5436 Worthington Forest Place W Unit 5436 Columbus, OH 43229

Salem Village NeighborhoodEstimated Value: $130,000 - $137,000

2

Beds

2

Baths

1,196

Sq Ft

$113/Sq Ft

Est. Value

About This Home

This home is located at 5436 Worthington Forest Place W Unit 5436, Columbus, OH 43229 and is currently estimated at $134,774, approximately $112 per square foot. 5436 Worthington Forest Place W Unit 5436 is a home located in Franklin County with nearby schools including Salem Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2018

Sold by

Ayers Jennifer

Bought by

Spiers Bonita

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2013

Sold by

Hines Latisha A and Worthington Forest Condominium

Bought by

Ayers Jennifer

Purchase Details

Closed on

Oct 21, 2004

Sold by

Cassie Richard G and Cassie Connie C

Bought by

Hines Latisha A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,900

Interest Rate

8.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 31, 1987

Bought by

Rgc-2 Income Properties

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spiers Bonita | $48,000 | None Available | |

| Ayers Jennifer | $13,000 | None Available | |

| Hines Latisha A | $62,900 | -- | |

| Rgc-2 Income Properties | $49,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hines Latisha A | $62,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,541 | $34,340 | $3,500 | $30,840 |

| 2023 | $1,521 | $34,335 | $3,500 | $30,835 |

| 2022 | $963 | $18,560 | $2,560 | $16,000 |

| 2021 | $964 | $18,560 | $2,560 | $16,000 |

| 2020 | $966 | $18,560 | $2,560 | $16,000 |

| 2019 | $775 | $12,780 | $1,750 | $11,030 |

| 2018 | $806 | $12,780 | $1,750 | $11,030 |

| 2017 | $847 | $12,780 | $1,750 | $11,030 |

| 2016 | $899 | $13,230 | $2,520 | $10,710 |

| 2015 | $818 | $13,230 | $2,520 | $10,710 |

| 2014 | $820 | $13,230 | $2,520 | $10,710 |

| 2013 | $874 | $14,700 | $2,800 | $11,900 |

Source: Public Records

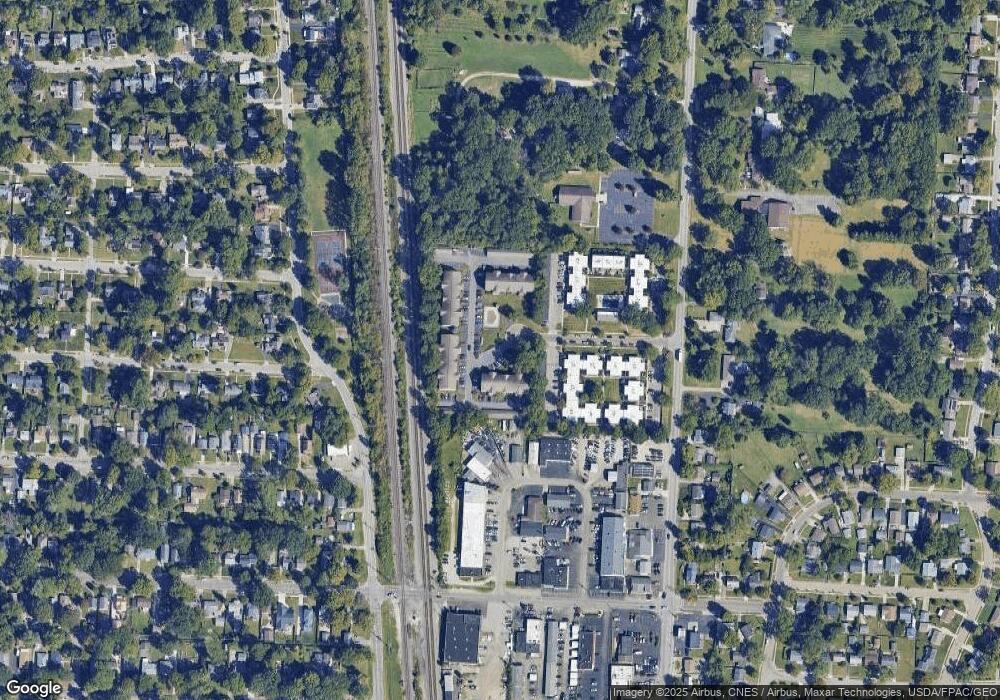

Map

Nearby Homes

- 5475 Worthington Forest Place E Unit 5475

- 5495 Worthington Forest Place E

- 559 E Lincoln Ave

- 544 N Selby Blvd

- 562 Loveman Ave

- 510 Kenbrook Dr

- 5681 Indianola Ave

- 5290 Forest Ave

- 503 Meadoway Park

- 1029 Minerva Ave

- 5246 Eisenhower Rd

- 5579 Norcross Rd

- 5462 Roche Dr

- 292 Chase Rd

- 5772 N Meadows Blvd

- 5480 Rockwood Ct Unit R1

- 254 Park Blvd

- 1174 Belden Rd

- 153 Chase Rd

- 264 E South St

- 5434 Worthington Forest Place W

- 5438 Worthington Forest Place W Unit 5438

- 5432 Worthington Forest Place W

- 5428 Worthington Forest Place W Unit 5428

- 5444 Worthington Forest Place W Unit 5444

- 5428 Worth Forest Place W

- 5440 Worthington Forest Place W Unit 5440

- 5440 Worthington Forest Place W Unit 5440 / 2A

- 5426 Worthington Forest Place W Unit 5426

- 5429 Worthington Forest Place W Unit 5429

- 5446 Worthington Forest Place W

- 5427 Worthington Forest Place W

- 5442 Worthington Forest Place W

- 5448 Worthington Forest Place W Unit 5448

- 5431 Worthington Forest Place W

- 5425 Worthington Forest Place W

- 741 Worthington Forest Place Unit 741

- 733 Worthington Forest Place

- 737 Worthington Forest Place

- 5433 Worthington Forest Place W Unit 5433