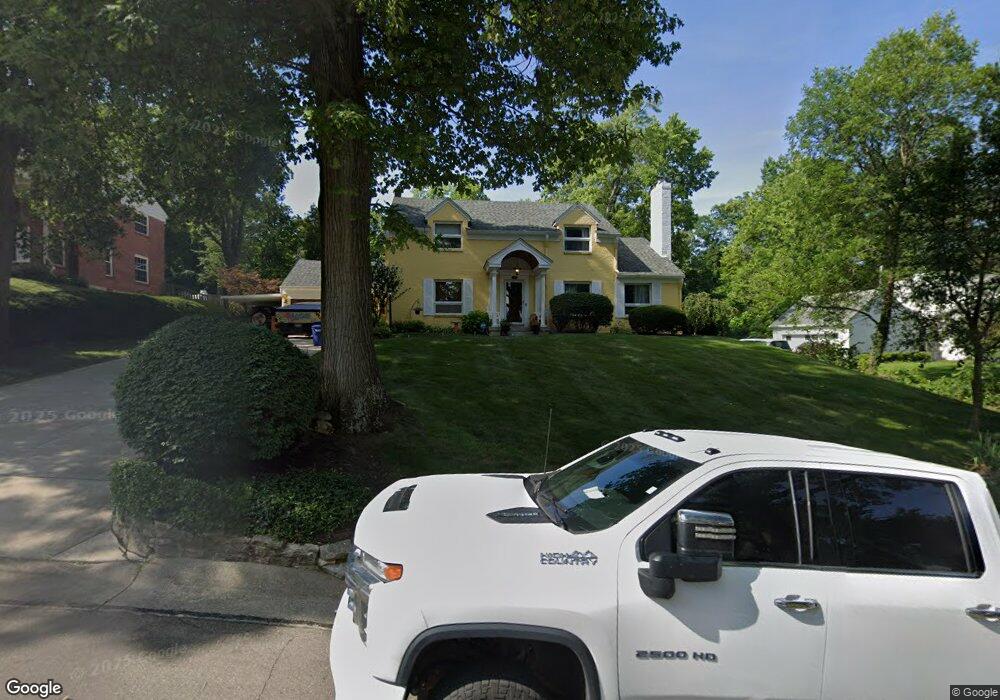

54 E Thruston Blvd Dayton, OH 45409

Estimated Value: $622,000 - $749,000

4

Beds

3

Baths

3,785

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 54 E Thruston Blvd, Dayton, OH 45409 and is currently estimated at $690,701, approximately $182 per square foot. 54 E Thruston Blvd is a home located in Montgomery County with nearby schools including Harman Elementary School, Julian & Marjorie Lange School Elementary School, and Oakwood Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2025

Sold by

Clark John Paul

Bought by

Clark Darcie R

Current Estimated Value

Purchase Details

Closed on

Jun 22, 2020

Sold by

Hughes Kathryn G and Hughes Paul C

Bought by

Clark John Paul and Clark Darcie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$392,000

Interest Rate

3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 2014

Sold by

Voisard Jane G

Bought by

Hughes Kathryn G and Hughes Paul C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$410,000

Interest Rate

4.2%

Mortgage Type

VA

Purchase Details

Closed on

Jun 12, 2008

Sold by

Voisard Jane G

Bought by

Voisard Jane G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clark Darcie R | -- | None Listed On Document | |

| Clark John Paul | $490,000 | Chicago Title Company Llc | |

| Hughes Kathryn G | $410,000 | None Available | |

| Voisard Jane G | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Clark John Paul | $392,000 | |

| Previous Owner | Hughes Kathryn G | $410,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,560 | $199,290 | $56,060 | $143,230 |

| 2024 | $14,868 | $199,290 | $56,060 | $143,230 |

| 2023 | $14,868 | $199,290 | $56,060 | $143,230 |

| 2022 | $13,918 | $155,700 | $43,800 | $111,900 |

| 2021 | $13,912 | $155,700 | $43,800 | $111,900 |

| 2020 | $13,861 | $155,700 | $43,800 | $111,900 |

| 2019 | $12,401 | $128,970 | $43,800 | $85,170 |

| 2018 | $11,416 | $128,970 | $43,800 | $85,170 |

| 2017 | $11,253 | $128,970 | $43,800 | $85,170 |

| 2016 | $9,689 | $100,820 | $43,800 | $57,020 |

| 2015 | $8,212 | $100,820 | $43,800 | $57,020 |

| 2014 | $8,212 | $100,820 | $43,800 | $57,020 |

| 2012 | -- | $114,230 | $52,080 | $62,150 |

Source: Public Records

Map

Nearby Homes

- 100 E Thruston Blvd

- 710 Harman Ave

- 333 Oakwood Ave Unit 2B

- 116 Thruston Blvd W

- 446 Lookout Ridge

- 31 Walnut Ln

- 0 Ledges Trail

- 54 Beverly Place

- 645 Orlando Terrace

- 560 Irving Ave

- 509 Hathaway Rd

- 1211 Far Hills Ave

- 1211 Runnymede Rd

- 525 Woodview Dr

- 203 Harman Blvd

- 1160 Waving Willow Dr

- 51 Forrer Rd

- 726 Acorn Dr

- 561 Kling Dr

- 327 Harman Blvd

- 54 Thruston Blvd E

- 62 Thruston Blvd E

- 42 Thruston Blvd E

- 53 E Thruston Blvd

- 53 Thruston Blvd E

- 6 Lookout Dr

- 63 Thruston Blvd E

- 32 Thruston Blvd E

- 72 Thruston Blvd E

- 69 Thruston Blvd E

- 26 E Thruston Blvd

- 26 Thruston Blvd E

- 20 Lookout Dr

- 5 Lookout Dr

- 42 Lookout Dr

- 100 Lookout Dr

- 601 Harman Ave

- 77 Thruston Blvd E

- 531 Far Hills Ave

- 539 Far Hills Ave

Your Personal Tour Guide

Ask me questions while you tour the home.