5370 Harvestwood Ln Columbus, OH 43230

Strawberry Farms NeighborhoodEstimated Value: $350,000 - $389,000

3

Beds

2

Baths

1,290

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 5370 Harvestwood Ln, Columbus, OH 43230 and is currently estimated at $369,996, approximately $286 per square foot. 5370 Harvestwood Ln is a home located in Franklin County with nearby schools including Hawthorne Elementary School, Heritage Middle School, and Westerville-North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 30, 2025

Sold by

Spalsbury Keith I

Bought by

Morley Thomas A and Morley Michele Dawn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$419,900

Outstanding Balance

$419,520

Interest Rate

6.5%

Mortgage Type

VA

Estimated Equity

-$49,524

Purchase Details

Closed on

Jul 6, 2018

Sold by

Baker Anna and Baker Dalton

Bought by

Spalsbury Keith I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,500

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 23, 2014

Sold by

Bernard Melissa M

Bought by

Baker Anna and Baker Dalton

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,600

Interest Rate

3.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 31, 1989

Bought by

Bernard Melissa M

Purchase Details

Closed on

Jul 6, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morley Thomas A | $442,000 | Crown Search Box | |

| Spalsbury Keith I | $210,000 | Ohio Real Title | |

| Baker Anna | $180,000 | Quality Choice Title Box | |

| Bernard Melissa M | $72,500 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morley Thomas A | $419,900 | |

| Previous Owner | Spalsbury Keith I | $199,500 | |

| Previous Owner | Baker Anna | $174,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,328 | $104,620 | $41,370 | $63,250 |

| 2023 | $6,239 | $104,615 | $41,370 | $63,245 |

| 2022 | $5,096 | $79,420 | $26,920 | $52,500 |

| 2021 | $5,179 | $79,420 | $26,920 | $52,500 |

| 2020 | $5,147 | $79,420 | $26,920 | $52,500 |

| 2019 | $4,474 | $61,110 | $20,720 | $40,390 |

| 2018 | $3,859 | $52,990 | $20,720 | $32,270 |

| 2017 | $3,582 | $52,990 | $20,720 | $32,270 |

| 2016 | $3,748 | $52,080 | $15,470 | $36,610 |

| 2015 | $3,824 | $52,080 | $15,470 | $36,610 |

| 2014 | $3,775 | $52,080 | $15,470 | $36,610 |

| 2013 | $1,825 | $49,595 | $14,735 | $34,860 |

Source: Public Records

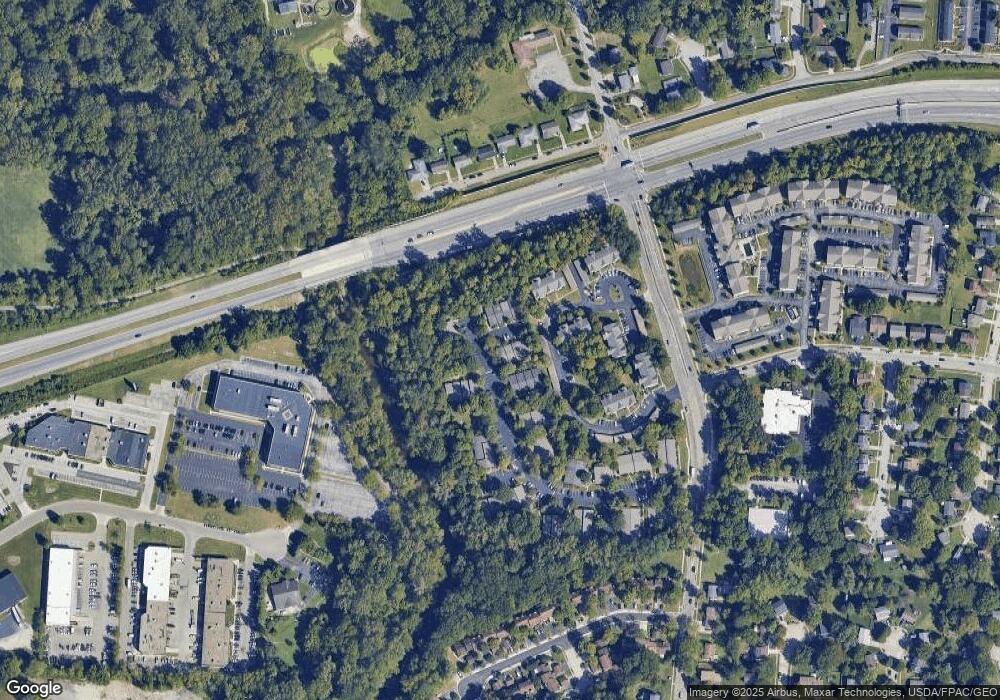

Map

Nearby Homes

- 5080 Strawberry Farms Blvd

- 5047 Killowen Ct

- 5524 Buenos Aires Blvd

- 3544 Madrid Dr

- 6412 Angelica Way

- 5563 Madrid Dr

- 3955 Daffodil Dr

- 4960 Honeysuckle Blvd

- 3564 Stockholm Rd

- 5550 Westerville Crossing Dr

- 3616 Stockholm Rd

- 5042 Magnolia Blossom Blvd

- 3682 Mexico Ave

- 5660 Buenos Aires Blvd

- 3535 Paris Blvd

- 3576 Blendon Bend Way

- 3515 Paris Blvd

- 0 Blendon Bend Way Unit 225037483

- 4881 Pear Tree Ct

- 3474 Paris Blvd

- 5392 Harvestwood Ln

- 5348 Harvestwood Ln

- 5405 Harvestwood Ln

- 5387 Harvestwood Ln

- 5396 Harvestwood Ln

- 5373 Harvestwood Ln

- 5379 Harvestwood Ln

- 5400 Harvestwood Ln

- 5395 Harvestwood Ln

- 5391 Harvestwood Ln

- 5347 Harvestwood Ln

- 5367 Harvestwood Ln

- 5326 Harvestwood Ln

- 5355 Harvestwood Ln

- 5321 Harvestwood Ln

- 5341 Harvestwood Ln

- 5327 Harvestwood Ln

- 5281 Strawberry Farms Blvd

- 5335 Harvestwood Ln

- 5239 Harvestwood Ln