5421 Razor Peak Dr Unit 403 Mount Vernon, WA 98273

Estimated Value: $611,488 - $643,000

4

Beds

3

Baths

2,520

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 5421 Razor Peak Dr Unit 403, Mount Vernon, WA 98273 and is currently estimated at $633,372, approximately $251 per square foot. 5421 Razor Peak Dr Unit 403 is a home located in Skagit County with nearby schools including Madison Elementary School, Mount Baker Middle School, and Mount Vernon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2021

Sold by

Ortiz Pia S Costales and Borrero Yan D

Bought by

Birchler Stephen and Birchler Paulaann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,189

Outstanding Balance

$373,546

Interest Rate

3.1%

Mortgage Type

FHA

Estimated Equity

$259,826

Purchase Details

Closed on

May 27, 2020

Sold by

Johnson Dean G and Johnson Jennifer Siu

Bought by

Ortiz Pia S Costales and Borrero Yan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$404,490

Interest Rate

3.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 6, 2015

Sold by

The Quadrant Corporation

Bought by

Johnson Dean G and Johnson Jennifer Siu Fung

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$315,541

Interest Rate

3.81%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Birchler Stephen | $535,098 | Chicago Title | |

| Ortiz Pia S Costales | $417,000 | Chicago Title Company Of Wa | |

| Johnson Dean G | $308,900 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Birchler Stephen | $412,189 | |

| Previous Owner | Ortiz Pia S Costales | $404,490 | |

| Previous Owner | Johnson Dean G | $315,541 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,822 | $576,400 | $182,100 | $394,300 |

| 2023 | $5,822 | $569,400 | $177,500 | $391,900 |

| 2022 | $5,342 | $534,400 | $159,500 | $374,900 |

| 2021 | $4,979 | $455,400 | $107,100 | $348,300 |

| 2020 | $4,729 | $394,800 | $0 | $0 |

| 2019 | $3,946 | $364,600 | $0 | $0 |

| 2018 | $4,713 | $344,600 | $0 | $0 |

| 2017 | $4,221 | $316,800 | $0 | $0 |

| 2016 | $2,517 | $286,200 | $61,800 | $224,400 |

| 2015 | $726 | $169,000 | $57,000 | $112,000 |

| 2013 | $606 | $44,300 | $44,300 | $0 |

Source: Public Records

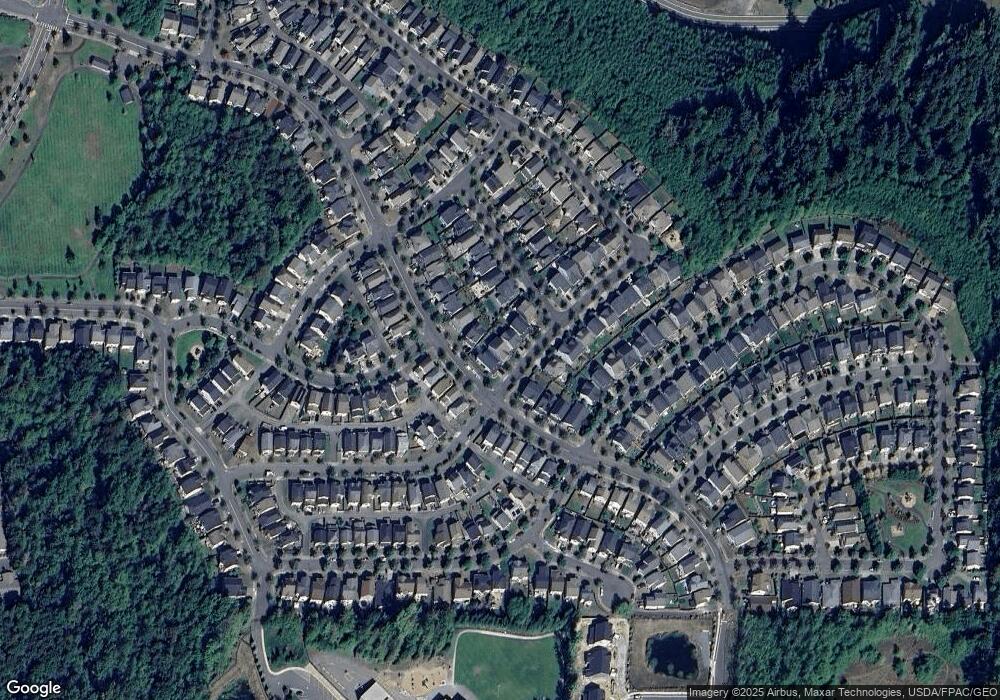

Map

Nearby Homes

- 5377 Timber Ridge Dr

- 341 N 55th St Unit 30

- 341 N 55th St

- 333 N 55th St

- 5609 Timber Ridge Dr

- 301 N 55th St Unit 25

- 237 N 55th St Unit 23

- 224 N 54th Place

- 225 N 54th Place

- 229 N 55th St Unit 22

- 229 N 55th St

- Hemingway Plan at Highpoint East

- Ponderosa Plan at Highpoint East

- Twain Plan at Highpoint East

- Decker Plan at Highpoint East

- 4625 Shuksan

- 4624 Shuksan

- 214 Dallas St

- 134 Shantel St

- 4312 Kiowa Dr

- 5421 Razor Peak Dr Unit 5403

- 5421 Razor Peak Dr

- 5429 Razor Peak Dr Unit 402

- 5415 Razor Peak Dr Unit 5404

- 632 Crested Butte Blvd Unit 5405

- 5437 Razor Peak Dr

- 5437 Razor Peak Dr Unit 5401

- 640 Crested Butte Blvd Unit 5406

- 640 Crested Butte Blvd

- 5445 Razor Peak Dr Unit 5400

- 5445 Razor Peak Dr Unit 400

- 635 Brookstone St Unit 5399

- 536 Crested Butte Blvd Unit 5053

- 536 Crested Butte Blvd

- 5438 Razor Peak Dr Unit 5052

- 700 Crested Butte Blvd Unit 5407

- 700 Crested Butte Blvd

- 613 Crested Butte Blvd

- 621 Crested Butte Blvd

- 643 Brookstone St Unit 5398