5373 SE Miles Grant Rd Unit C 106 Stuart, FL 34997

Estimated Value: $153,000 - $220,000

1

Bed

2

Baths

903

Sq Ft

$195/Sq Ft

Est. Value

About This Home

This home is located at 5373 SE Miles Grant Rd Unit C 106, Stuart, FL 34997 and is currently estimated at $175,919, approximately $194 per square foot. 5373 SE Miles Grant Rd Unit C 106 is a home located in Martin County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2024

Sold by

Bernard A Ohara Revocable Trust

Bought by

Mccormack Peter

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2019

Sold by

Hara Bernard A O

Bought by

Hara Bernard A O and Hara Linda A O

Purchase Details

Closed on

Oct 31, 2019

Sold by

Fortescue James P and Estate Of Kathleen Fortescue K

Bought by

Hara Bernard A O

Purchase Details

Closed on

Feb 11, 2009

Sold by

Aurora Loan Services Llc

Bought by

Fortescue Kavasansky Kathleen

Purchase Details

Closed on

Dec 15, 2008

Sold by

Eckhart Rand

Bought by

Deutsche Bank Trust Company

Purchase Details

Closed on

Sep 23, 2005

Sold by

Torrealba Jacqueline

Bought by

Eckhart Rand

Purchase Details

Closed on

Aug 29, 2003

Sold by

Iannillo Michael F and Iannillo Carol

Bought by

Eckhart Rand E and Torrealba Jacqueline

Purchase Details

Closed on

Nov 16, 2001

Sold by

Grabert Vincent J and Grabert Lucy J

Bought by

Iannillo Michael F and Iannillo Carol

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccormack Peter | $200,000 | Arrow Title Services | |

| Mccormack Peter | $200,000 | Arrow Title Services | |

| Hara Bernard A O | -- | Attorney | |

| Hara Bernard A O | $90,000 | Arrow Title Services Inc | |

| Fortescue Kavasansky Kathleen | $44,000 | Attorney | |

| Aurora Loan Services Llc | -- | Attorney | |

| Deutsche Bank Trust Company | -- | Attorney | |

| Eckhart Rand | $55,000 | -- | |

| Eckhart Rand E | $70,400 | Stewart Title Of Martin Cnty | |

| Iannillo Michael F | $62,000 | Universal Land Title Inc |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,861 | $127,140 | -- | $127,140 |

| 2024 | $1,739 | $99,558 | -- | -- |

| 2023 | $1,739 | $90,508 | $0 | $0 |

| 2022 | $1,441 | $82,280 | $0 | $0 |

| 2021 | $1,302 | $74,800 | $0 | $0 |

| 2020 | $1,341 | $68,000 | $0 | $0 |

| 2019 | $1,003 | $54,000 | $0 | $0 |

| 2018 | $910 | $47,000 | $0 | $0 |

| 2017 | $694 | $49,000 | $0 | $0 |

| 2016 | $765 | $39,000 | $0 | $39,000 |

| 2015 | $714 | $30,000 | $0 | $30,000 |

| 2014 | $714 | $34,000 | $0 | $34,000 |

Source: Public Records

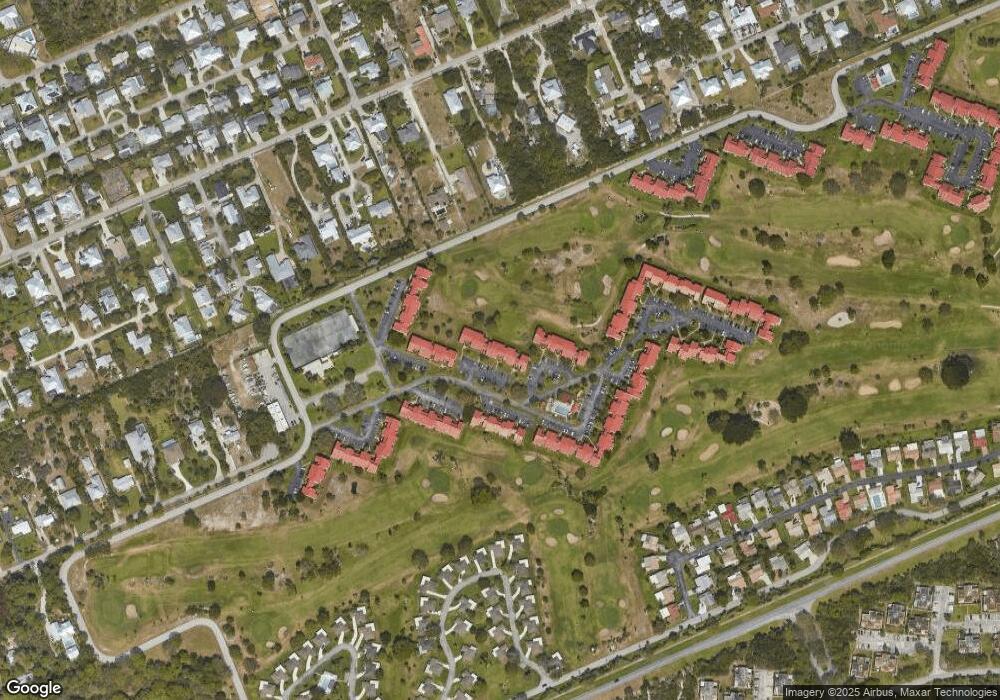

Map

Nearby Homes

- 5373 SE Miles Grant Rd Unit C-208

- 5335 SE Miles Grant Rd Unit 214

- 5335 SE Miles Grant Rd Unit 102

- 5355 SE Miles Grant Rd Unit E-212

- 5383 SE Miles Grant Rd Unit B-206

- 5373 SE Miles Grant Rd Unit C102

- 5313 SE Miles Grant Rd Unit 102

- 5413 SE Miles Grant Rd Unit 104

- 5413 SE Miles Grant Rd Unit 205

- 5413 SE Miles Grant Rd Unit 206

- 5439 SE Horseshoe Point Rd

- 5423 SE Miles Grant Rd Unit F201

- 5433 SE Miles Grant Rd Unit E104

- 5403 SE Miles Grant Rd Unit 209

- 5403 SE Miles Grant Rd Unit H-111

- 5652 SE Riverboat Dr Unit 124

- 5668 SE Riverboat Dr Unit 125

- 5273 SE Tall Pines Way

- 5678 SE Riverboat Dr Unit 129

- 4360 SE Kubin Ave

- 5383 SE Miles Grant Rd Unit B106

- 5303 SE Miles Grant Rd Unit L202

- 5335 SE Miles Grant Rd Unit 216

- 5353 SE Miles Grant Rd Unit F109

- 5393 SE Miles Grant Rd Unit A101

- 5343 SE Miles Grant Rd Unit G203

- 5303 SE Miles Grant Rd

- 5363 SE Miles Grant Rd Unit 105

- 5335 SE Miles Grant Rd Unit 120

- 5323 SE Miles Grant Rd Unit J103

- 5313 SE Miles Grant Rd Unit K-109

- 5333 SE Miles Grant Rd Unit I-202

- 5355 SE Miles Grant Rd Unit E108

- 5335 SE Miles Grant Rd Unit H-217

- 5323 SE Miles Grant Rd Unit J103

- 5343 SE Miles Grant Rd Unit G-104

- 5383 SE Miles Grant Rd Unit 104

- 5313 SE Miles Grant Rd Unit K 106

- 5353 SE Miles Grant Rd Unit f101

- 5393 SE Miles Grant Rd Unit A102