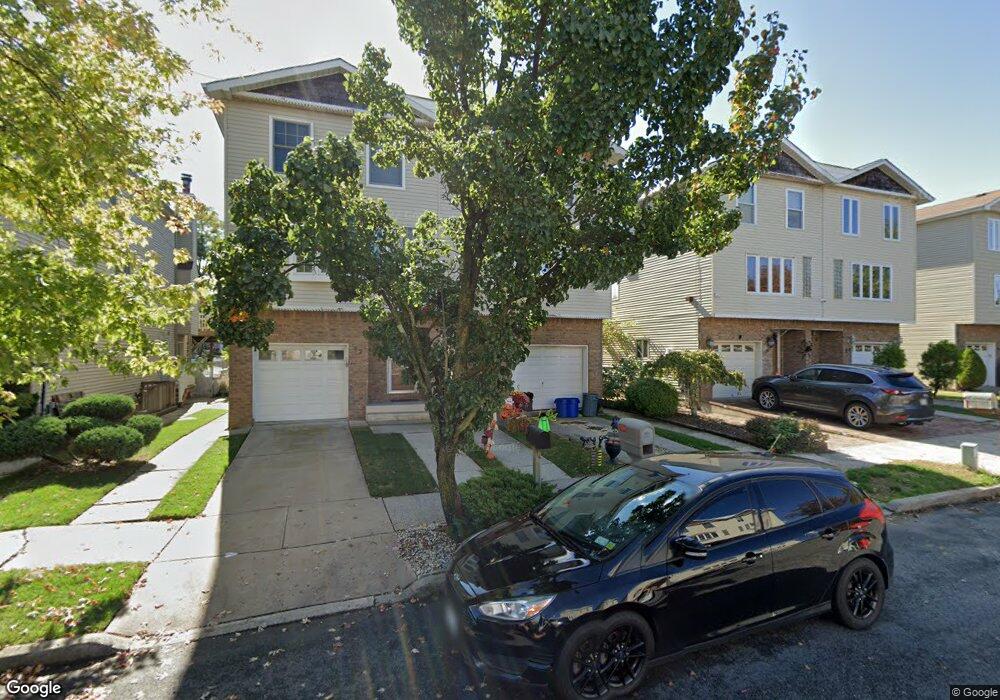

54 Marne Ave Unit Building Staten Island, NY 10312

Eltingville NeighborhoodEstimated Value: $836,000 - $910,000

--

Bed

4

Baths

1,912

Sq Ft

$462/Sq Ft

Est. Value

About This Home

This home is located at 54 Marne Ave Unit Building, Staten Island, NY 10312 and is currently estimated at $883,262, approximately $461 per square foot. 54 Marne Ave Unit Building is a home located in Richmond County with nearby schools including P.S. 42 The Eltingville School, I.S. 007 Elias Bernstein, and Tottenville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2018

Sold by

Christopher Stephen and Christopher Donna

Bought by

Lu Tim Dong and Zhang Mei Ying

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$453,100

Outstanding Balance

$383,252

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$500,010

Purchase Details

Closed on

Apr 5, 2001

Sold by

Milling Elliott and Milling Sandra

Bought by

Christopher Stephen and Christopher Donna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,700

Interest Rate

6.88%

Purchase Details

Closed on

Jul 6, 1994

Sold by

Milling Jeffrey and Milling Laura

Bought by

Milling Elliot and Milling Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$23,579

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lu Tim Dong | $655,000 | None Available | |

| Christopher Stephen | $322,000 | -- | |

| Milling Elliot | -- | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lu Tim Dong | $453,100 | |

| Previous Owner | Christopher Stephen | $273,700 | |

| Previous Owner | Milling Elliot | $23,579 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,701 | $47,460 | $10,555 | $36,905 |

| 2024 | $8,701 | $43,320 | $11,477 | $31,843 |

| 2023 | $8,445 | $41,581 | $10,061 | $31,520 |

| 2022 | $7,026 | $40,620 | $11,280 | $29,340 |

| 2021 | $7,788 | $42,840 | $11,280 | $31,560 |

| 2020 | $7,029 | $40,440 | $11,280 | $29,160 |

| 2019 | $6,879 | $38,400 | $11,280 | $27,120 |

| 2018 | $7,064 | $34,651 | $10,785 | $23,866 |

| 2017 | $6,364 | $32,690 | $11,133 | $21,557 |

| 2016 | $5,855 | $30,840 | $11,280 | $19,560 |

| 2015 | $5,691 | $32,100 | $10,980 | $21,120 |

| 2014 | $5,691 | $31,242 | $10,808 | $20,434 |

Source: Public Records

Map

Nearby Homes

- 102 Lovelace Ave

- 110 Lovelace Ave

- 774 Barlow Ave

- 775 Barlow Ave

- 135 Mcarthur Ave

- 56 Mcarthur Ave

- 731 Barlow Ave

- 457 Genesee Ave

- 71 Reading Ave

- 156 Mcarthur Ave

- 682 Barlow Ave

- 50 Reading Ave

- 53 Ludlow St

- 688 Leverett Ave Unit 8520

- 226 Annadale Rd

- 171 Figurea Ave

- 20 Notus Ave

- 132 Alexander Ave

- 149 Crossfield Ave

- 116 Woehrle Ave