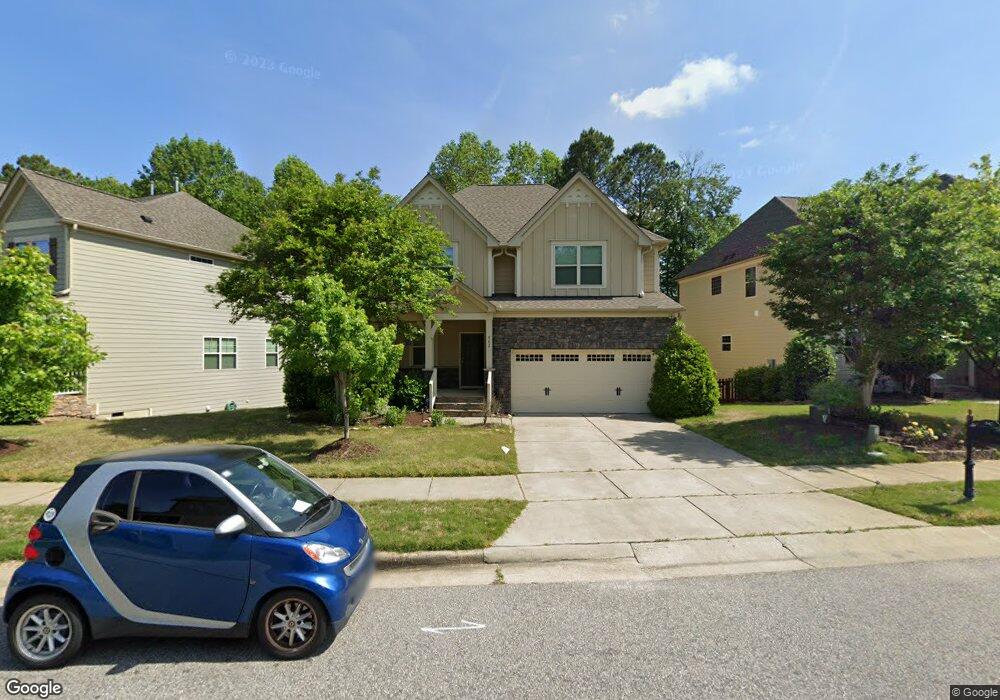

542 Highrock Lake Rd Fuquay Varina, NC 27526

Estimated Value: $538,077 - $564,000

4

Beds

5

Baths

2,780

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 542 Highrock Lake Rd, Fuquay Varina, NC 27526 and is currently estimated at $550,269, approximately $197 per square foot. 542 Highrock Lake Rd is a home located in Wake County with nearby schools including Carolina Charter Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 11, 2020

Sold by

Opendoor Property Trust I

Bought by

Eluhu Manix L and Eluhu Missie Gessyca

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$345,000

Outstanding Balance

$315,594

Interest Rate

4.37%

Mortgage Type

New Conventional

Estimated Equity

$234,675

Purchase Details

Closed on

Sep 17, 2020

Sold by

Suitt Bruce D and Suitt Anna

Bought by

Opendoor Property Trust I

Purchase Details

Closed on

Aug 7, 2014

Sold by

D R Horton Inc

Bought by

Suitt Bruce D and Suitt Anna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,110

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 1, 2010

Sold by

Ipg South Lakes Llc

Bought by

South Lakes Investors Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eluhu Manix L | $365,000 | None Available | |

| Opendoor Property Trust I | $342,000 | None Available | |

| Suitt Bruce D | $274,500 | None Available | |

| South Lakes Investors Llc | $7,210,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Eluhu Manix L | $345,000 | |

| Previous Owner | Suitt Bruce D | $269,110 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,456 | $506,876 | $100,000 | $406,876 |

| 2024 | $4,437 | $506,876 | $100,000 | $406,876 |

| 2023 | $3,700 | $330,974 | $42,000 | $288,974 |

| 2022 | $3,477 | $330,974 | $42,000 | $288,974 |

| 2021 | $3,313 | $330,974 | $42,000 | $288,974 |

| 2020 | $3,313 | $330,974 | $42,000 | $288,974 |

| 2019 | $3,204 | $276,077 | $45,000 | $231,077 |

| 2018 | $3,021 | $276,077 | $45,000 | $231,077 |

| 2017 | $2,912 | $276,077 | $45,000 | $231,077 |

| 2016 | $2,872 | $276,077 | $45,000 | $231,077 |

| 2015 | $2,474 | $245,520 | $54,000 | $191,520 |

| 2014 | -- | $54,000 | $54,000 | $0 |

Source: Public Records

Map

Nearby Homes

- 637 Lake Artesia Ln

- 420 Apalachia Lake Dr

- 2709 Banks Lake Ct

- 639 Ashe Lake Way

- 719 Shoals Lake Dr

- 521 Lake Gaston Dr

- 2933 Lake James Dr

- 2942 Wilkes Lake Dr

- 858 Lake Artesia Ln

- 2405 Heathland Farm Dr

- 515 Glenville Lake Dr

- 3408 Apple Meadow Dr

- 112 Wilbur Lake Dr

- 3301 Cobham Ct

- 3409 Bennyfield Ct

- 101 Boone Lake Way

- 2716 Rindlewood Ct

- 3509 Bailey Lake Dr

- 3316 Jones Lake Rd

- 747 Catherine Lake Ct

- 600 Highrock Rd

- 538 Highrock Lake Rd

- 546 Highrock Lake Rd

- 534 Highrock Lake Rd

- 565 Lake Gaston Dr Unit 6

- 429 Apalachia Lake Dr Unit 4

- 425 Apalachia Lake Dr

- 425 Apalachia Lake Dr Unit 3

- 2694 Jenkins Lake Ct

- 421 Apalachia Lake Dr Unit Lot2

- 561 Lake Gaston Dr

- 433 Apalachia Lake Dr Unit 5

- 530 Highrock Lake Rd

- 2695 Jenkins Lake Ct

- 547 Highrock Lake Rd

- 547 Highrock Lake Rd Unit 250

- 551 Highrock Lake Rd

- 551 Highrock Lake Rd Unit L232

- 524 Highrock Lake Rd Unit 268

- 524 Highrock Lake Rd