

- 5363 Godown Rd

- 1558 Denbigh Dr

- 2179 Victoria Park Dr Unit 2179

- 2172 Hedgerow Rd Unit 2172G

- 1865 Willoway Cir N Unit 1865

- 1835 Willoway Cir N

- 2236 Victoria Park Dr Unit 2236

- 1297 Slade Ave

- 4924 Reed Rd Unit B

- 1284 Slade Ave

- 2229 Teardrop Ave Unit 35E

- 5624 Wigmore Dr Unit 50B

- 2265 Teardrop Ave Unit 39C

- 5352 Shannon Ln

- 5356 Shannon Ln Unit 72

- 5350 Shannon Ln

- 5350 Shannon Ln Unit 69

- 5348 Shannon Ln Unit 68

- 5300 Acevedo Ct

- 5346 Shannon Ln Unit 67

- 5305 Acevedo Ct

- 5306 Acevedo Ct

- 5368 Reed Rd

- 5368 Reed Rd Unit 65

- 5366 Reed Rd

- 5364 Reed Rd

- 5359 Shannon Ln Unit 73

- 5360 Reed Rd Unit 61

- 5361 Shannon Ln Unit 74

- 5362 Reed Rd Unit 62

- 5370 Reed Rd

- 5370 Reed Rd Unit 66

- 5363 Shannon Ln